Gold rebounds at $1900, may enter a range-bound phase for a while.【September 15, 2023】

Fundamental Analysis

The ECB decides on a 0.25% rate hike, raising the policy rate to 4.5%.

The euro weakens in response, influenced by the perception that interest rates have peaked and a downward revision of growth outlook.

US economic indicators exceed expectations, increasing hopes for a soft landing.

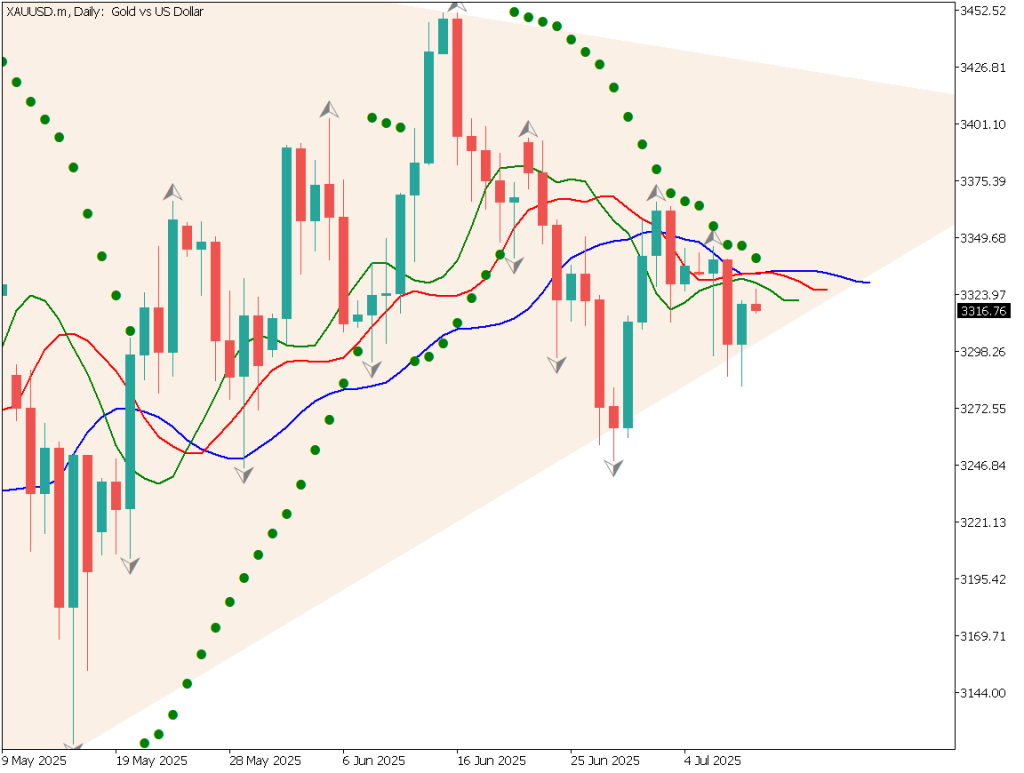

XAUUSD Technical Analysis

Analyzing the daily chart of gold. While it has been declining along a downward channel, it rebounded at the round number of USD 1900, and volatility has decreased. The 10-day moving average is below the 240-day moving average, indicating the appearance of another death cross.From a daily perspective, whether gold breaks below USD1895 will be the focus moving forward. US economic indicators have been exceeding market expectations, fueling the appetite for a stronger dollar. Gold might face selling pressure for a while.

Day Trading Strategy (Hourly)

Analyzing the 1-hour chart of gold. While gold has dropped to USD 1900, it has rebounded to USD 1910. A thick cloud from the Ichimoku Kinko Hyo (one-glance equilibrium chart) lies ahead as a resistance, suggesting that breaking above might take time.Due to the unpredictable nature of the current situation, we might anticipate either a range-bound market or a situation where the price is suppressed by the cloud and starts declining.As a trading strategy, consider a range-bound market scenario. Consider buying around USD 1900 and selling in the USD 1915 – 1918 range.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

1900 USD – A round number and support line.

Market Sentiment

XAUUSD Sell: 33% Buy: 67%

Today’s Important Economic Indicators

Economic Indicators and EventsJST (Japan Standard Time)NY Empire State Manufacturing Index21:30University of Michigan Consumer Sentiment Index23:00

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.