U.S. stock prices rise, U.S. financial authorities waver between inflation and bank bailouts【March 15, 2023】

Fundamental Analysis

Major U.S. Stock Indexes Rise, Bank Failure Turmoil Set to Settle

U.S. Core CPI Surpasses Estimates, Puts Pressure on FOMC to Raise Interest Rates

U.S. government issued a statement saying that deposits above the guaranteed amount will be fully protected

Focus on whether a chain of failures of smaller regional banks with similar management structures will occur

Difficult choice between inflation control and banking system stabilization at next FOMC meeting

A rate hike would destabilize the banking system, while a halt in rate hikes would fail to contain inflation

The yen will weaken against the U.S. dollar in reaction to the previous day’s large price move

Nikkei Stock Average pushing near 200-day moving average

Crude oil sharply lower, below the lower end of the range due to expected lower US demand

Bitcoin surged above recent highs, temporarily hitting the USD 26,000 level

US drone reportedly shot down by Russian military concerns, cautioning against worsening geopolitical risks

Technical Analysis

Analyzing currency strength and weakness, a number of fundamental factors are overlapping and the market is trying to find a sense of direction. It is a difficult market development. Will Crude Oil break below the lower end of its range and test recent lows? The USD/JPY will be watched to see if risk aversion resumes after the end of the goto day’s movement.

crude oil (USOUSD)

Crude oil is sharply lower. The issue is easy to understand both technically and fundamentally at this point. Technically, it has broken the lower end of the range, and watch for a break above the recent low of USD 70.2.

Looking at the highs in the range, we can see that the highs are cutting down to USD 82.6 and USD 80.96. Taking into account the fundamentals, we can conclude that the probability of a decline is high.

Estimated rangeUSD 70.24 – USD 74.00Resistance lineUSD 73.00Support lineUSD 71.42

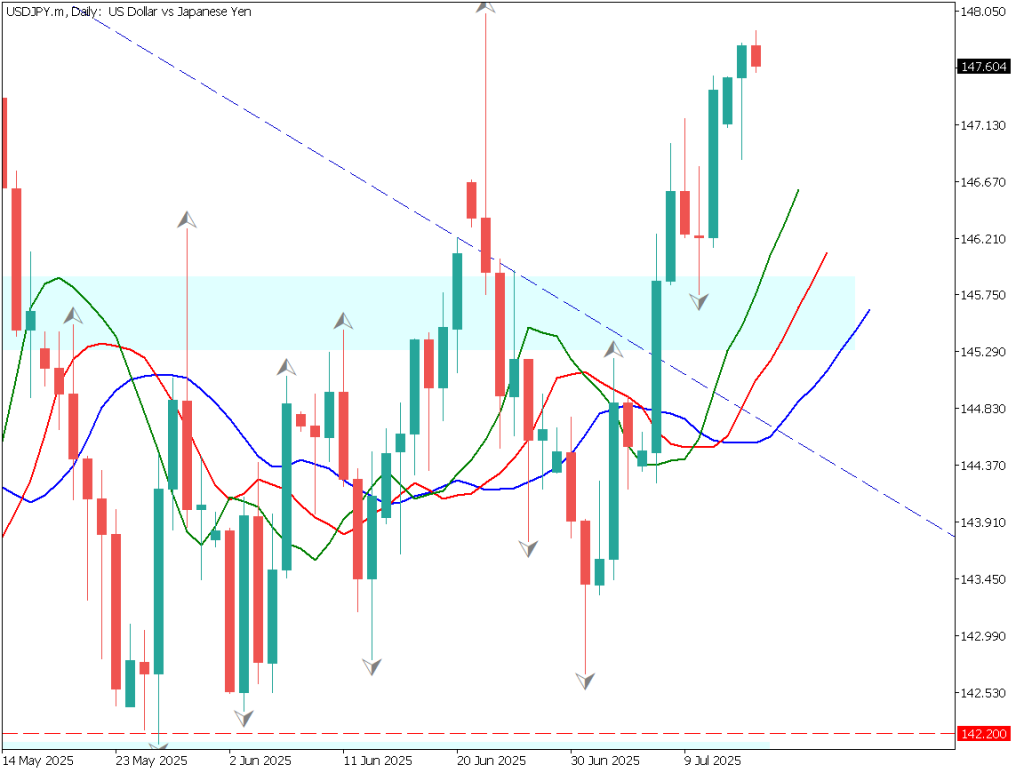

US dollar/JPY (USD/JPY)

At the time of writing, the dollar’s and the yen’s strength are in a state of struggle, making it difficult to discern a sense of direction. Drawing the moving average and Fibonacci Expansion, the USDJPY has a “negative + crosshair + positive” near the moving average and is rebounding in the 4-hour time frame. The 100% line of the Expansion is near JPY 140.35.

Is optimism spreading after the announcement of the US government’s bailout package? However, it will depend on future news, and the focus will be on the next FOMC meeting.

Estimated rangeJPY 133.25 – JPY 135.45Resistance lineJPY 135.02Support lineJPY 134.12

Bitcoin (BTC/USD)

Bitcoin rallied significantly on the weaker US dollar and temporarily exceeded its recent highs. However, there is selling pressure on the upside, and an upper mustache is emerging. If risk-on moves spread again, bitcoin may turn to sell-off.

Estimated rangeUSD 23520 – USD 25750Resistance lineUSD 25260Support lineUSD 24120

Today’s Important Economic Indicators

Economic Indicators and EventsJST (Japan Standard Time)U.S. Retail SalesU.S. Producer Price Index (PPI)21:30

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.