Gold Profit-Taking as Funds Flow into USD and Equity Markets【November 12, 2024】

Fundamental Analysis

Bitcoin surged by 10,000 USD since the weekend, potentially fueled by a “Trump rally.”

Rising equities and a strengthening USD are prompting a fund outflow from gold.

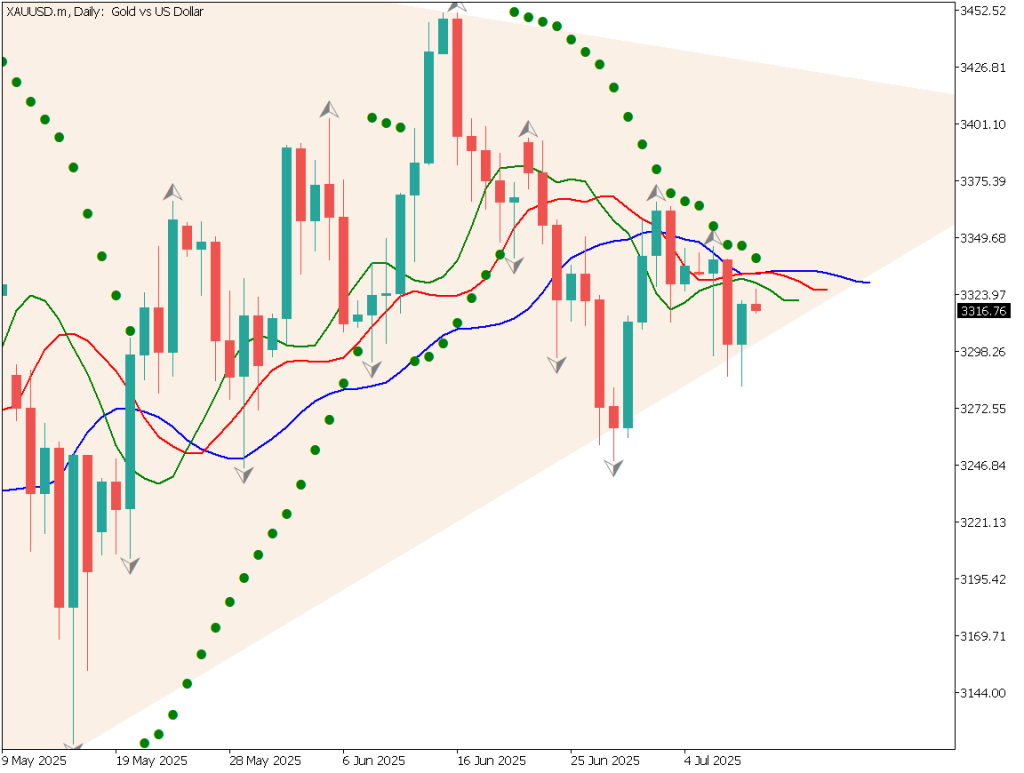

XAUUSD Technical Analysis

Analyzing the daily chart for gold, the Ichimoku Kinko Hyo cloud provides support at lower levels, and the price is touching the -3σ line of the Bollinger Bands. There’s a strong potential for a rebound from the -3σ line, with a scenario of a rally up to the -2σ line expected today.

With U.S. stock markets resuming after the presidential election and FOMC meetings, this is the first week of trading. The focus is on whether a “Trump rally” will take shape. Policies associated with Mr. Trump are typically seen as favorable to the stock market, contributing to a supportive market environment for rising equities.

Gold is prone to profit-taking in an environment of rising stocks and a strengthening USD. Given this, a potential decline to around 2,600 USD by the end of this week is anticipated.

Day trading strategy (1 hour)

Analyzing the hourly chart for gold, the 90-period moving average serves as a pullback point, with gold falling near 2,610 USD. The daily analysis shows potential for a temporary rise to around 2,640 USD due to the Ichimoku cloud and the Bollinger Bands’ -3σ line.

For a contrarian trade, consider a long position at 2,605 USD today. Set a stop-loss if it breaks below 2,600 USD. The profit target is set at 2,636 USD.

Support/Resistance lines

Key support and resistance lines to consider:

- 2,600 USD: Fibonacci/Round Number Level

Market Sentiment

XAUUSD Sell: 38% | Buy: 62%

Today’s important economic indicators

Economic Indicators and EventsJapan TimeUK Employment Data16:00ECB’s McCaul Speech21:00Speech by Fed’s WallerMidnightFOMC Member Speech4:00 Following Day

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.