Gold Rises as U.S. Rate Cut Expectations Drive Record High【August 19, 2024】

Fundamental Analysis

U.S. consumer spending suggests resilience, while U.S. housing starts decline.

Gold reaches record highs as rate cut expectations come into focus.

All eyes are on Fed Chair Powell’s speech at the Jackson Hole Symposium.

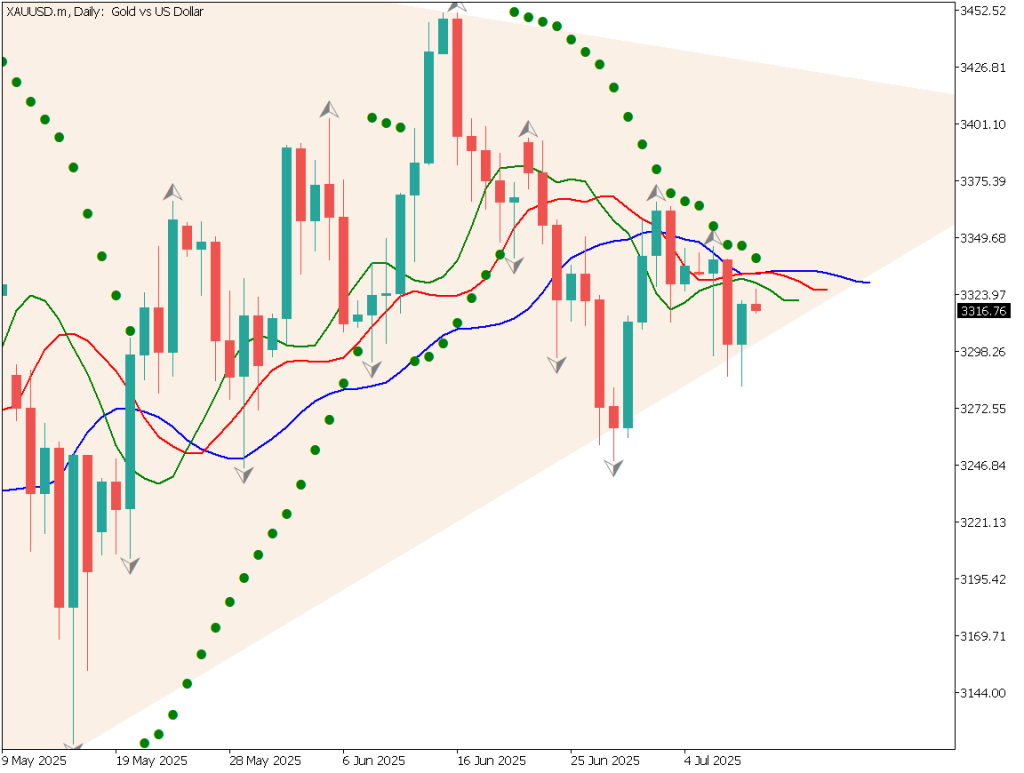

XAUUSD technical analysis

Analyzing the daily chart of gold: Gold has reached 161.8% of the Fibonacci expansion on the daily chart, breaking into the 2500 USD range for the first time. There is a sense of accomplishment. It is trading above the +2σ line of the Bollinger Bands, and profit-taking is expected. With the Jackson Hole Symposium and other key statements approaching, the market is likely to retrace today.

However, whenever new developments heighten expectations for U.S. rate cuts, upward pressure on gold will increase. The focus will be on 2515 USD, 2545 USD, and 2580 USD moving forward.

Day trading strategy (1 hour)

Gold is in a slight downtrend. Profit-taking appears to have occurred after reaching 2500 USD. Given the current market outlook, 2500 USD is considered slightly high, so I want to buy on a dip after a pullback.

Specifically, I would like to buy if it falls to around 2472 USD. This was the upper limit of the range that had been sustained for a long time. I expect a rebound here. If it breaks below 2462 USD, there is a risk of a sharp drop to around 2416 USD, so this will be the stop level.

Support/Resistance lines

The following support and resistance levels should be considered going forward:

2515 USD: Monthly resistance zone2470 USD: Previously recognized price level

Market Sentiment

XAUUSD: Sell: 64%, Buy: 36%

Today’s important economic indicators

Economic indicators and eventsJapan timeFed Officials’ Speeches22:15U.S. Leading Economic Index23:15

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.