Gold Rises as Middle East Tensions Escalate【October 2, 2024】

Fundamental Analysis

Iran Launches Direct Attack on Israel

Gold is rising as a safe-haven asset

There is a seasonal tendency for gold to be bought toward the end of the year

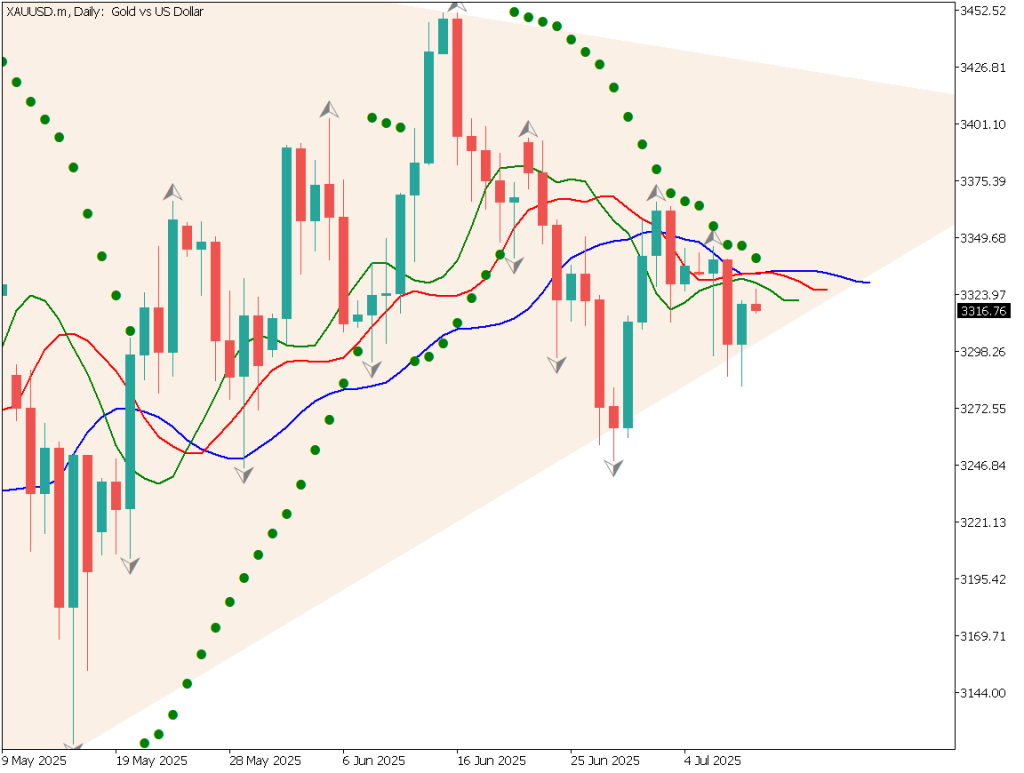

XAUUSD technical analysis

Analyzing the daily chart of gold, it is moving within an upward channel, and the market is continuing in a state where dips are likely to be bought. Based on the N measurement, gold could rise to approximately 2,740 USD, with the potential for further upward momentum.

The 200-day moving average is also trending upward, suggesting a continued slight rise. The escalation of tensions in the Middle East shows no sign of a ceasefire. As a rate cut for the USD is anticipated in the future, it is expected that gold will be more attractive than the USD.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of gold, both the 52 and 200 moving averages are being monitored. Currently, both have been broken above, but there seems to be a slight weakening in the upward momentum.

A high wick has formed in the upper price range, and the highs are gradually decreasing. Approaching 2,700 USD, there seems to be a lack of strong catalysts. Today, the ADP employment report is scheduled to be released. If the ADP report shows weaker results, expectations for a U.S. rate cut may rise again, which would be a bullish factor for gold. However, if the ADP report is strong, gold could see a relatively large correction.

A potential buying entry could be considered around 2,640 USD, aiming to buy on dips. A rebound at the 200 moving average is expected. If 2,635 USD is breached, it could serve as the stop-loss level.

Support/Resistance lines

The support and resistance levels to consider are as follows:

2,650 USD: 52 Moving Average

2,640 USD: 200 Moving Average

Market Sentiment

XAUUSD – Sell: 60%, Buy: 40%

Today’s important economic indicators

Economic indicators and eventsJapan timeU.S. ADP Employment Report21:15U.S. Crude Oil Inventory23:30Speech by Fed Governor BowmanMidnight (00:00)

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.