U.S. interest rate hikes to halt? 3 U.S. Banks Collapse in Just 5 Days【March 14, 2023】

Fundamental Analysis

Silvergate Bank, Silicon Valley Bank, and Signature Bank Fail

Investors are watching to see whether the monetary authority’s policy of sharply raising interest rates will spread to other banks.

Fundamentals turn sharply, funds flow out to safer assets

President Biden attempts to calm the situation by promising full deposit protection

Some observers believe that the March FOMC meeting will halt interest rate hikes

Inflation or Stabilization of the Banking System: The Fed’s Response Will Be the Focal Point

Gold surges to $1900 level as risk aversion continues

The yen strengthens sharply, temporarily at 132 yen, as investors buy the yen as a safe-haven asset

Market volatility continues to rise

Technical Analysis

Gold is soaring. In addition, the yen is buying more yen as risk aversion weakens the dollar. Fundamental metals are deteriorating due to the collapse of U.S. banks, and the Nikkei Stock Average is plunging. Bitcoin, a virtual currency, is surging. The dollar is weakening and has recovered to the $24,000 level.

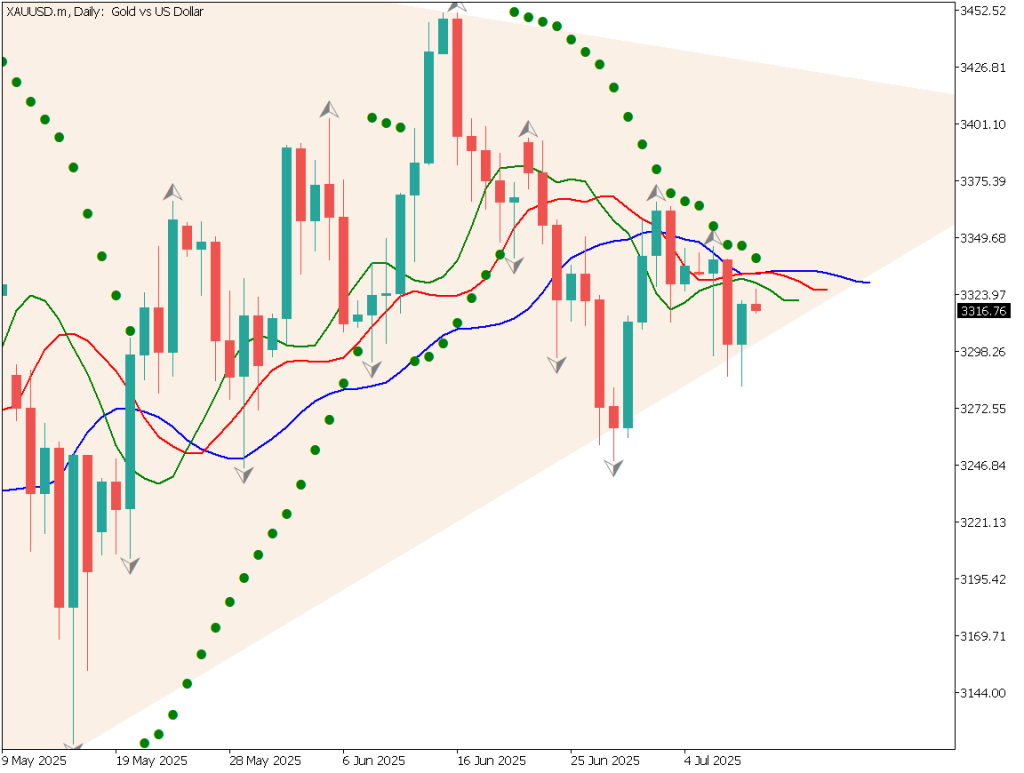

Gold (XAUUSD)

Gold broke through USD 1,900.00 and was rising higher and higher due to risk aversion, but the RSI shows that it is sticking around 70 and the upward momentum is weakening. The possibility of a one-time adjustment cannot be ruled out. There is a possibility that the price may fall back to USD 1900.00 on profit-taking. Today’s range forecast is USD 1892.00 – USD 1931.00.

Estimated rangeUSD 1,892.00 – USD 1,931.00Resistance lineUSD 1,921.00Support lineUSD 1,902.00

Nikkei Stock Index (NIKKEI225)

The Nikkei 225 trend has shifted due to a change in fundamentals. Attention has been focused on whether Japanese companies will be affected by the collapse of U.S. regional banks. The 4-hour RSI is hovering at 34 and may fall further.

Estimated rangeJPY 27,000 – JPY 27,700Resistance lineJPY 25,500Support lineJPY 22,500

Bitcoin (BTC/USD)

Bitcoin rallied sharply due to the weak dollar. It briefly fell below USD 20,000, but has now risen to USD 24,000. The price was at an oversold level and appears to have soared on the back of a change in fundamentals. The price to watch is around USD 25,250, which was prevented from breaking through last time.

Estimated rangeUSD 23,000 – USD 25,500Resistance lineUSD 24,600Support lineUSD 23,500

Today’s Important Economic Indicators

Economic Indicators and EventsJST (Japan Standard Time)U.S. Consumer Price Index (CPI)21:30

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.