EUR/USD edges higher, markets await early-morning FOMC【June 18, 2025】

Fundamental Analysis

The Bank of Japan has eased its reduction in JGB purchases, showing consideration for long-term yields.

With the FOMC looming, the market is watching closely for any mention of forthcoming rate cuts.

EURUSD Technical Analysis

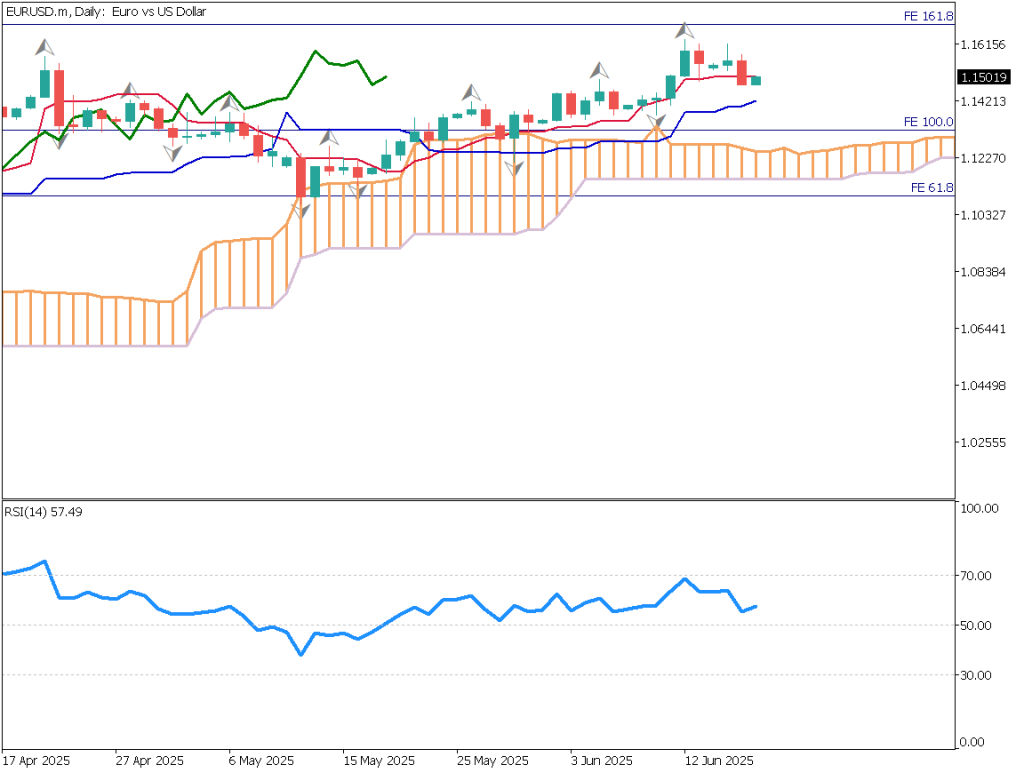

EUR/USD is hovering near the round number of 1.150USD. While price has slipped fractionally below the Tenkan-sen, the Kijun-sen is pointing upward, so the overall upward bias remains.

The Tenkan-sen sits at 1.1502USD, and traders are eyeing whether the pair can regain this level.

A look at Fibonacci expansion shows clear reactions at 61.8 % and 100 %, indicating these levels are closely watched.

The 161.8 % projection, around 1.1685USD, is likely to serve as the next upside target.

If the FOMC hints at rate cuts, dollar selling could lift EUR/USD. A hawkish stance with no cut guidance could see dollar buying drive the pair down toward 1.1350USD.

EURUSD/Daily

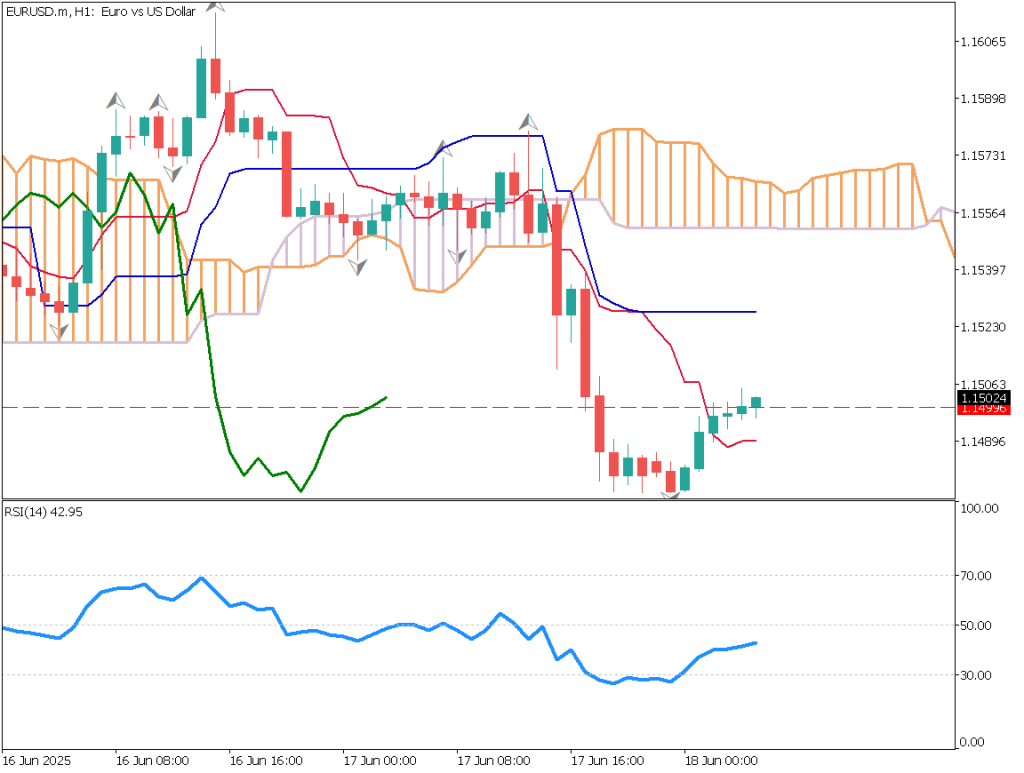

Day Trading Strategy (1-Hour Chart)

On the 1-hour chart, the 1.150USD round number is pivotal. After dipping to 1.1475USD, the pair staged a return-move and is slightly above 1.150USD. Should 1.150USD prove to be resistance, a slide toward 1.1350USD is possible.

Intraday bias: sell on rallies

Entry : limit sell at 1.1535USD

Take-profit : around 1.1385USD

Stop : 1.1560USD

EURUSD/1H

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 1.150USD – round number

Market Sentiment

EURUSD

- 62% short / 38% long

Key Economic Events Today

*Event/Indicator***Time(JPT)**UK Consumer Price Index (CPI)15:00Eurozone Consumer Price Index (HICP)18:00US Initial Jobless Claims21:30US Federal Funds Rate (FOMC)03:00 (next day)Fed Chair Powell press conference03:30 (next day)

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.