EURUSD Holds Steady Along the Cloud as USD Selling Pauses【May 23, 2025】

Fundamental Analysis

The U.S. House of Representatives narrowly passed the Trump administration’s tax reform bill.

U.S. 10-year Treasury yields temporarily rose to 4.6%, while Japan’s 10-year government bond yield climbed to 1.586%.

EURUSD Technical Analysis

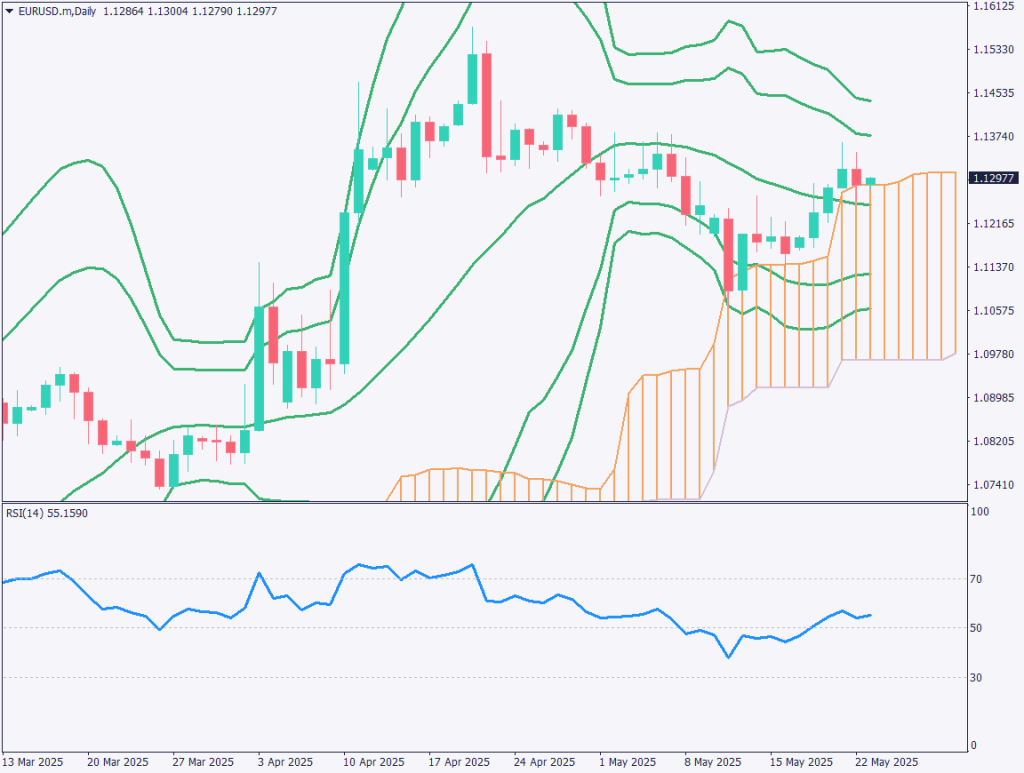

Looking at the daily chart of EURUSD, the thick Ichimoku cloud is functioning as a support zone, and the pair has been showing a modest upward movement along the cloud.

The Bollinger Bands are narrowing, indicating that market volatility is declining.

The RSI is hovering around 55, suggesting that the broader uptrend remains intact.

EURUSD tends to react to round numbers, and the 1.1200 and 1.1000 levels are expected to serve as strong support zones.At present, a buy-on-dip strategy appears favorable.

EURUSD/DAY

Day Trading Strategy (1-Hour Chart)

On the 1-hour chart, EURUSD faces resistance above 1.1350, with multiple upper wicks indicating heavy selling pressure. After falling to 1.1250, it has since rebounded.The 1.1280 level has previously been recognized as a significant price zone and may offer firm support.

From a daily perspective, the upward trend remains intact, suggesting a buy-on-dip approach. However, on the hourly chart, the Ichimoku cloud hovers above the price, and the 1.1300 level is likely to act as a resistance zone.

It may be a difficult decision, but a short-term dip toward the 1.1280 level could present a buying opportunity.

Set a stop-loss at 1.1265 and a take-profit target at 1.1320.

EURUSD/1H

Support and Resistance Levels

Support and resistance levels to watch going forward:

1.1300 – Psychological round number

1.1280 – Previously established key price level

Market Sentiment

EURUSD

- Short positions: 56% Long positions: 44%

Today’s Key Economic Indicators

**Time (JST)**Event08:30Japan CPI15:00Germany GDP23:00U.S. New Home Sales

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.