Gold Pulls Back as Ceasefire Agreement Eases Risk-Off Sentiment【June 25, 2025】

Fundamental Analysis

The ceasefire agreement between Iran and Israel has eased risk-off sentiment.

Gold has declined, breaking below the upward trendline.

Fed Chair Powell hints at possible rate cuts, leading to further dollar weakness.

XAUUSD Technical Analysis

On the daily chart, gold has fallen as tensions in the Middle East have eased. From a short-term perspective, prices have moved below the upward trendline. The resistance around 3475USD, corresponding to the 61.8% Fibonacci expansion level, is becoming significant.

From a broader perspective, a double top pattern appears to be forming, suggesting a possible decline toward the 3200USD level, which serves as a major neckline.

XAUUSD/Daily

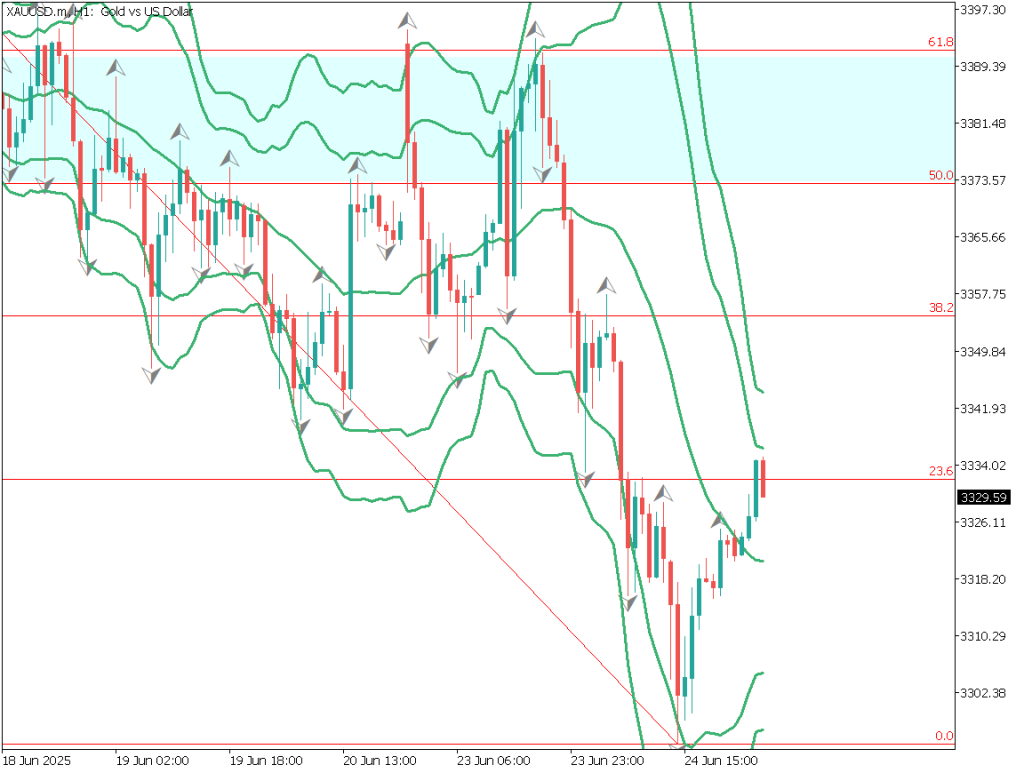

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour gold chart, prices touched the -2σ line of the Bollinger Bands and rebounded. They have risen to the 23.6% Fibonacci retracement level, which is currently being monitored. Unless an unexpected return to risk-off sentiment occurs, the downward trend is expected to continue.

The proposed strategy is to sell on rallies near 3350USD, set a stop at 3358USD, and take profit at 3300USD.

USDJPY/1H

Support and Resistance Levels

Support and resistance levels to watch going forward:

3450USD – Major resistance level

3330USD – Fibonacci level

3250USD – Strong support zone

Market Sentiment

USDJPY

- 20% short / 80% long

Key Economic Events Today

*Event/Indicator***Time(JPT)**Australia CPI10:30Fed Chair Powell Speech23:00US New Home Sales23:00

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.