USDJPY Continues Downtrend, Strong Selling Pressure on Rallies【March 14, 2025】

Fundamental Analysis

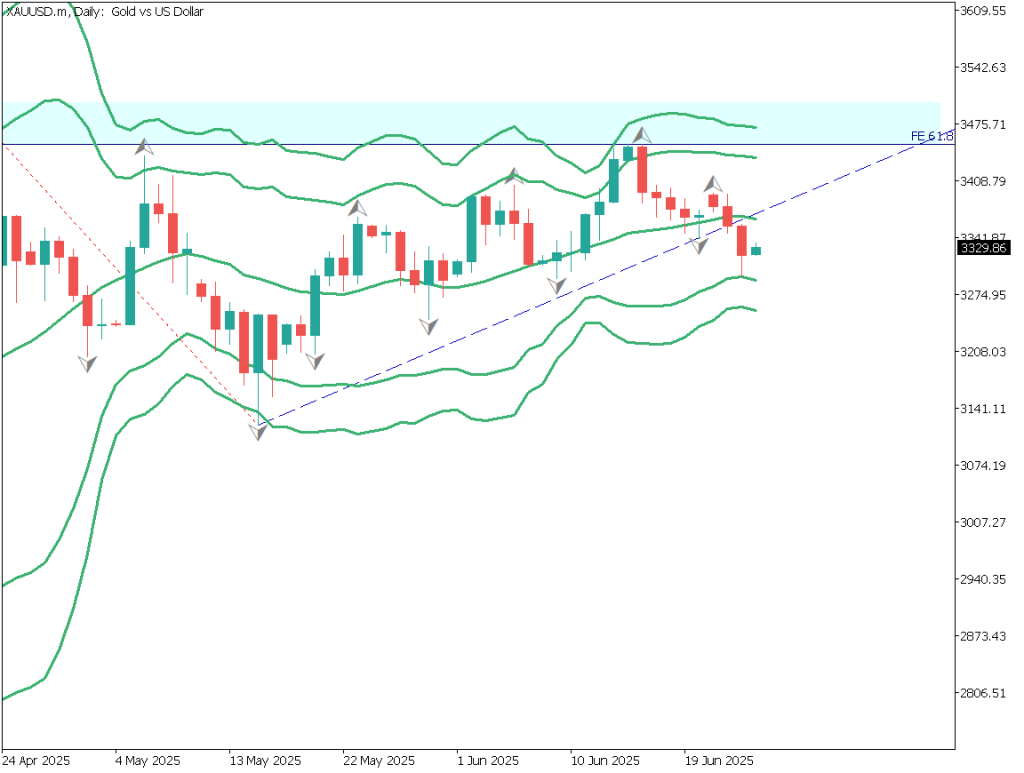

Gold Surges to New High, Reaches USD 2,989

Trump Administration Imposes Retaliatory Tariffs on Europe

Trump Administration Also Eyes Japan’s Rice Tariffs

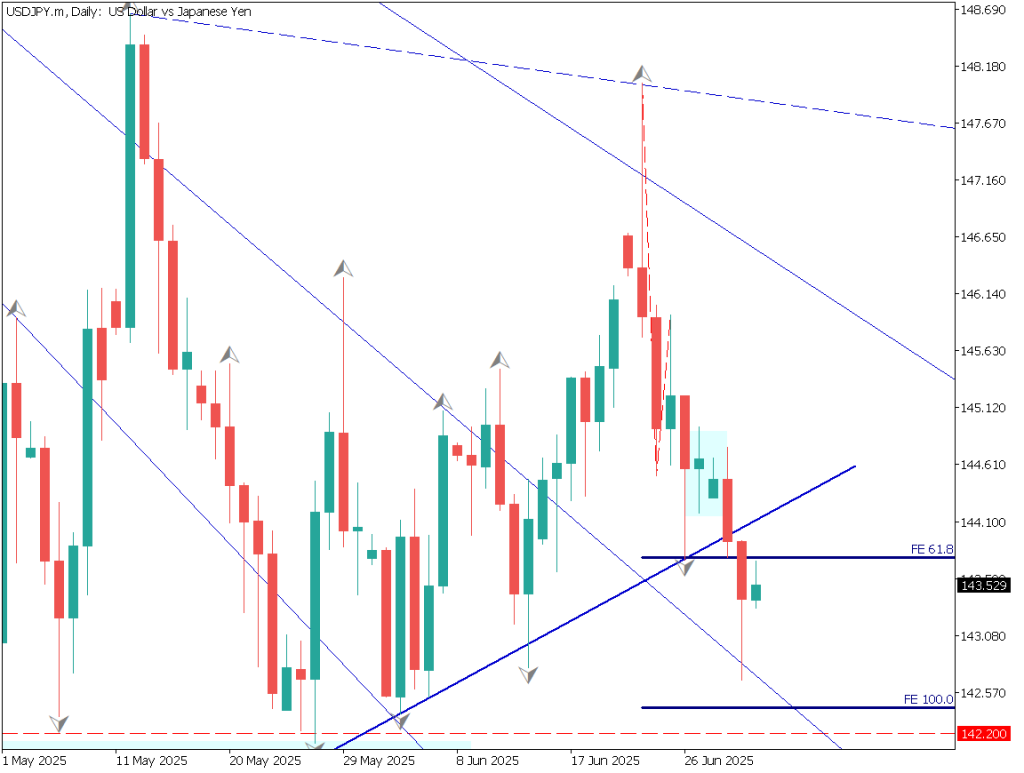

USDJPY Technical Analysis

USDJPY remains in a downtrend, following the conversion line. The pair faces resistance at the conversion line, reinforcing JPY appreciation pressure. Concerns over the U.S. economic slowdown, coupled with Japan’s rising wages and expectations of interest rate hikes, are further supporting JPY strength.

The 38.2% Fibonacci retracement level is in focus, and USDJPY may attempt to break below the 146.50 JPY low again. If tariffs on Japan are implemented, the impact could be significant, making it uncertain whether JPY will appreciate or depreciate sharply.

In April, tariffs on the automotive sector are also planned. The market will closely watch whether Japan will become a primary target.

Day trading strategy (1 hour)

Analyzing the USDJPY 1-hour chart, the price has broken below the cloud, with the lower boundary of the cloud acting as resistance. The RSI remains below 50, indicating signs of a potential pullback.

Today’s day trading strategy is selling USDJPY:

Sell limit order at 148.35 JPY (recent high)

Stop-loss if the price breaks above the cloud

Take profit at 146.50 JPY

Support/Resistance lines

Key support and resistance lines to consider:

- 148.35 JPY – Recent high on the 1-hour chart

Market Sentiment

USDJPY Sell: 41% / Buy: 59%

Today’s important economic indicators

Economic Indicators and EventsJapan TimeUK GDP16:00Germany Consumer Price Index16:00University of Michigan Expected Inflation Rate23:00University of Michigan Consumer Sentiment Index23:00

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.