Gold Rises as Safe-Haven Demand Strengthens Despite Strong U.S. Employment Data【January 13, 2025】

Fundamental Analysis

U.S. non-farm payrolls and unemployment rate showed strong results, with payrolls significantly exceeding expectations.

Speculation about U.S. interest rate cuts has decreased sharply, driving USD appreciation.

The market is accelerating its review of 2025 rate-cut expectations.

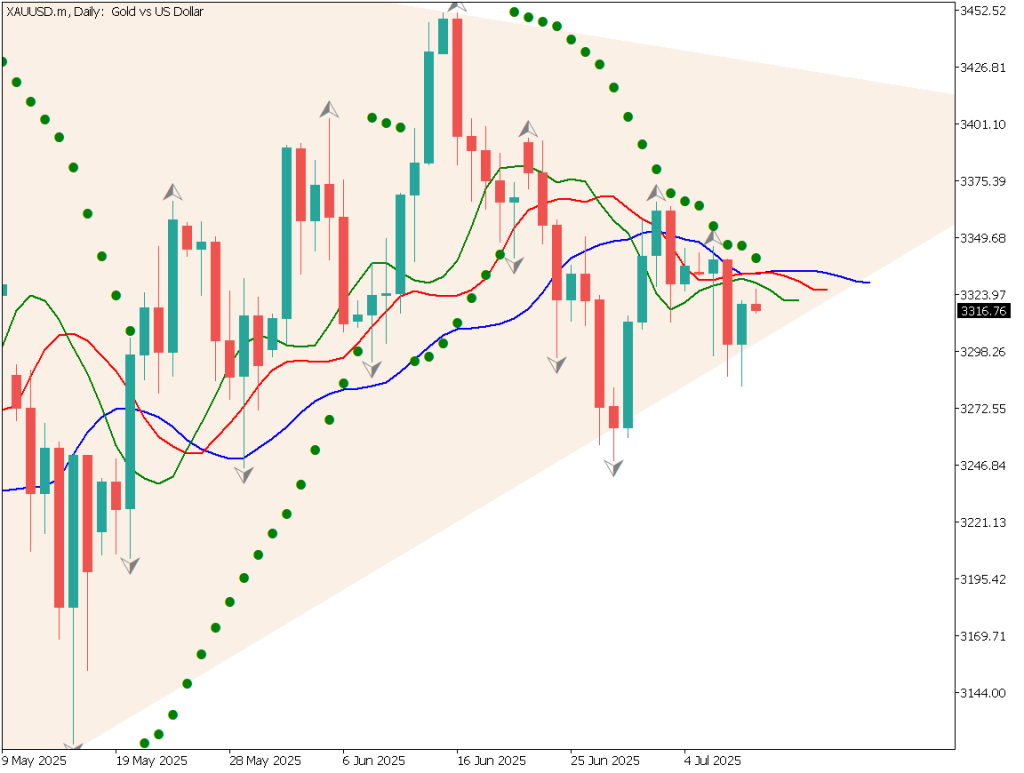

XAUUSD Technical Analysis

On the daily chart, gold is forming a triangle pattern with lower highs and higher lows. It has broken upward through the descending trendline, indicating strengthening bullish momentum. The RSI is at 62, nearing its resistance at 63. The MACD histogram continues to rise, suggesting upward momentum.Despite strong U.S. employment data and diminished rate-cut speculation—typically bearish for gold—safe-haven buying is intensifying ahead of President Trump’s inauguration.

Day trading strategy (1 hour)

On the 1-hour chart, gold is rising along the baseline and conversion line, currently nearing the conversion line. If it surpasses the recent high, it could enter the $2,700 USD range.The RSI shows a bearish trend, and the MACD also suggests downward momentum.Recommended Strategy: Buy on dips at $2,680 USD, set take-profit at $2,696 USD, and place a stop-loss below $2,675 USD.

Support/Resistance lines

Key support and resistance lines to consider:

- $2,720 USD: Neckline

Market Sentiment

XAUUSD: Sell: 55% / Buy: 45%

Today’s important economic indicators

Economic Indicators and EventsJapan TimeJapanese equity markets closed–

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.