USD Selling Extends for 7 Consecutive Days as President Trump Increases Pressure on Fed Chair【JULY2, 2025】

Fundamental Analysis

President Trump sends a handwritten letter demanding a rate cut from the Fed Chair

Markets question the Fed’s independence, leading to intensified USD selling

US-Japan trade talks stall, reports suggest consideration of 30–35% tariffs

Gold rises $80 over two days, suggesting asset flows out of USD

USDJPY Technical Analysis

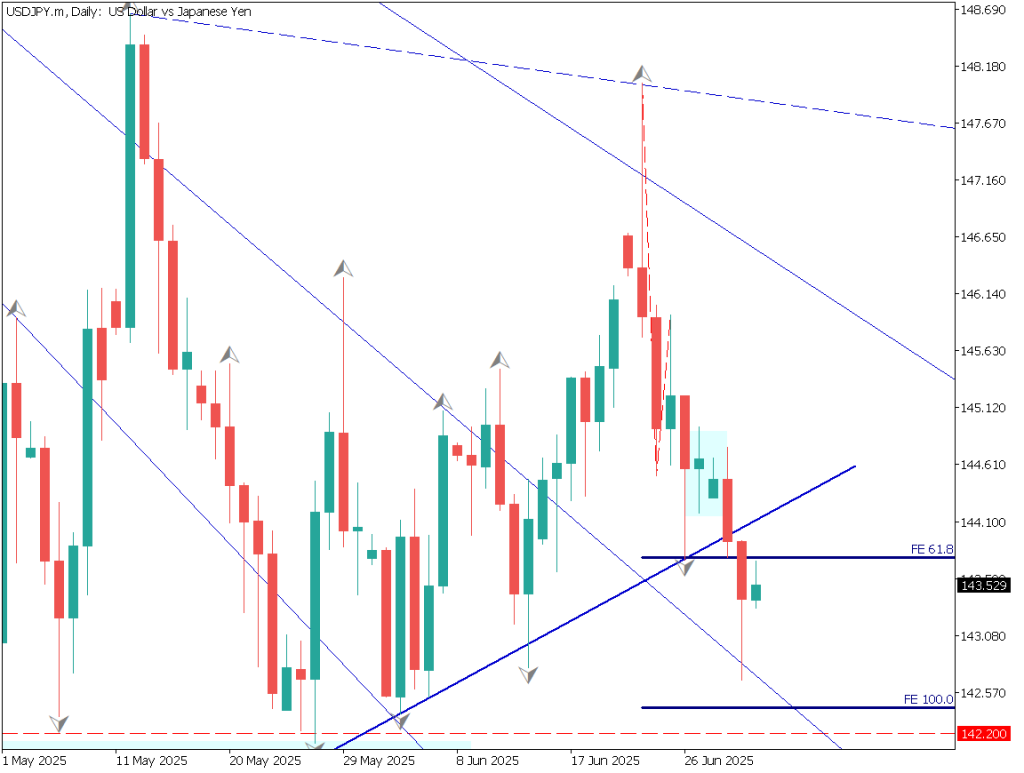

Analyzing the USDJPY daily chart: USDJPY broke below the 61.8% retracement level, briefly dipping under 143. Although short covering occurred, the 61.8% level now serves as resistance, indicating persistent selling pressure.

President Trump’s handwritten demand for rate cuts sent to the Fed Chair came as a major shock. It clearly casts doubt on the Fed’s independence. The market reacted with USD selling, pushing USDJPY lower.

As long as the Trump administration remains in power, the rate-cutting stance will likely persist. Consequently, further USD selling and JPY buying seem likely.

USDJPY/Daily

Day Trading Strategy (1-Hour Chart)

On the 1-hour chart, a clear rebound from the 61.8% level is observed. As long as this level isn’t breached to the upside, a bearish trading stance is preferred. Since the price is currently above the 24-period moving average, it would be prudent to wait for a drop below this line before considering entry.

The RSI hovers around the 50 mark, indicating a balance between buying and selling pressure.

Day trading strategy: Consider short entry after a confirmed break below the 24-period moving average. Set take-profit near 142.85 yen and stop-loss if the price moves back above the 24-period MA. Note that market volatility may increase due to the upcoming ADP Employment Report.

USDJPY/1H

Support and Resistance Levels

Support and resistance levels to watch going forward:

143.78 – 61.8% retracement level

142.68 – Yesterday’s low

Market Sentiment

USDJPY

- 39% short / 61% long

Key Economic Events Today

Event/Indicator****Time(JPT)*US ADP Employment Report21:15*ECB President Lagarde Speech23:15US Crude Oil Inventories23:30

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.