Fundamental Analysis

U.S. ADP employment data fell short of expectations: -32,000 vs forecast +51,000

U.S. government shutdown forces 750,000 workers into furloughs; potential layoffs could cause severe disruption

Risk-off sentiment grows, dollar selling strengthens, USD/JPY falls into the 146 range

Second Consecutive Monthly Decline

The latest ADP employment report showed negative figures for the second straight month. The August data was also revised downward, from +54,000 to -3,000. Although the unemployment rate remains low, U.S. labor conditions are clearly deteriorating.

Additionally, the government shutdown has already put 750,000 workers on temporary furlough, and President Trump is reportedly considering permanent layoffs. Should such a measure be enacted, it would inevitably cause major disruption to both the economy and government functions.

USD/JPY has fallen below the conversion line, base line, and the Ichimoku cloud, with the 200-day moving average acting as support. While it may not break below immediately, a prolonged shutdown could trigger further heavy dollar selling. On the other hand, a sudden “agreement” could spark a sharp rebound.

Attention is also needed on comments from Bank of Japan officials regarding possible rate hikes.

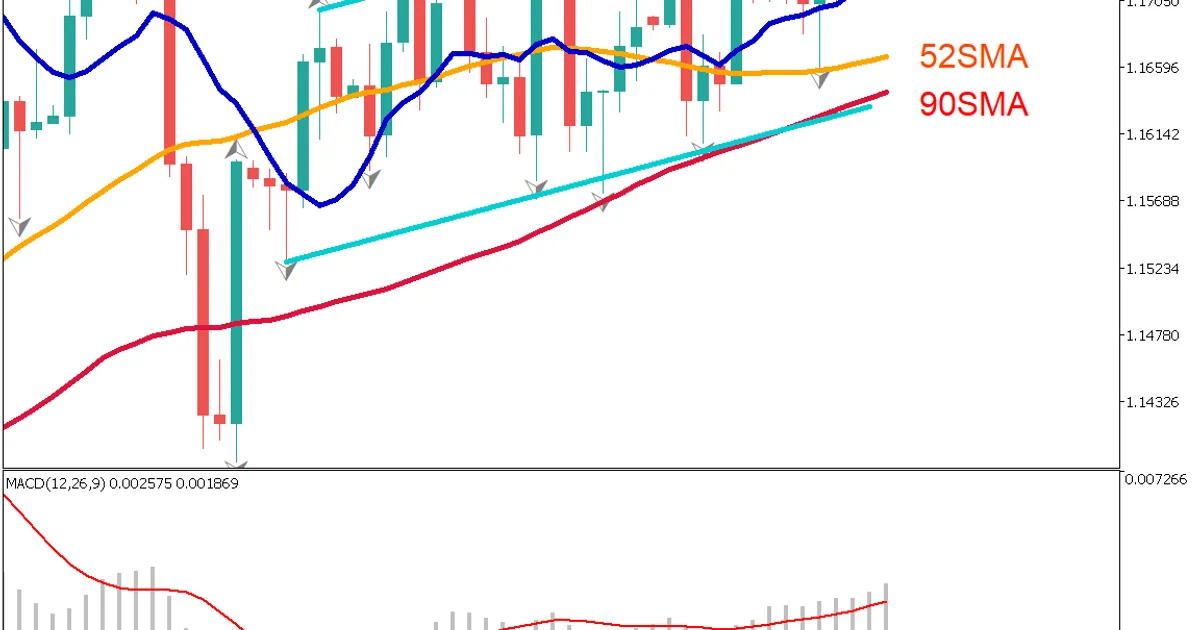

Day Trading Strategy (1H Chart)

USD/JPY rebounded from the 146 range and is trading in the 147 range. The key focus is whether the base line will act as resistance. RSI is approaching 50; if it rises toward 50 from below, selling pressure could intensify.

For aggressive traders, a sell limit order could be set near 147.57, where the base line is positioned. More cautious traders may consider sell limit entries around 147.80–148.25.

Considering worsening U.S. employment, growing rate-cut expectations, the government shutdown, and possible BOJ hikes, downside risks for USD/JPY remain dominant.

Today’s Key Economic Indicators

Event | Time |

|---|---|

Eurozone Employment Report | 18:00 |

U.S. Jobless Claims | 21:30 |

U.S. Durable Goods Orders | 23:00 |