Fundamental Analysis

Tomorrow, Japan will hold the Liberal Democratic Party (LDP) leadership election, expected to head into a runoff vote.

Over the weekend, the new prime minister will effectively be decided, so traders should be cautious of potential weekend gaps.

The Nikkei gained on expectations

The Nikkei 225 has been rising steadily, maintaining a gradual upward trend. The LDP election on October 4 will essentially determine Japan’s next prime minister. Since the candidates differ in their stance on fiscal expansion versus austerity, market reaction next week could vary significantly.

Today, it is almost certain that the U.S. Nonfarm Payrolls report will be postponed, making the LDP election the major event of the weekend. While the Bollinger Bands are narrowing slightly, past leadership elections have often driven the Nikkei higher on optimism.

Currently, the Nikkei is trading above the Ichimoku conversion line, with the key question being whether it can break above the recent high of 45,950.

[Nikkei 225 / Daily Chart]

Professional USD/JPY Day Trading Strategy

Let’s consider today’s day-trading strategy for USD/JPY.

The pair is moving within the Ichimoku cloud, with the baseline acting as firm support while prices attempt to climb higher. A key focus will be whether USD/JPY can break out above the cloud. However, resistance around 148 remains strong, and short-term selling near that level may be effective.

It may be best to wait for a clear pullback and then sell into the recovery.

With the LDP leadership election scheduled for the weekend, traders may want to avoid holding positions overnight and instead stick to intraday strategies today.

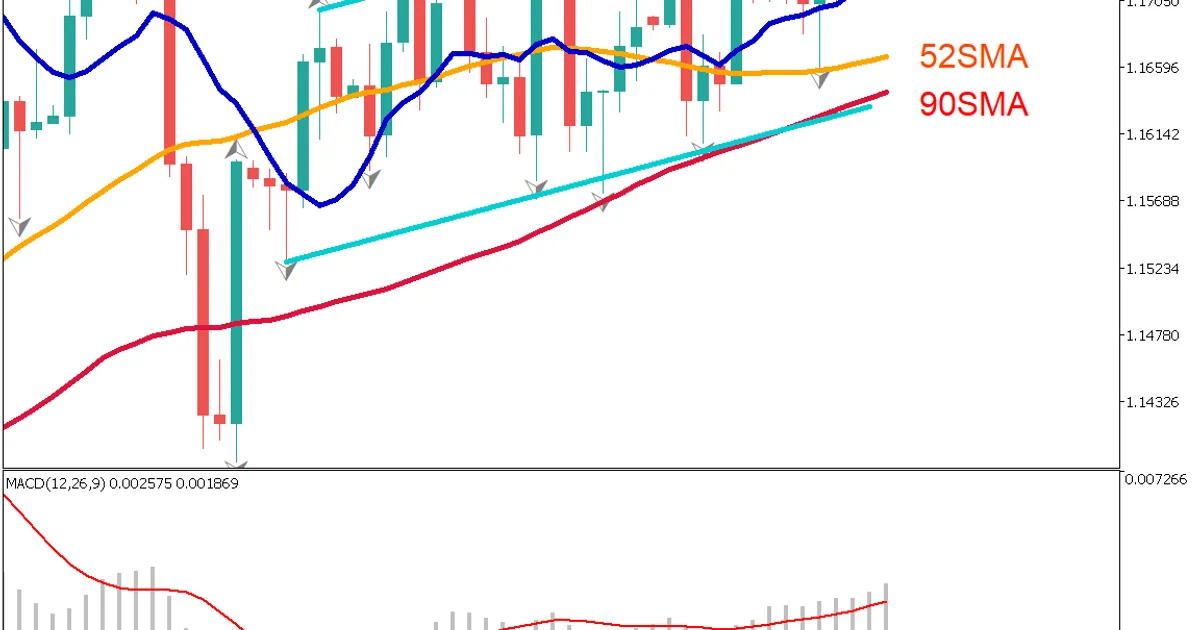

[USD/JPY / 1H]

Today’s Key Economic Indicators

Event | Time |

|---|---|

Eurozone Services PMI | 17:00 |

ECB President Lagarde Speech | 18:40 |