Quiet market, focus on U.S. jobs data, but Easter vacations around the world【April 7, 2023】

Fundamental Analysis

NASDAQ and S&P 500 rebounded slightly, with limited price movement

Focus on U.S. Employment Statistics; Volatility May Rise Whether Good or Worse

If the U.S. Employment Statistics are favorable, the prospect of interest rate cuts will recede; if they worsen, there will be fears of a recession

Almost all major markets except Japan are closed, quiet market

IMF warns of low global growth outlook for next 5 years

Technical Analysis

The New Zealand dollar fell sharply. The market has been quiet, resulting in less volatility overall and a consolidation of positions. The market is difficult to forecast in the short term.

The dollar has rebounded without breaking below JPY 130.60 and is hovering around JPY 131.70 at the time of writing. Depending on the U.S. Employment Statistics, the market outlook could change significantly.

New Zealand Dollar (NZDUSD)

Analyzing the NZDUSD technically, a return high was formed around 61.8% of the Fibonacci retracement, and yesterday’s sharp decline took it below 38.2%. An uptrend line can be drawn, which does not indicate a downtrend, but a large sell order may be in the pipeline.

A clear break below the uptrend line would make the moving average the next support band. How the dollar moves on today’s jobs report will likely determine the trend for the coming week.

Estimated rangeUSD 0.6180 – USD 0.6307Resistance lineUSD 0.63Support lineUSD 0.62

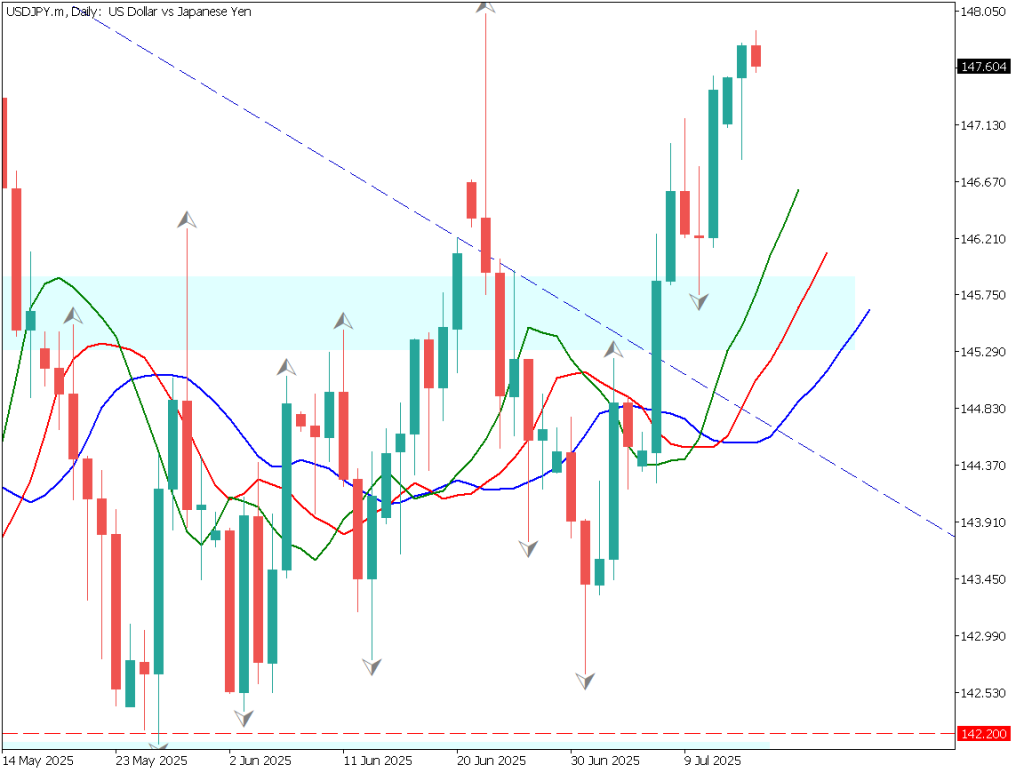

Dollar-Yen (USDJPY)

Analyzing the 4-hour chart of the dollar-yen, the pair rallied to JPY 131.90 yesterday, perhaps due to position consolidation, but the sell-off back to JPY 131.90 became stronger in the morning. A “bearish wrapping leg (outside bar)” in terms of price action has appeared, which is a downside signal.

Since prices are trending above the uptrend, we should be cautious about selling positions despite the downtrend.

Estimated rangeJPY 130.40 – JPY 133.4Resistance lineJPY 132.64Support lineJPY 131.20

Bitcoin (BTCUSD)

Analyzing the daily chart of bitcoin, we note the possibility of a “top island reversal” shape emerging. Although it has not occurred at this time, bitcoin has not been able to break out of USD 28,000, although it has risen through the window with great momentum.

If today’s jobs report were to turn down and open a lower window to begin the next candle, a “Top Island Reversal” would be completed. However, the dollar is weakening and we should be cautious in our positions.

Estimated rangeUSD 26650 – USD 29930Resistance lineUSD 28850Support lineUSD 27350

Today’s Important Economic Indicators

Economic Indicators and EventsJST (Japan Standard Time)U.S. Employment Statistics21:30

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.