Trump Administration Implements New Tariffs, Gold Rises Amid Risk Aversion【March 4, 2025】

Fundamental Analysis

President Trump Criticizes Currency Depreciation Policies, Targets JPY Weakness

Trump Warns Japan of Tariffs, Impact on Japanese Companies Expected

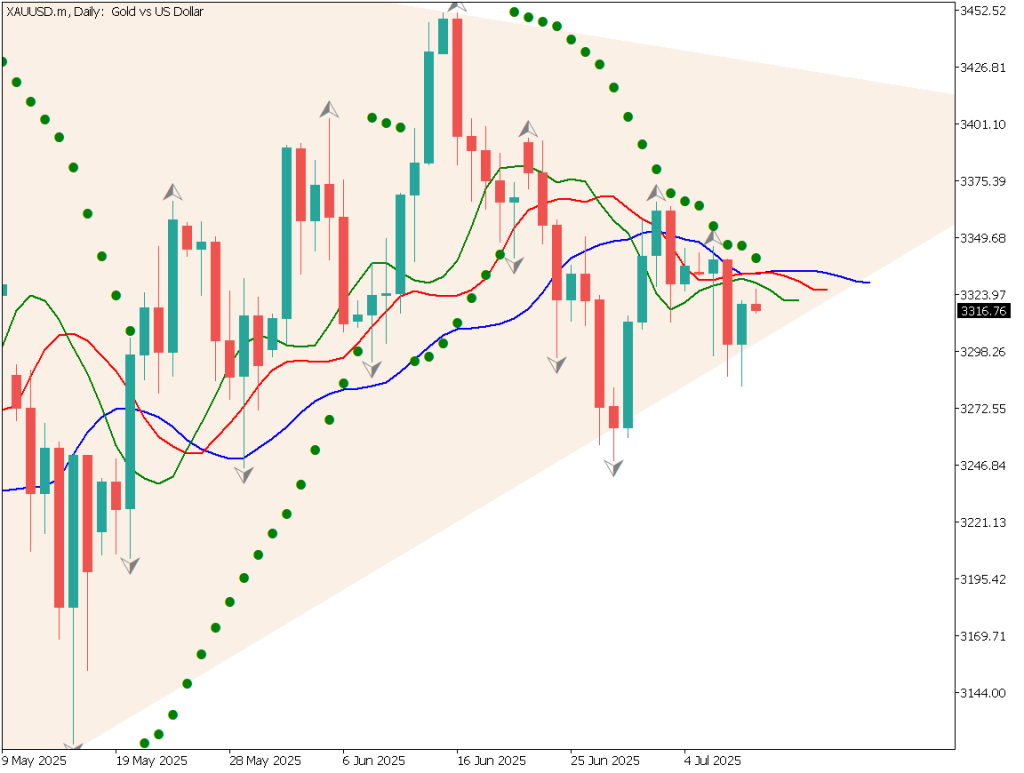

XAUUSD Technical Analysis

Gold rebounds and continues to rise. Fibonacci retracement levels are in focus, leading to two consecutive days of gains. Although it is trading below the 10-day moving average, uncertainty is increasing, making gold more attractive as a safe-haven asset. The key point in the short term is whether it can break above the 10-day MA.

The 90-day moving average is gradually trending upward, reinforcing the bullish momentum. The RSI rebounded at 50, indicating buying interest on dips. Even if USD experiences temporary buying pressure, the ongoing implementation of tariff policies could drive up import prices and fuel recession concerns, ultimately leading to USD depreciation.

With the increasing demand for safe-haven assets, reaching 3,000 USD appears to be just a matter of time.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of gold, it rebounded near 2,830 USD and is approaching 2,900 USD again. The 10MA has crossed above the 90MA, forming a golden cross. The key focus is whether it can break above the recent high of 2,920 USD.

The day trading strategy is buying on dips.

Buy Limit Order: 2,880 USD (Pivot Point)

Take Profit: 2,910 USD

Stop Loss: Below 2,860 USD

Support/Resistance lines

Key support and resistance lines to consider:

2,956 USD – Recent High

2,856 USD – Fibonacci 23.6% Level

Market Sentiment

XAUUSD: Sell: 57% / Buy: 43%

Today’s important economic indicators

Economic Indicators and EventsJapan TimeJapan Unemployment Rate8:30RBA Monetary Policy Meeting Minutes9:30Australia Retail Sales9:30

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.