USDJPY Remains in the Low 153 JPY Range as U.S. Consumer Confidence Index Surges【October 30, 2024】

Fundamental Analysis

The U.S. Consumer Confidence Index exceeded all expectations and surged.

Gold is hitting new all-time highs, surpassing the key level of 2,770 USD.

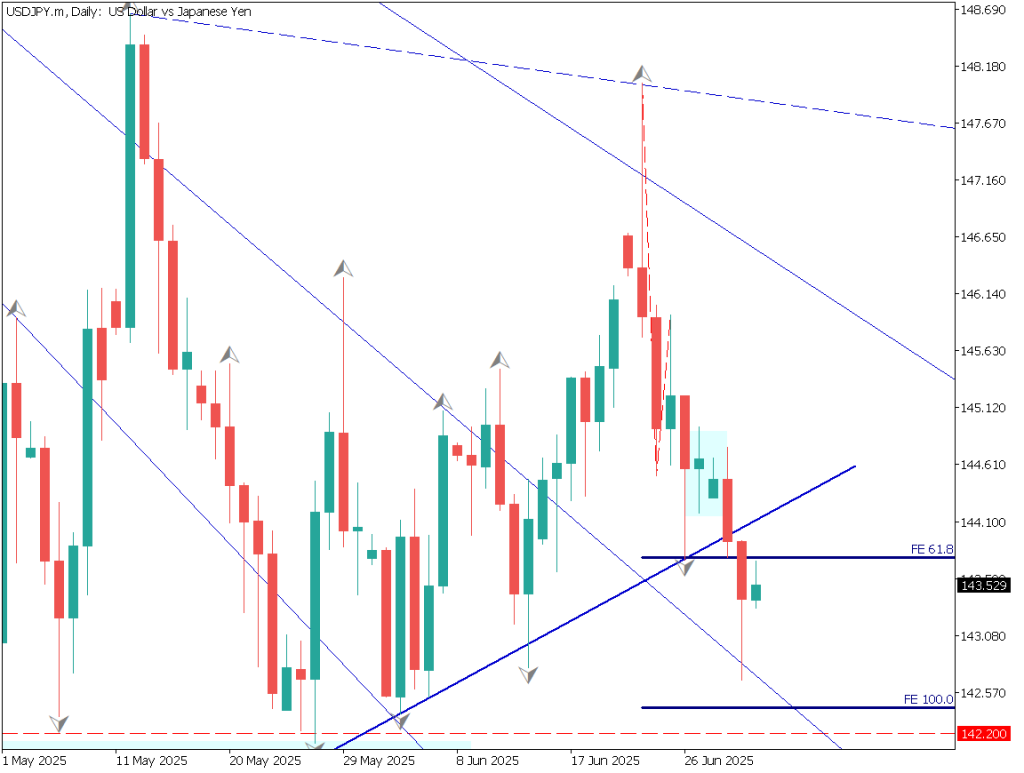

USDJPY technical analysis

Analyzing the daily chart of USDJPY, the pair has clearly broken above the 200-day moving average, signaling a strong upward trend. It has also closed above 153.30 JPY, corresponding to the 61.8% Fibonacci retracement, and tested the 154 JPY level for the second consecutive day.

The 10-day moving average is approaching the 200-day moving average, and attention is on whether a golden cross will form. The 10-day moving average has been functioning as a support line, and USDJPY has remained above it throughout October.The Bank of Japan’s monetary policy meeting is being held today and tomorrow, but a rate hike is unlikely. Ongoing optimism about the U.S. economy is believed to be fueling continued USD buying.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY, the pair is forming a double top with a high of 153.88 JPY. However, strong buying on dips is also present. Buying interest has emerged at the key Fibonacci level of 153.30 JPY on the daily chart, resulting in a narrow range.

The U.S. ADP Employment Report will be released today. There have been reports of increased layoffs and a reduction in job openings, raising the possibility of a weak outcome. There is also a chance that USDJPY could fall to the 152 JPY range.

For day trading, targeting a deeper pullback is advisable. Consider setting a buy limit at 152.65 JPY, the lower boundary of the Ichimoku Cloud, with a stop at 152.35 JPY and aiming to take profit in the high 153 JPY range.

Support/Resistance lines

The following are key support and resistance lines to consider:

153.88 JPY – Recent High

151.50 JPY – Key Level

Market Sentiment

USDJPY: Sell 70% / Buy 30%

Today’s important economic indicators

Economic Indicators and EventsJapan TimeAustralian Consumer Price Index9:30 AMGerman Employment Statistics5:55 PMGerman GDP6:00 PMEurozone GDP7:00 PMU.S. ADP Employment Report9:15 PMCore Personal Consumption Expenditure Price Index9:30 PMU.S. GDP9:30 PMU.S. Crude Oil Inventories11:30 PM

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.