USDJPY Faces Strong Selling Pressure on Rallies as U.S. Credit Rating Concerns Linger 【May 21, 2025】

Fundamental Analysis

The impact of the recent U.S. credit rating downgrade appears to be gradually weighing on the market, fueling a moderate risk-off sentiment and strengthening the JPY.

Comments from the Bank of Japan’s Vice Governor, who reaffirmed the path toward continued interest rate hikes, also contributed to JPY strength.

USDJPY Technical Analysis

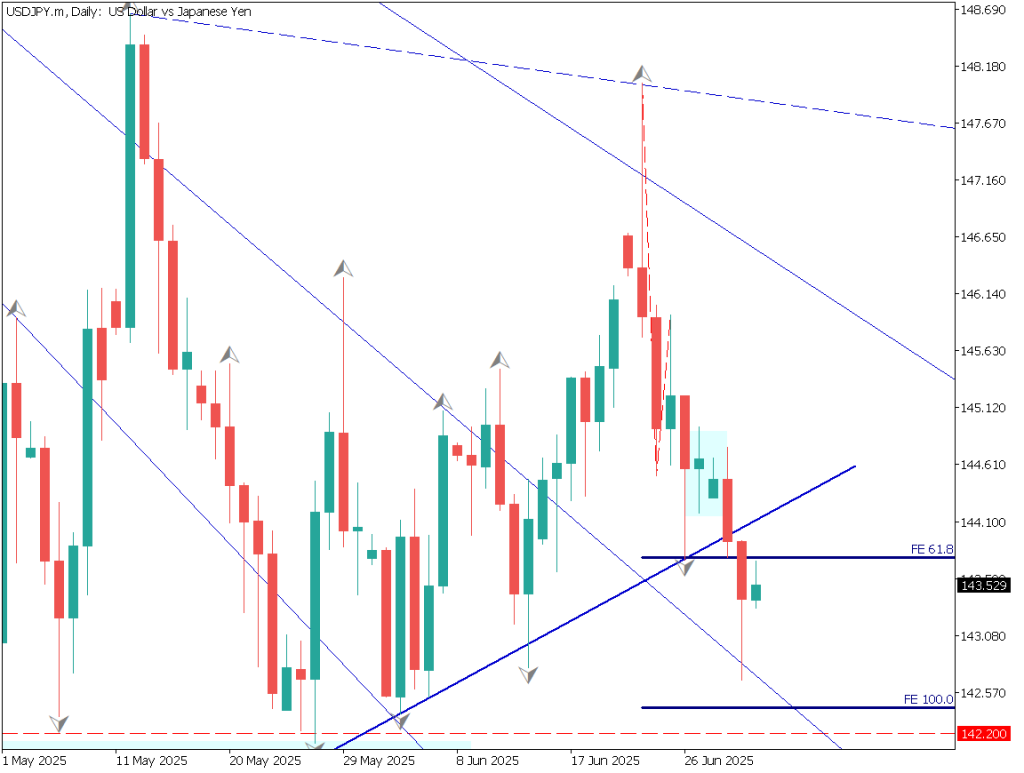

On the daily chart, USDJPY is trending lower after breaking below its 26-day moving average, reinforcing the downtrend.

Despite a brief bullish candle earlier, the pair has fallen for three consecutive sessions and has breached the low of that bullish candle—indicating weakening momentum.

While U.S. equities continue to trade in a narrow range with little directional bias, USDJPY remains under selling pressure.

The pair has already broken through recent lows, suggesting that a renewed downtrend is underway. Market participants are now watching to see if the pair dips into the 143 JPY range.

USDJPY/Daily

Intraday Trading Strategy (1-Hour Chart)

The 1-hour chart reveals that USDJPY has pulled back after testing the 26-period moving average, declining to around 144.25 JPY.

Although some buying interest has emerged in the lower 144 range, the overall trend remains bearish. A key focus is whether the pair will break below the 144.10 JPY level.

The RSI has failed twice at the 50 level and currently stands at 38, suggesting further downside potential.

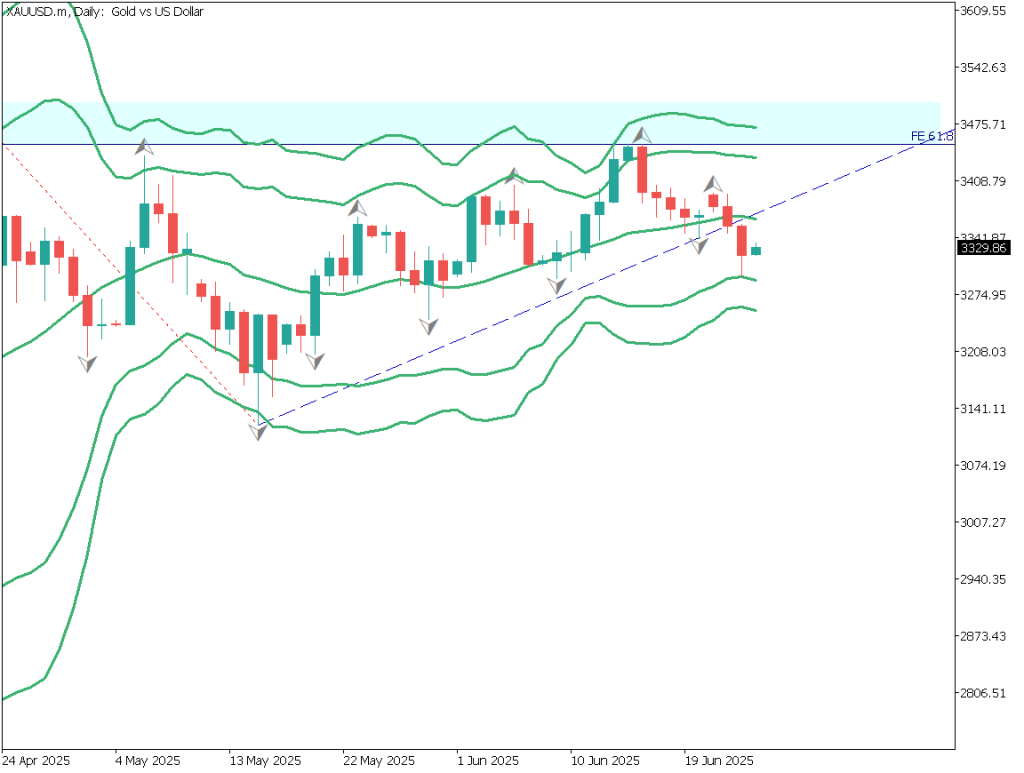

Day Trading Strategy:

Enter short positions as close to 3250 USD as possible.

Stop Loss: Above the neckline (around 3260 USD)

Take Profit: Around 3100 USD

USDJPY/1H

Support & Resistance Levels to Watch:

Support: 144.40 JPY – near yesterday’s low

Gold Market Sentiment

- Sell: 46%,Buy: 54%

Key Economic Events Today

EventTime (JST)UK Consumer Price Index (CPI)15:00U.S. MBA Mortgage Applications20:00U.S. Crude Oil Inventories23:30

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.