USDJPY surges as U.S. and China announce major tariff cuts amid risk-on sentiment【May 13, 2025】

Fundamental Analysis

The United States and China made a joint announcement to drastically reduce tariffs, surprising global markets.

The U.S. will slash tariffs on Chinese goods from 115% to 30%, while China will lower tariffs on U.S. goods to 10%.

These actions triggered a significant shift toward risk-on sentiment, leading to broad-based USD buying and a rally in equities.

USDJPY Technical Analysis

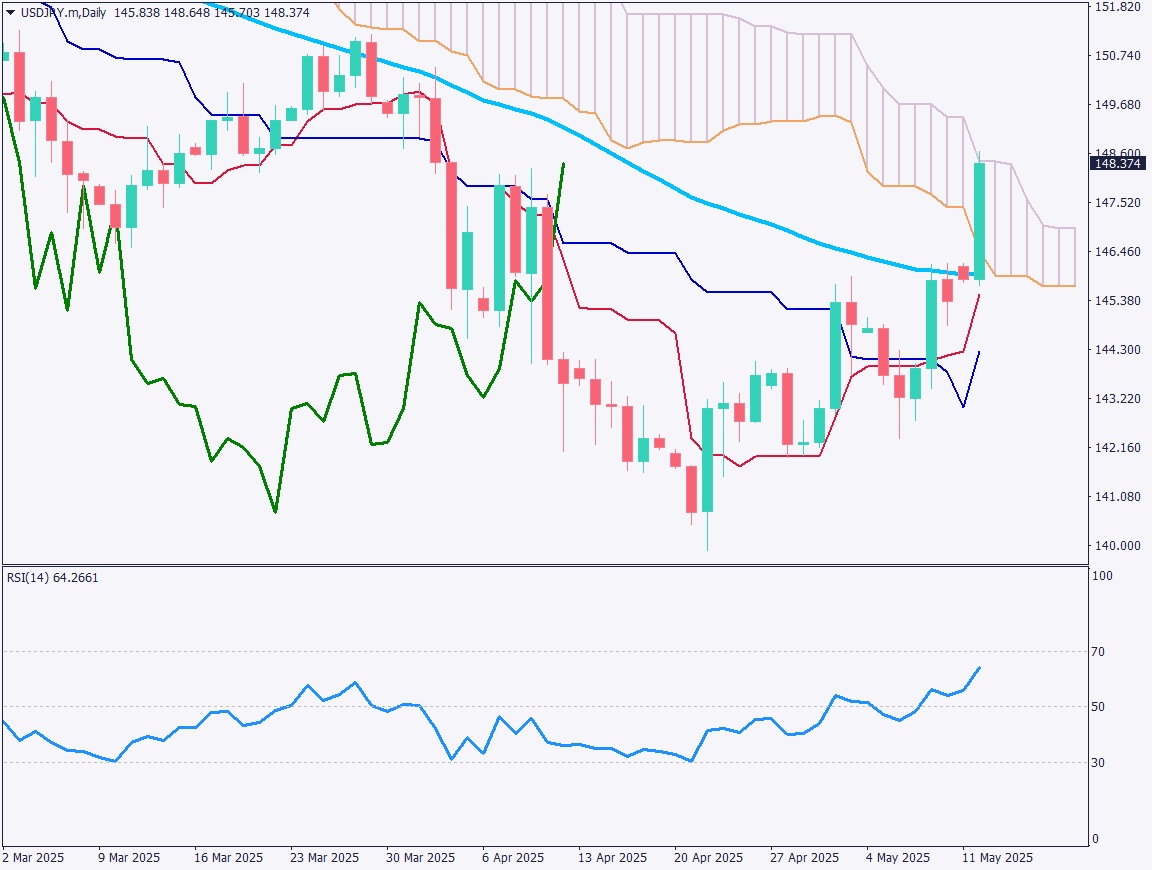

USDJPY responded strongly to the surprise announcement, breaking above the 52-day moving average and rising to around 148.35 JPY. The pair is now approaching the upper edge of the Ichimoku Cloud.

A closer look at the Ichimoku system reveals:

The Chikou Span has crossed above the candlesticks

The Tenkan-sen has crossed above the Kijun-sen

If the price breaks above the cloud, a bullish “Three Line Break” (Sanyaku Kouten) signal will be confirmed

RSI currently stands at 64, indicating stable upward momentum.

Day trading strategy

On the hourly chart, USDJPY rallied from the high 145 JPY range to approximately 148.50 JPY following the tariff news. RSI has dipped from overbought levels near 70, suggesting some short-term profit-taking pressure.

However, the broader geopolitical landscape supports risk appetite, with not only U.S.-China easing tensions but also a ceasefire between India and Pakistan reinforcing a peaceful global outlook.

Intraday Trading Strategy:

Buy on dips

Entry: Around the pivot point at 147.60 JPY

Take Profit: 148.50 JPY

Stop Loss: 147.30 JPY

Support/Resistance lines

Key support and resistance lines to consider:

- 147.60 yen – Pivot Point

Market Sentiment

USDJPY positioning:

Short: 61%

Long: 39%

Today’s important economic indicators

Economic Indicators and Events**Scheduled Time (JST)**Australia Westpac Consumer Confidence Index09:30UK ILO Unemployment Rate15:00Eurozone & German ZEW Economic Sentiment Index18:00U.S. Consumer Price Index (CPI)21:30Speech by BOE Governor Andrew Bailey24:00

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.