Judicial Confusion Over Trump Tariffs Sends USD/JPY Tumbling to 143yen【May 30, 2025】

Fundamental Analysis

The U.S. Court of Appeals has suspended the effect of a Trade Court ruling that deemed certain Trump-era tariffs illegal. This reversal has intensified selling pressure on the U.S. dollar, driving USD/JPY back into a downward trend.

USD/JPY, which had once surpassed 146, has sharply fallen back to the 143 level, reflecting a risk-off sentiment in the markets. The resistance from the Ichimoku cloud has also played a role in this reversal.

The final legal decision is likely to be made by the U.S. Supreme Court. If the Court upholds the tariffs, judicial intervention will no longer be possible, keeping markets on edge.

USDJPY Technical Analysis

USD/JPY is currently trading below 143.50, forming a bearish engulfing candle after being rejected at the 90-day moving average. The pair continues to trend downward and is now approaching the 142.50 support level — a historically significant zone.

USDJPY/Daily

Day Trading Strategy (1-Hour Chart)

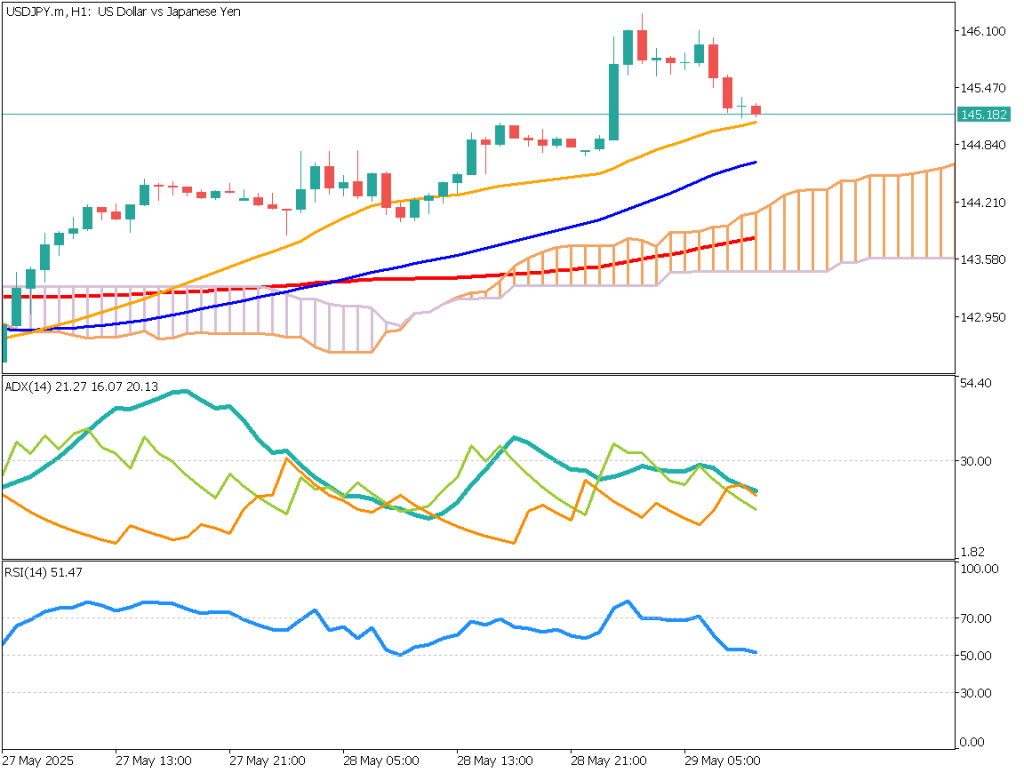

The hourly chart shows a strengthening bearish trend as the pair remains below the Ichimoku cloud. ADX and -DI are both rising, indicating continued downside momentum.

However, RSI has dropped to 26, suggesting potential for a short-term bounce. With market sentiment remaining fragile and news flow unpredictable, caution is advised.

**Day Trading Strategy:**Support: 142.50 – previously significant level

USDJPY/1H

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 145.60 – Upper boundary of the Ichimoku cloud

Market Sentiment

USDJPY

- Short positions: 29% Long positions: 71%

Today’s Key Economic Events

*Event***Time (JST)**Australia Retail Sales10:30Germany CPI21:00Canada GDP21:30U.S. PCE Price Index21:30U.S. Michigan Consumer Sentiment Index23:00

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.