Gold Temporarily Declines as Fed Chair Comments on Rate Cuts【January 30, 2025】

Fundamental Analysis

Gold temporarily declined, hitting a low of USD 2,744.

The U.S. Federal Reserve decided to keep interest rates unchanged and stated that they are not in a hurry to cut rates.

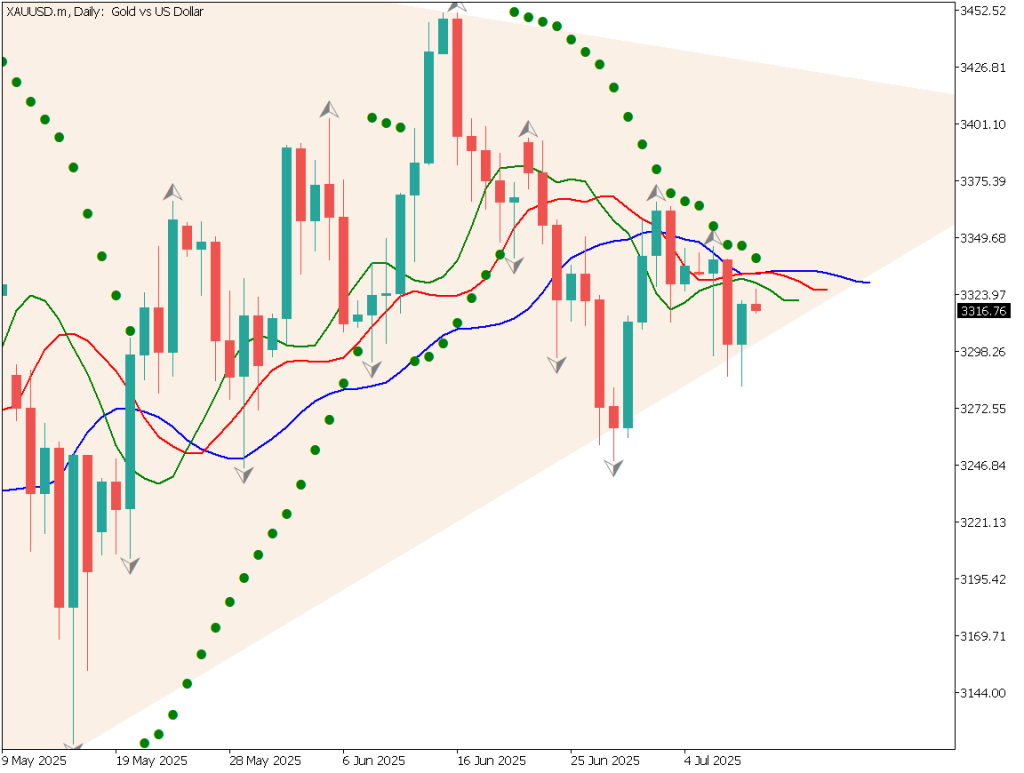

XAUUSD Technical Analysis

Analyzing the daily chart of gold, the price dropped to USD 2,744 following the Fed Chair’s remarks but formed a pullback and rebounded. Overall, the upward trend remains intact.

Gold faces strong resistance at USD 2,772, and there is a possibility of reaching new highs in February. Since the beginning of the year, the uptrend has continued, maintaining a position above the conversion line. The current trend remains strong.

The underlying factors include an increasing trend of central banks holding gold as foreign exchange reserves, strong demand as a hedge against U.S. monetary policy risks, and overall economic uncertainty.

The RSI stands at 64, indicating a stable upward trend.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of gold:

A rebound from the 52-period moving average confirms a buying opportunity.

Fibonacci Expansion analysis indicates that 100% corresponds to USD 2,780, while 161.8% aligns with USD 2,800.

The day trading strategy remains bullish. Since the price has broken above the Ichimoku cloud, the target is set at USD 2,772. A stop-loss should be placed if the price falls below the recent low of USD 2,744.

Support/Resistance lines

Key support and resistance lines to consider:

- USD 2,744 – Recent 1-hour chart low

Market Sentiment

XAUUSD: Sell: 59% / Buy: 41%

Today’s important economic indicators

Economic Indicators and EventsJapan TimeGermany GDP18:00Eurozone GDP19:00ECB Monetary Policy Announcement & Interest Rate Decision22:15U.S. Continuing Jobless Claims22:30U.S. Core PCE Price Index22:30U.S. Initial Jobless Claims22:30ECB Press Conference22:45

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.