USDJPY Falls Below 142 as Risk-Off Sentiment Deepens【April 17, 2025】

Fundamental Analysis

Fed Chair Powell denies any early policy adjustments, effectively ruling out renewed market intervention.

The U.S. stock market plunged, while gold surged to a record high amid risk-off sentiment.

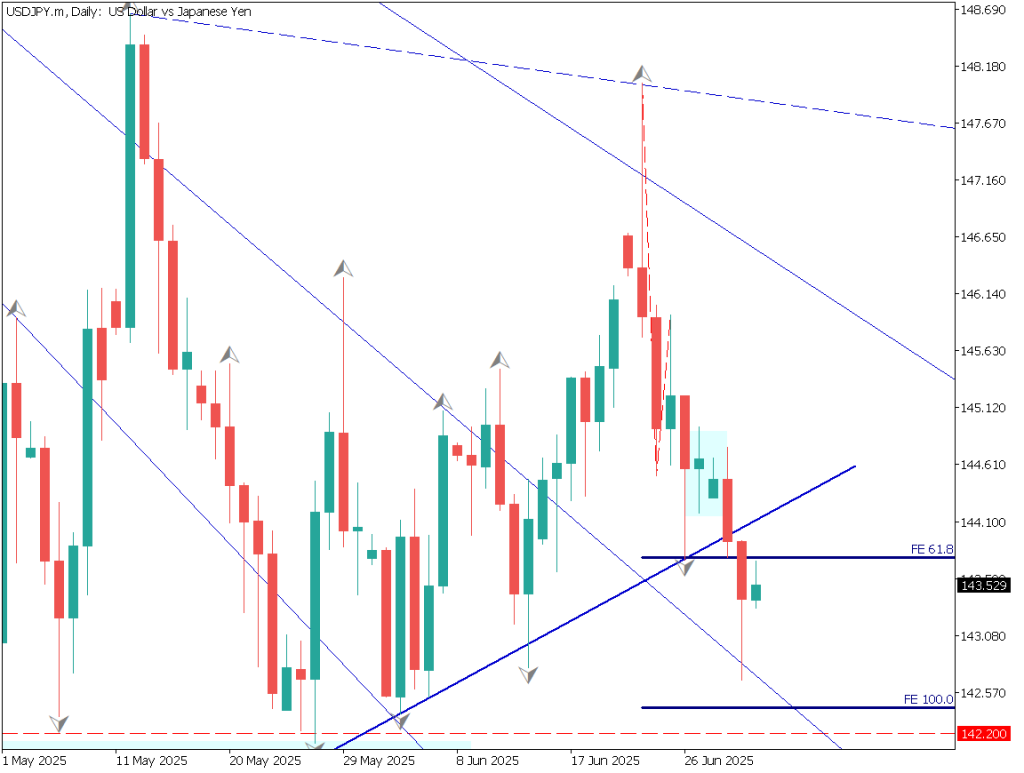

USDJPY Technical Analysis

The daily USDJPY chart shows a decisive break below 142JPY, closing the day at the lowest level since September 2024. The 140JPY range is now in realistic focus.

This move was triggered by Fed Chair Powell’s remarks rejecting the idea of early intervention. When asked whether the Fed might introduce measures to stabilize current volatility, he clearly responded, “No, with explanation.”

As a result, U.S. equities tumbled, and gold rose sharply to 3,350USD, setting a new all-time high. The USD weakened, pushing USDJPY into the 141JPY range.

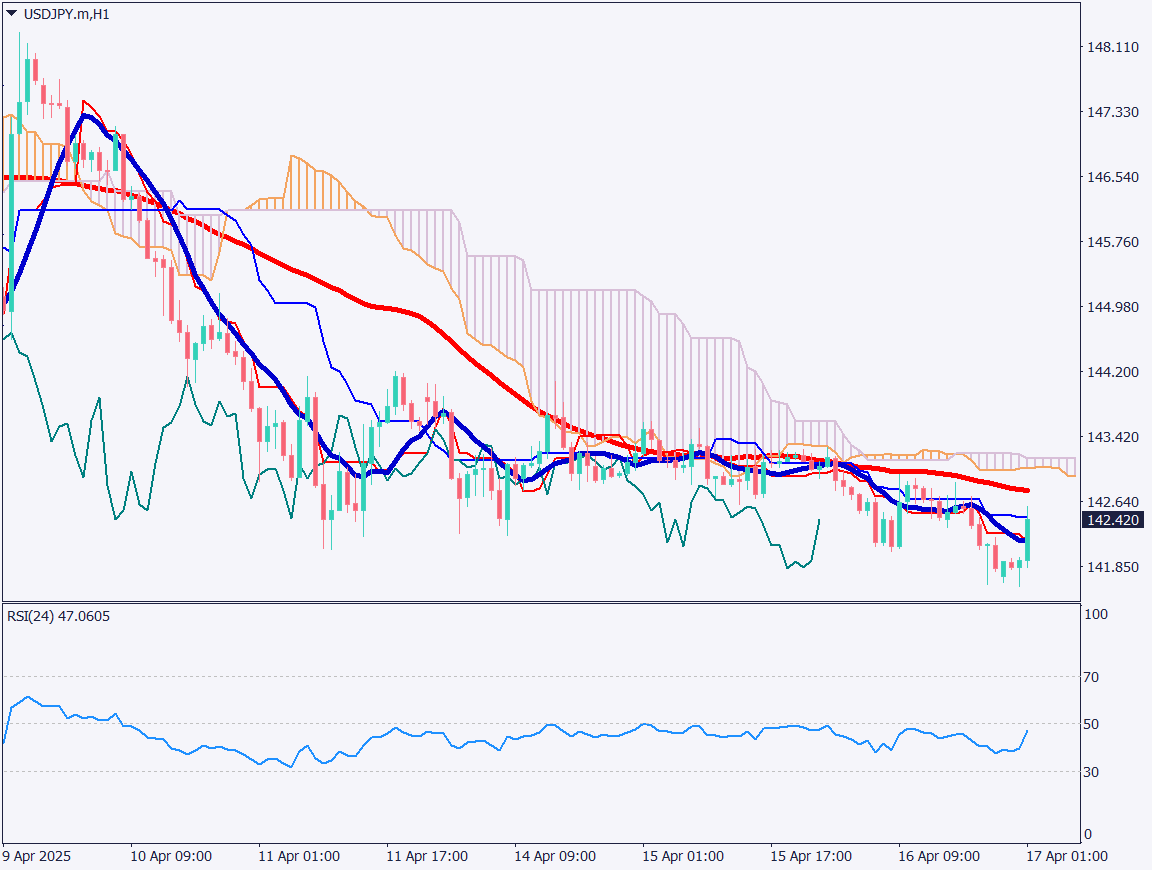

Day trading strategy (1 hour)

Looking at the 1-hour USDJPY chart, the 142JPY level had been a strong support zone. The drop into the 141JPY range triggered short-covering, but the overall trend still favors a stronger JPY. This is a scenario for selling on rallies.

The suggested day trading plan is:Sell Limit: 143.15JPYStop Loss: 143.45JPYTake Profit: 140.65JPY

Support/Resistance lines

Key support and resistance lines to consider:

- 141.60JPY: Yesterday’s low

Market Sentiment

USDJPY: Sell: 38% / Buy: 62%

Today’s important economic indicators

Economic Indicators and EventsJapan TimeAustralia Employment Data10:30ECB Interest Rate Decision21:15

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.