U.S. Jobs Data Beats Expectations, USDJPY Briefly Touches 145【June 9, 2025】

Fundamental Analysis

Strong U.S. Jobs Data Eases Recession Concerns

President Trump Hints at Early Fed Chair Nomination

Uncertainty Remains High for USDJPY Outlook – Caution Advised

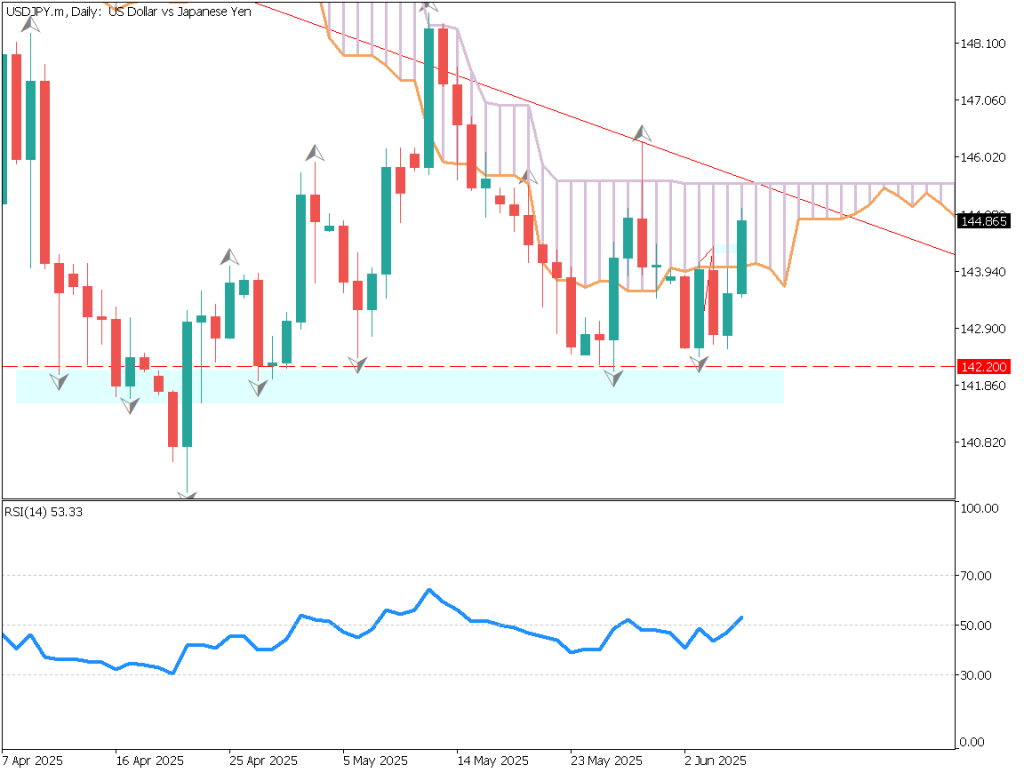

USDJPY Technical Analysis

Following the release of the U.S. employment report, USDJPY surged, briefly reaching the 145 yen level and recording a high of 145.09. The pair rebounded from the solid support line at 142.20, and a triangle pattern continues to form.

From a long-term perspective, lower highs are forming, and the triangle is gradually converging. The key focus is whether the pair can break above the descending trendline.

Although the jobs data was well-received, over the weekend, President Trump made remarks suggesting an early nomination for the next Fed Chair.

Chair Powell still has nearly a year remaining in his term, so an early nomination would be unusual.

If the President appears to be undermining the independence of the central bank, this could trigger renewed dollar selling pressure and depreciation.

Considering the “Trump risk,” it’s difficult to predict the direction of USDJPY.

While RSI is above 50, indicating strong buying pressure, attention should be paid to whether the trendline can be broken.

USDJPY/Daily

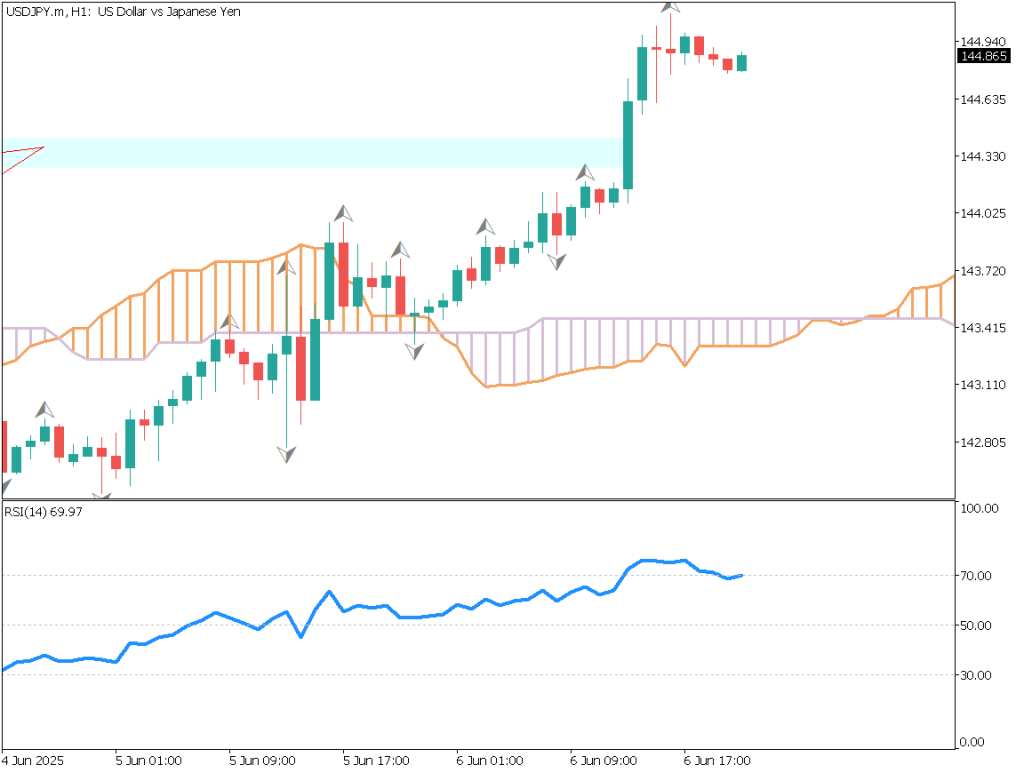

Day Trading Strategy (1-Hour Chart)

On the 1-hour chart, the RSI is approaching 70, indicating very strong buying pressure.With the key 145 yen level nearby, a temporary pullback is likely.Considering the Fibonacci retracement, a decline toward around 144.48 yen is highly possible.

It is unclear how much impact Trump’s remarks about the early Fed Chair nomination will have,but we would like to consider buying on a deep dip.

Day Trading Plan:

Entry: Buy limit around 144.10 yen

Stop: 143.80 yen

Take Profit: 144.85 yen

USDJPY/1H

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 145.10 – Last week’s high

Market Sentiment

USDJPY

- 53% short / 47% long

Key Economic Events Today

**Time (JST)**Event8:50Japan GDP

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.