USDJPY falls, markets focus on Fed Chair Powell’s congressional testimony【June 21, 2023】

Fundamental Analysis

Major U.S. stock indexes fell, perhaps pausing at overbought levels

Finance Minister Suzuki commented, “We will closely monitor currency movements and take appropriate measures.

METI Minister Nishimura commented, “We will watch for excessive volatility and speculative movements.

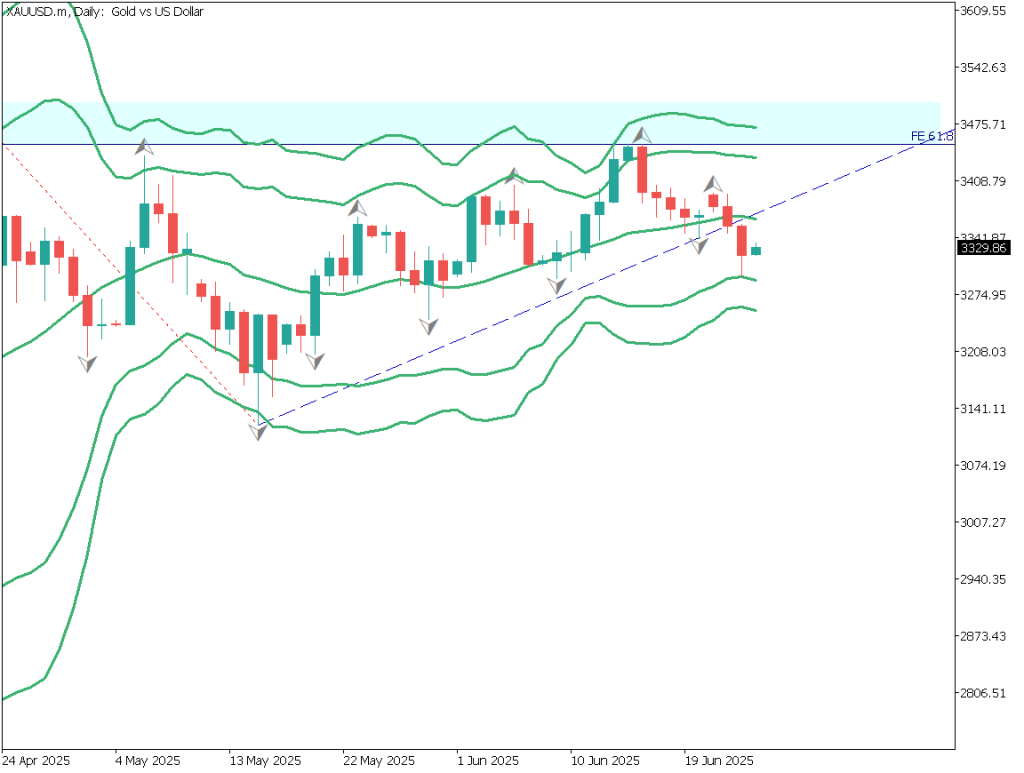

Commodity prices were under downward pressure globally, with Gold breaking below its range.

USD/JPY failed to break above the resistance zone at JPY 142, forming a daily wrap-around

Powell’s congressional testimony to be closely watched, with significant impact on USD/JPY

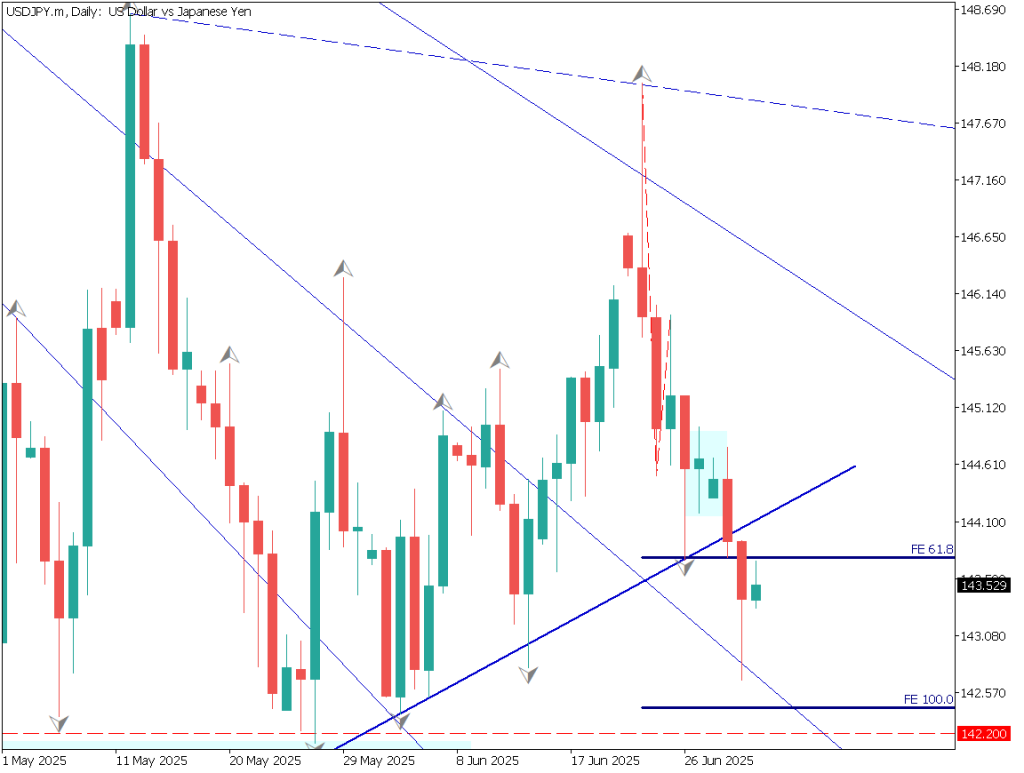

USDJPY Technical Analysis

The dollar hit a high of JPY 142.25 but fell back to around JPY 141.20. The market is paying close attention to Fed Chair Jerome Powell’s semi-annual congressional testimony today. Since he is expected to make remarks on interest rates, the dollar/yen is nervous. Therefore, a wait-and-see attitude may prevail during the day.

Looking at the equilibrium chart, the conversion line has become a resistance line and is driving prices lower. The price is likely to be unstable as it has entered the clouds, but the direction of the price is expected to be in the direction of a short-term decline. However, from a medium- to long-term perspective, there seems to be a strong appetite for buying.

Day Trading Strategy (Hourly)

The day trade policy is to buy at the push. If the price is near 141.05 yen, buy and stop when the price breaks below 140.80. The target price is around JPY 141.70, which is the reference line on the Ichimoku Chart.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

141.63 JPY – Pivot point140.88 JPY – Major support zone

Market Sentiment

USDJPY Sell: 71% Buy: 29%

Today’s Important Economic Indicators

Economic Indicators and EventsJST (Japan Standard Time)BOJ Policy Meeting Agenda8:50UK Consumer Price Index15:00Fed Chairman Powell speaks23:00

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.