USDJPY Turns Yen-Bullish, Boosted by Upbeat BOJ Tankan Survey【JULY1, 2025】

Fundamental Analysis

Nikkei 225 remains above 40,000, but upside is capped

BOJ Tankan Survey beats market expectations, fueling yen buying

President Trump voices repeated dissatisfaction with Japan–U.S. trade

USDJPY Technical Analysis

USDJPY has declined for two consecutive days. The dollar continues to weaken, creating a favorable environment for yen buying.

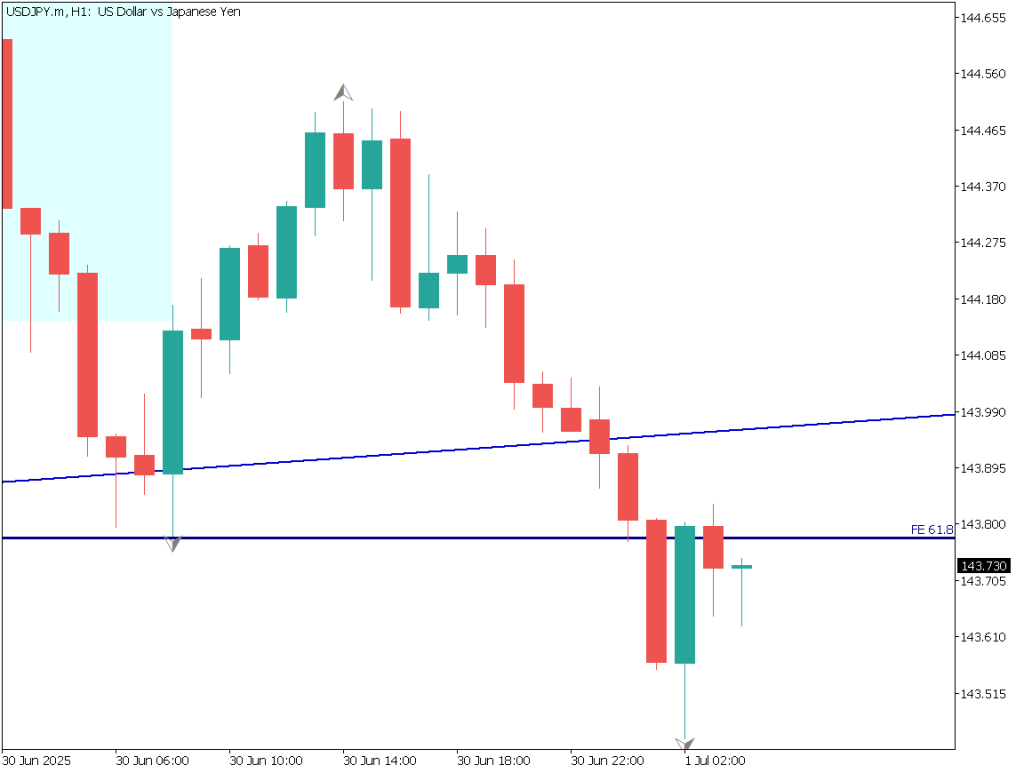

Drawing a Fibonacci expansion shows the pair breaking below the upward trendline and falling into the high 143-yen range.The 61.8% Fibonacci level is acting as support, but there is a possibility it may be broken.

The 100% projection level is around 142.50 yen. Watch closely for a clear break below the 61.8% level.

USDJPY/Daily

Day Trading Strategy (1-Hour Chart)

On the 1-hour chart, the pair plunged toward 143.50 yen and then rebounded back to the 61.8% retracement level. However, it appears the 61.8% level is now acting as resistance.If confirmed, this could lead to new selling orders. That said, it’s not yet a decisive setup, so caution is advised.

Day trading plan:Place a sell limit order around 144.00 yen, take profit at around 142.50 yen, and set a stop at 144.25 yen.

Set two pending orders and wait for the market movement.

USDJPY/1H

Support and Resistance Levels

Support and resistance levels to watch going forward:

1144.00 – Trendline

143.80 – Fibonacci level

142.50 – Fibonacci level

Market Sentiment

USDJPY

- 40% short / 60% long

Key Economic Events Today

*Event/Indicator***Time(JPT)**Japan – BOJ Tankan Survey8:50Eurozone – CPI (HICP)18:00U.S. – Fed Chair Powell Speaks22:30U.S. – Manufacturing PMI22:45U.S. – ISM Manufacturing Index23:00

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.