EUR/USD Around 1.17 – A Temporary Correction Phase【JULY11, 2025】

Fundamental Analysis

San Francisco Fed President mentions rate cuts

U.S. jobless claims come in below expectations

FOMC minutes show most members oppose early rate cuts

EURUSD Technical Analysis

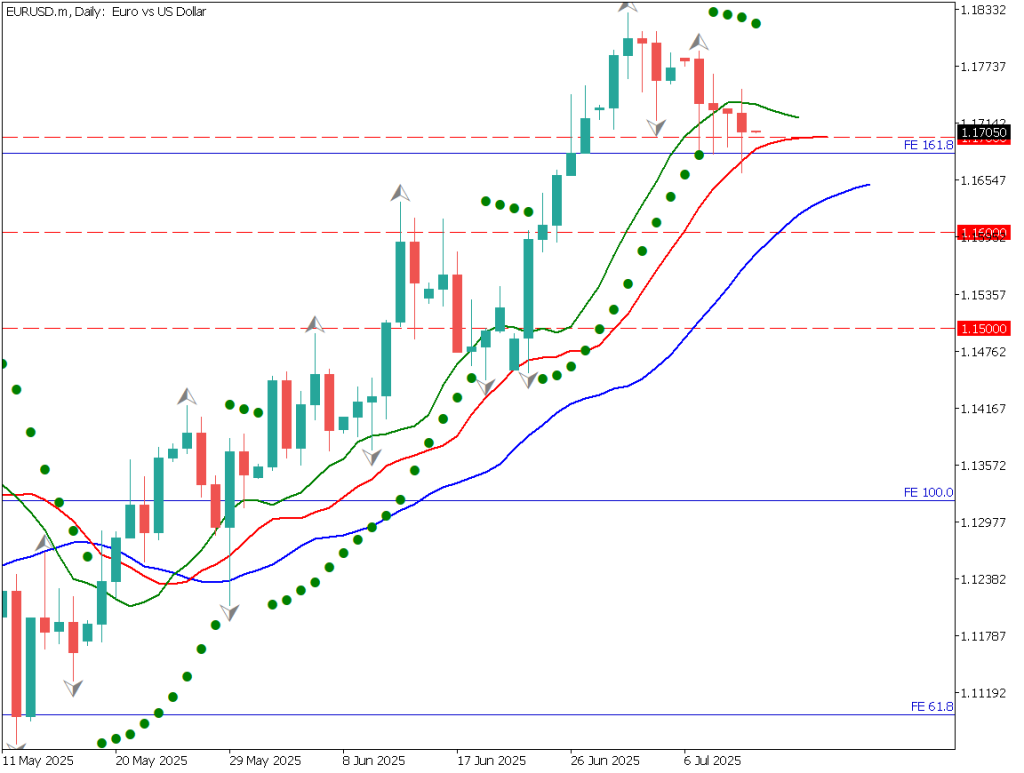

EUR/USD is hovering around the 1.17 level. Until last week, it had been hitting new highs daily, but that upward momentum has paused, and a corrective movement is underway.

Last night, a rebound occurred from the low 1.16s after the San Francisco Fed President commented on potential rate cuts, forming a lower shadow.

The market is currently focusing on whether EUR/USD can hold above the 161.8% Fibonacci extension level, which stands at 1.1682.The Alligator lines are slightly narrowing, suggesting trend convergence.

It remains to be seen whether this is merely a temporary correction. As tariff measures have effectively been delayed, some renewed dollar buying is expected.

EURUSD/Daily

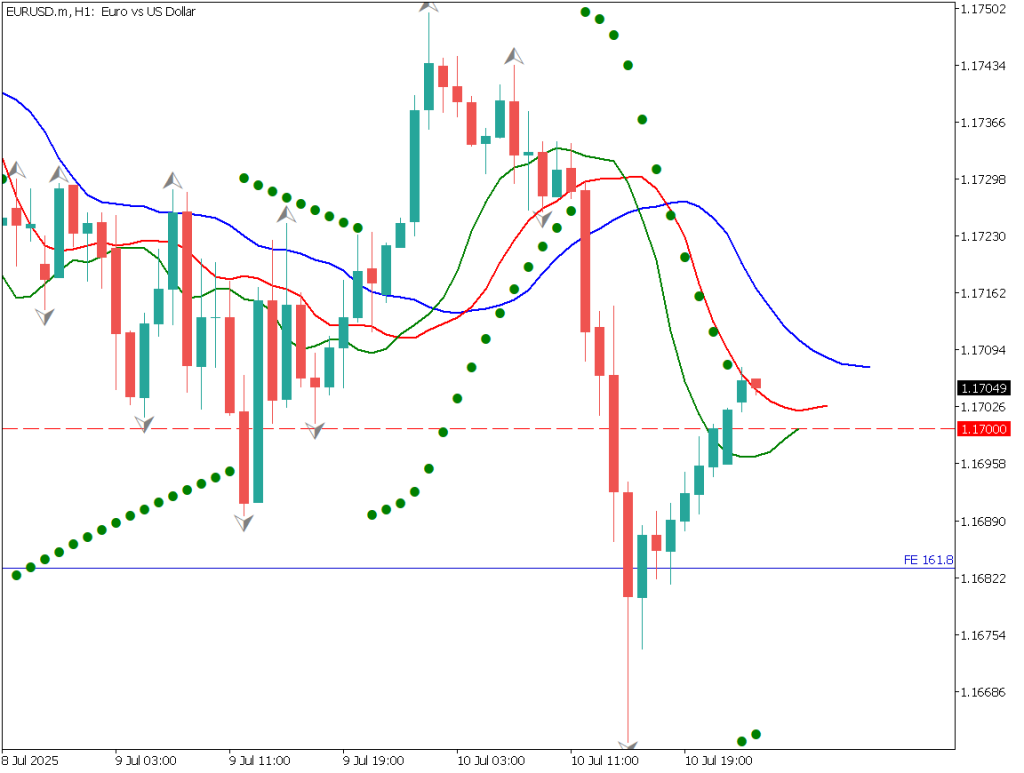

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour chart, EUR/USD dropped to 1.1662 but then rebounded sharply. U.S. jobless claims were lower than expected, reducing expectations of a Fed rate cut. Overall, the market appears to have returned to a range-bound pattern.

For day trading, consider selling around 1.1750. With the range-bound trend in mind, take profit at 1.17 and set a stop-loss at 1.18.

EURUSD/1H

Support and Resistance Levels

Support and resistance levels to watch going forward:

1.17 – Round number

1.1682 – Fibonacci level

Market Sentiment

EURUSD

- 61% short / 39% long

Key Economic Events Today

Event/Indicator*Time(JPT)*UK-GDP15:00*Canada Employment Data*21:30

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.