Dollar-Yen moves slightly, fails to try 140 JPY【June 7, 2023】

Fundamental Analysis

Major U.S. stock indexes rise, with financials and small caps leading the way

Australian central bank announces policy rate hike of 0.25% to 4.10

The Australian dollar rallied sharply, rising for the fifth day in a row

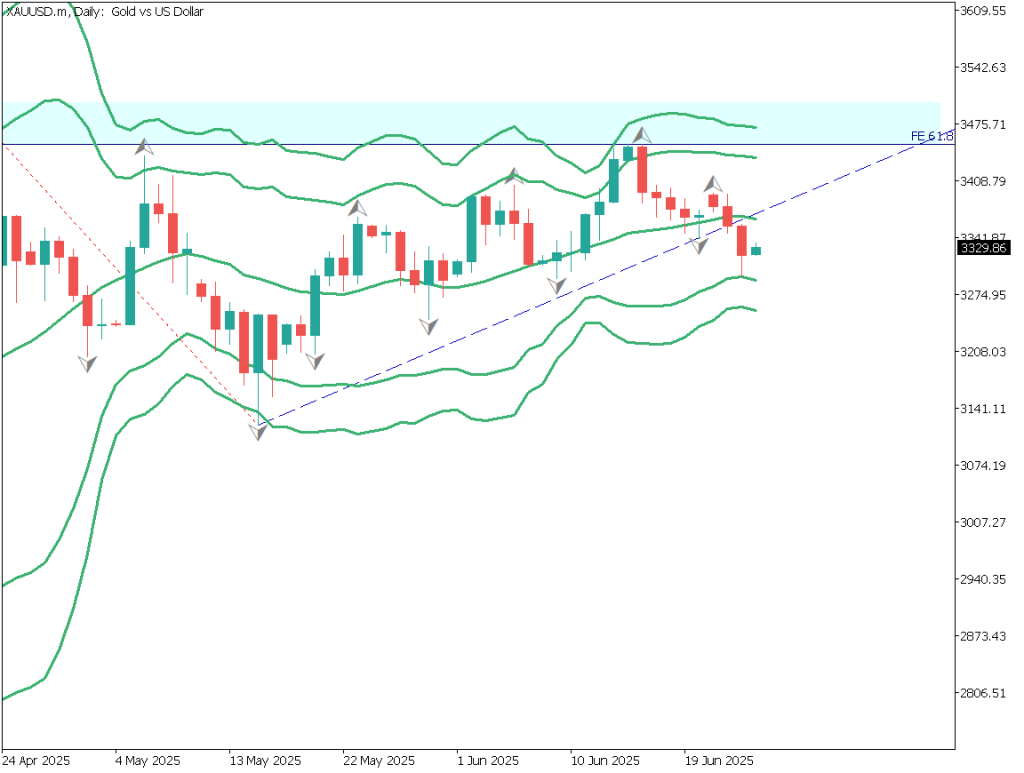

Gold mostly unchanged; volatility will depend on FOMC results

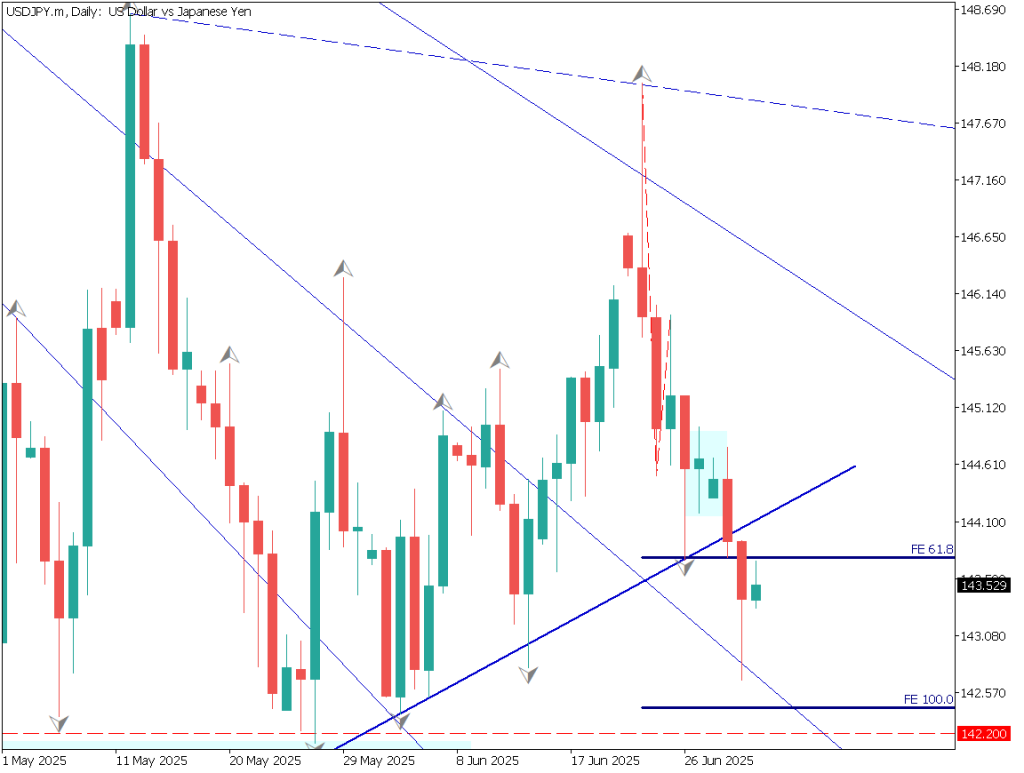

USDJPY Technical Analysis

The dollar-yen is experiencing very low volatility. Yesterday, it temporarily rose to just before JPY 140, but fell back. In the 1-hour time frame, the wrapping foot, which is a characteristic of a change of direction, can be seen three times in the recent past. Going forward, the occurrence of a wrapping foot (outside bar) is likely to indicate a change of direction, so we should pay close attention to the shape of the candlestick at the high and low price areas.

Day Trade Strategy (Hourly)

As a day trading strategy, we believe it is a good idea to set up short-term contrarian positions near the uptrend line and in the resistance zone. The JPY 139 area is also a past low to watch.

Triangle

A downward trend line and an upward trend line can be drawn, forming a triangle. The price is hovering around the 240 moving average and continues to be pulled back when it tries to move away. We can assume that the market is storing up energy in preparation for the FOMC meeting.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

JPY 139.07 – Major low price in the pastJPY 138.70 – The lower limit of the main range price in the past

Market Sentiment

USDJPY Sell: 68% Buy: 32%

Today’s Important Economic Indicators

Economic Indicators and EventsJST (Japan Standard Time)Australia GDP10:30Canada Policy Rate Announcement23:00U.S. crude oil inventories23:30

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.