Trump Tariff Shock Hits Japanese Exporters【April 3, 2025】

Fundamental Analysis

The Trump administration has announced new tariff policies, with Japan facing a 24% rate.

Toyota was singled out for criticism, triggering a sharp sell-off centered on auto-related stocks.

USDJPY Technical Analysis

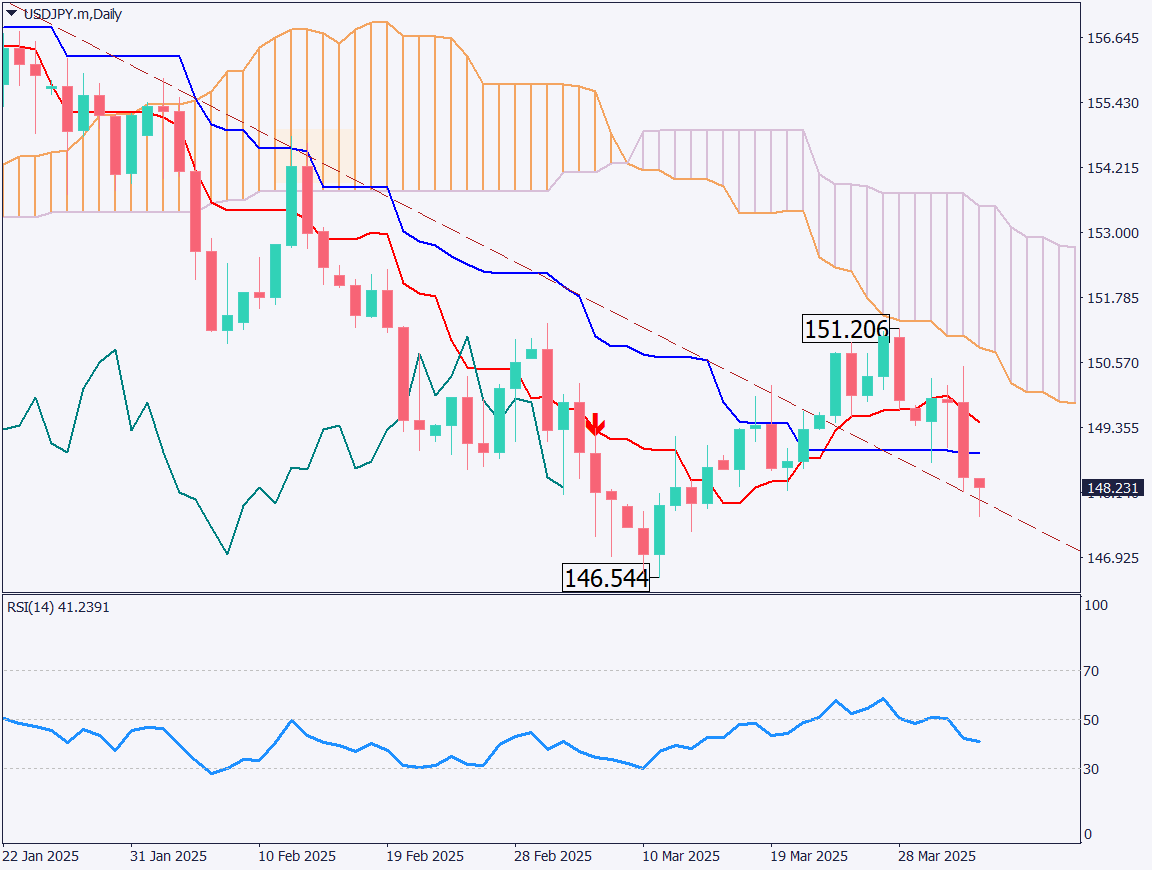

Analyzing the daily chart of USDJPY: The pair has declined in reaction to the Trump tariff shock, reflecting a stronger JPY. However, since Japan is subject to higher tariffs than Europe, it remains uncertain whether the Japanese Yen will function as a safe-haven asset this time.

A downward trendline is in focus, with attention on whether USDJPY will break below 146.50 JPY. A flat 10% tariff is being imposed on many countries, while higher rates are applied to China and Japan compared to the EU. Japanese stocks have also seen heavy selling, and global market reaction later tonight will be closely watched.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY: After falling to 147.68 JPY, USDJPY saw a sharp rebound, partly due to RSI dropping below 30. While it’s unclear whether the market has fully priced in the news, ongoing negotiations between countries may gradually ease the tariffs.

For day trading, the strategy today is to not trade. Volatility is high and unpredictable, so we prefer to stay on the sidelines.

Support/Resistance lines

Key support and resistance lines to consider:

- 146.50 JPY – Recent low

Market Sentiment

USDJPY – Sell: 41% / Buy: 59%

Today’s important economic indicators

Economic Indicators and EventsJapan TimeU.S. Initial Jobless Claims21:30

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.