Gold Rises, U.S. Consumer Price Index Falls Short of Market Expectations【November 15, 2023】

Fundamental Analysis

U.S. Consumer Price Index Falls Short of Market Expectations, Strengthening Views of End to Rate Hike Cycle

Expectations for U.S. Rate Cuts in the Coming Year, U.S. Stock Prices Surge & Dollar Selling Intensifies

Gold Soars on Lower Interest Rate Expectations, Rebounds at 240MA

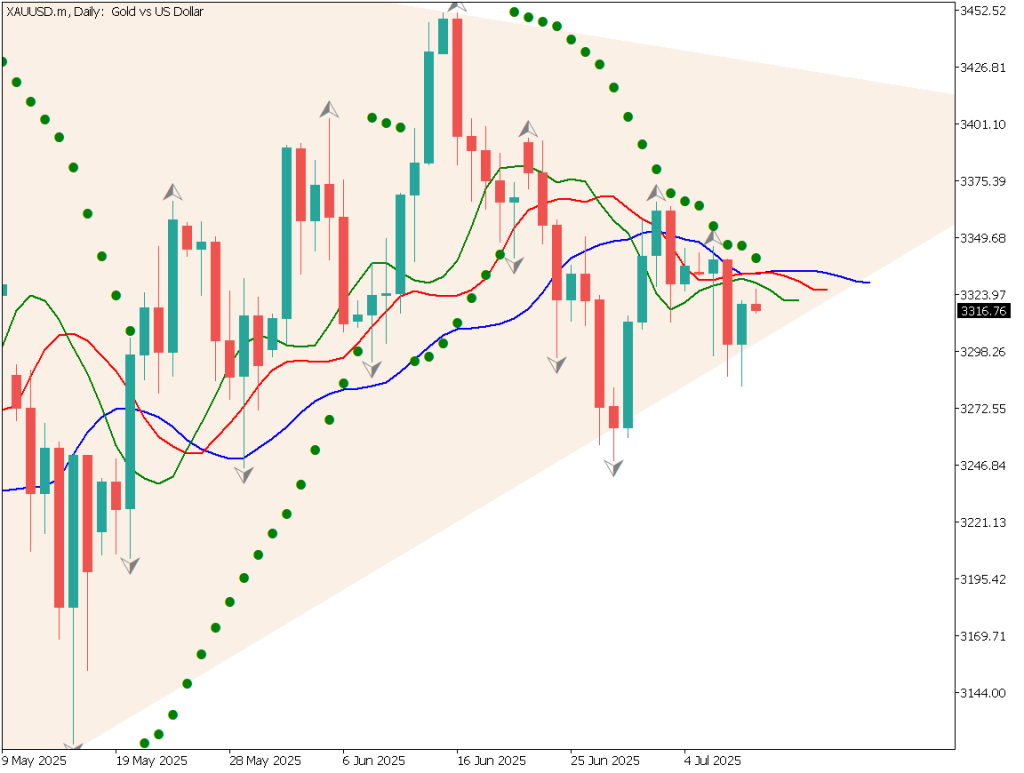

XAUUSD Technical Analysis

Analyzing the daily chart of the gold market. With the U.S. Consumer Price Index falling short of market expectations, the market anticipates an end to the rate hike cycle and rate cuts next year. As a result, U.S. stock indices have risen significantly, and with expected interest rate decreases, gold is attracting buyers.

Gold has rebounded at the 240-day moving average, with the conversion line of the Ichimoku Kinko Hyo acting as a resistance line. Based on Fibonacci expansion, the final target price on the upside is USD 2052.

On the other hand, the near-term upside target is expected to be USD 1985. As long as the market’s expectation of lower interest rates continues, the uptrend in gold is likely to persist.

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour chart of the gold market. The 240 moving average is showing a significant downward curve, and the current price has reached this moving average, showing signs of a rebound.

If the mood for rate cuts continues, gold will be fundamentally supported, but the focus will be on whether it can surpass the 240MA. With the RSI reaching around 70, there is a possibility of a certain degree of downward adjustment.

As a day trading strategy, consider buying on dips at USD 1950, setting the take profit at USD 1975, and stop loss at USD 1940.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

2052 USD – Major Resistance Line1985 USD – Near-term Major Resistance Line

Market Sentiment

XAUUSD Sell: 65% Buy: 35%

Today’s Important Economic Indicators

Economic Indicators and EventsJST (Japan Standard Time)Japanese GDP8:50UK Consumer Price Index (Forecast 4.8%)16:00U.S. Core Retail Sales22:30U.S. Producer Price Index22:30U.S. Crude Oil Inventory0:30 (Next Day)

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.