Gold Rises, Funds Concentrate on Expectations of U.S. Rate Cuts【November 22, 2023】

Fundamental Analysis

Gold rises as expectations of U.S. rate cut rise

Gold Aims for USD 2000, Resistance Lines at USD 2001 and 2009

Gold may rise to USD 2025, watch for dollar weakness

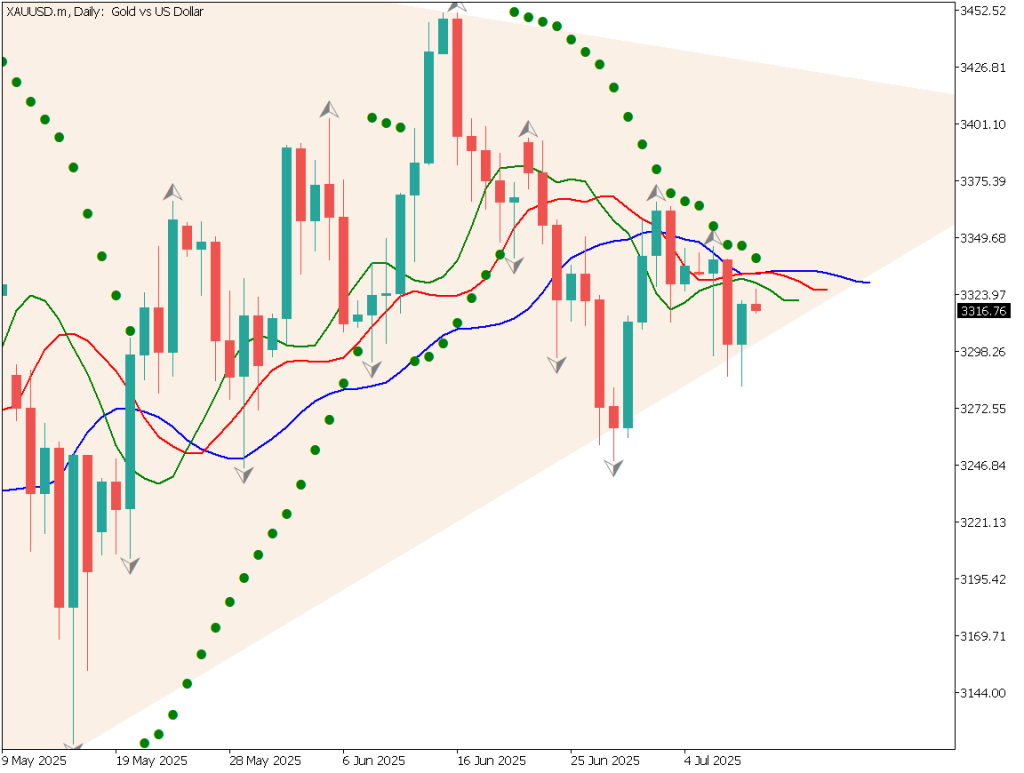

XAUUSD Technical Analysis

Analyze Gold daily. Gold continues to climb toward the recent high of USD 2009, and analysis of the GMMA shows that the gap between the short-term and long-term GMMAs is beginning to open up again. The focus will be on a break above the recent highs. If the recent high is exceeded, an uptrend based on the Dow Theory will be generated.

The RSI is hovering around 60, maintaining a solid uptrend. With the U.S. Thanksgiving holiday coming up, we would be wary of a decline in volatility.

Day Trading Strategy (1-Hour Chart)

Analyze the hourly chart of Gold. Yesterday, the price failed to break above the recent high of USD 2009, but rose to the USD 2007 level. If the trend of dollar weakness continues today, the price could remain above the recent high of USD 2009.

The focus will be on whether the USD 1993 level will become a support zone; if it does, we believe the price will rise again toward the USD 2000 level.

Day trading policy is to buy at the push. Entry is at USD 1993.5, close at USD 2001, and stop at USD 1990.

Support and Resistance Lines

Upcoming resistance lines to consider:

2009.6 USD – The recent high

Market Sentiment

XAUUSD – Sell: 74%, Buy: 26%

Today’s Important Economic Indicators

Economic Indicators and EventsJST (Japan Standard Time)U.S. Core Durable Goods Orders22:30U.S. Unemployment Insurance Claims22:30U.S. University of Michigan Consumer Confidence IndexMidnight 0:00U.S. crude oil inventoriesFollowing 0:30

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.