Fundamental Analysis

Gold continues to surge amid the ongoing U.S. government shutdown

Republicans and Democrats remain deadlocked

Dollar selling and safe-haven buying dominate the market

No Prospect for Government Reopening

It has now been seven days since the U.S. government shutdown began. The stopgap budget proposal has been rejected three times, and no agreement is in sight.

The Trump administration shows no sign of backing down and is preparing for a prolonged standoff. During his first term, the Trump administration once endured a 35-day shutdown.

This time, the president has warned of potential layoffs for furloughed federal employees, and actual dismissals may soon begin.

However, the lack of major economic reports—such as employment data—makes it difficult for the market to assess the true state of the U.S. economy. Economic deterioration appears increasingly likely, and the Federal Reserve may be forced to cut interest rates.

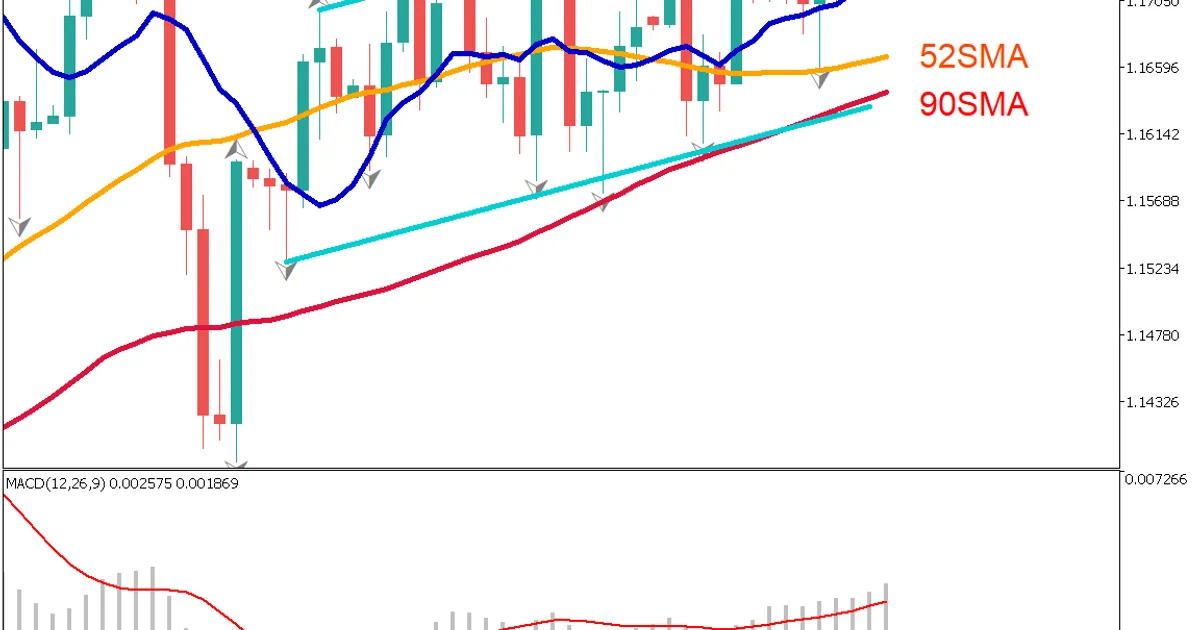

Technical Analysis

In such an environment, dollar selling tends to accelerate, and gold, as a traditional safe-haven asset, becomes more attractive.

[Gold / Daily Chart]

When examining the Bollinger Bands, a long-term band walk between +1σ and +2σ is clearly visible. The price is now trading around $3,950, showing strong momentum toward the key psychological level of $4,000.

Professional Gold Day-Trading Strategy

From a fundamental standpoint, the continued rise in gold prices appears inevitable. As investors sell the U.S. dollar, excess capital is likely to flow into cryptocurrencies and traditional safe-haven assets. Therefore, a move toward $4,000 seems highly probable.

However, as the price approaches the $4,000 level, profit-taking is expected to increase, potentially leading to a sharp correction. Before entering the $3,000 range previously, gold dropped as low as $2,830. A similar pattern may occur again before reaching $4,000.

The strategy remains to buy until $3,990, then wait for a correction before re-entering around $3,850 for another buying opportunity.

[Gold / 1-Hour Chart]

Today’s Key Economic Indicators and Events

None | - |