Gold surges, market in risk-off mood as new risk concerns arise at U.S. regional banks【May 3, 2023】

Fundamental Analysis

Major U.S. stock indexes sharply lower; concern over management of U.S. regional bank Pacific Western

U.S. Debt Ceiling Risk Emerges, Increasing Default Risk and Risk-Off Mood

U.S. Job Openings Decline; Economic Downturn and Additional Rate Hikes Cause Bank Stocks to Plunge

Yen strengthened across the board in New York, with the dollar falling to JPY 136

Gold rallies sharply, safe-haven assets are being bought amid risk-off mood

Technical Analysis

The currency markets were in a risk-off mood. Pacific Western Bank has become a new risk factor, and the market is skeptical that there will be a fifth bank failure. The previous day, another bank had just failed, resulting in a chain reaction sell-off of financial stocks as a whole. Although this is currently a one-off event, it should be watched closely because a chain of failures would make government intervention in all banks difficult.

Fears of default due to the U.S. debt ceiling are also growing, with Treasury Secretary Yellen warning that funds will dry up in June, creating an annual risk-off mood. Funds are concentrated in safe-haven assets, resulting in three major assets – gold, the yen, and the Swiss franc – surging during the New York session.

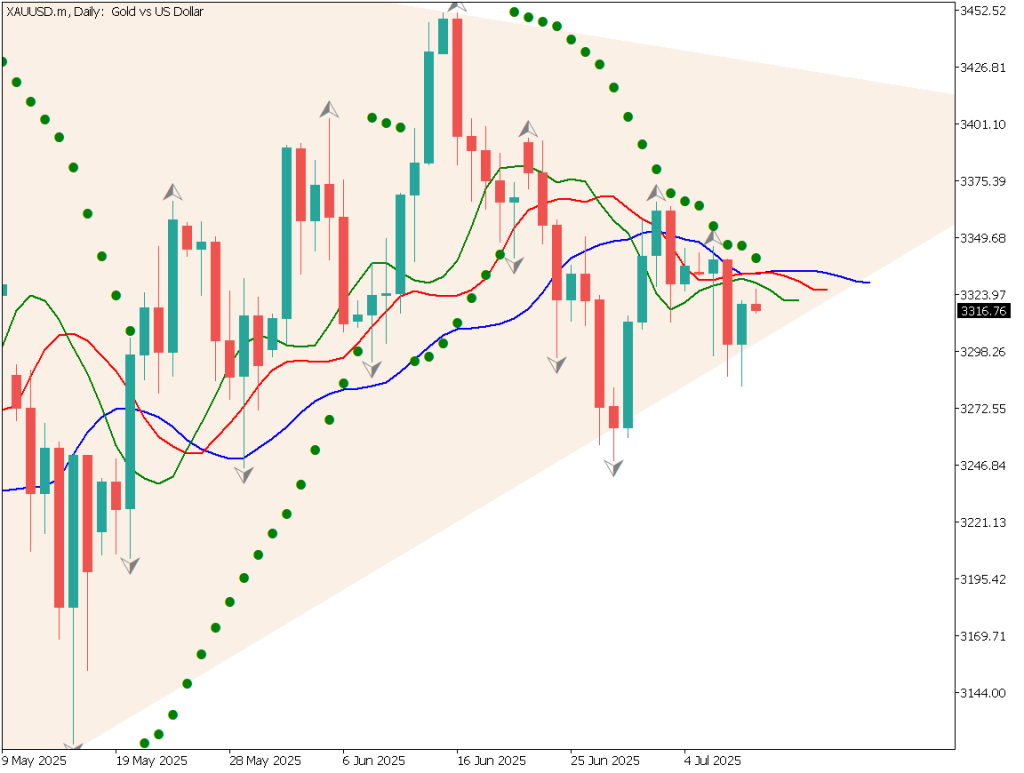

GOLD (XAUUSD)

Gold is trading above USD 2,000 and at USD 2016 due to risk-off moves. The current near-term upside target is near USD 2026 – USD 2030. Depending on the FOMC, Gold will come under renewed downward pressure if a future rate hike is indicated. The downside target is USD 1995.

If there is any hint of a rate hike halt in light of deteriorating job numbers and the negative impact on the financial system, the upside target for gold is in the USD 2,040 range. We caution against holding positions before the FOMC meeting.

Estimated rangeUSD 1995- USD 2041Resistance lineUSD 2025Support lineUSD 2006

Crude Oil (USOUSD)

Crude oil is significantly lower. The support level of USD 73.00, which had been a milestone, has broken out and is now at USD 71.00. Declining demand for crude oil and the deteriorating U.S. economy are the main reasons for the price decline. The next downside target is at USD 70.250.

Further declines are likely if the FOMC meeting signals continued rate hikes. Note that a drop below USD 70.25 could take the price down to USD 64.37, the recent low, with stop-losses involved.

Estimated rangeUSD 69.6 – USD 73.2Resistance lineUSD 72.89Support lineUSD 70.25

New Zealand-Dollar (NZDUSD)

The New Zealand dollar rose in the morning following the employment report. Analyzing the daily chart, we can confirm that the 240-day moving average is now in awareness and is gradually moving higher.

A rebound at the third moving average can be confirmed and the chart shape is such that the rise will continue. The near-term target is USD 0.6262, but the price could rise to USD 0.6352 by around the middle of this month.

Estimated rangeUSD 0.6158 – USD 0.6262Resistance lineUSD 0.6247Support lineUSD 0.6198

Today’s Important Economic Indicators

Economic Indicators and EventsJST (Japan Standard Time)Australian Retail Sales10:30US ADP Employment Report21:15U.S. ISM Non-Manufacturing Index23:00U.S. FOMCThe next day at 3:00

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.