Key Fundamental Points

U.S. budget expires at 1:00 PM JST, triggering a government shutdown

Gold continues to set new record highs for consecutive days

Republicans and Democrats remain unwilling to compromise

Gold Hits New Highs

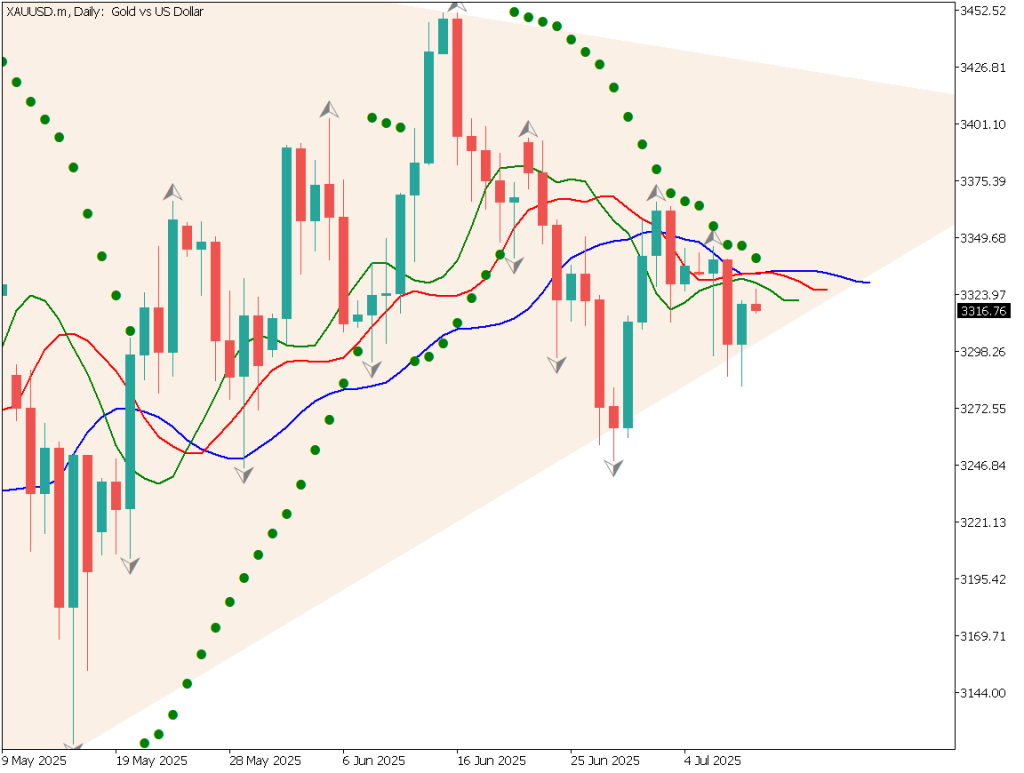

Gold has renewed its record highs for two consecutive days, with large bullish candlesticks emerging. Prices are moving further away from the 10-day moving average, while the RSI has reached a very high level of 77. This suggests that 77% of the last 24 candlesticks have moved upward.

If the U.S. government shutdown becomes a reality, the Trump administration plans mass layoffs of government employees. The U.S. labor market is already weakening, and many who lose their jobs may struggle to find new employment. Moreover, the release of U.S. employment data would be postponed during the shutdown, amplifying market uncertainty.

However, since government operations will eventually resume, the market could see a “sell the fact” reaction with today marking a potential peak.

Professional Day Trading Strategy

The strategy remains primarily bullish. Based on the N-wave theory, gold is expected to rise toward the $4,050 level. While the shutdown risk lingers, further deterioration in U.S. labor conditions would heighten expectations for rate cuts, weaken the dollar, and drive more capital into gold.

Other precious metals, such as platinum, are also soaring, presenting relative value opportunities. The precious metals sector as a whole is likely to remain strong, making long strategies favorable.

Entry: Around $3,800

Take Profit: Around $4,000

Stop Loss: Below $3,790

Key Economic Indicators Today

Event | Time |

|---|---|

Bank of Japan Tankan Survey | 8:50 |

Eurozone CPI | 18:00 |

U.S. ADP Employment Report | 21:15 |

U.S. Manufacturing PMI | 22:45 |