[Special Edition] Upper House Election Outcome Within Expectations, USD/JPY Remains Stable

Recap of the Election

Let’s first review the results of the Upper House election.****** Key takeaways from the election:**

The fiscally expansionist opposition party made significant gains, but the market had already priced it in

The ruling party failed to maintain a majority in both the House of Representatives and the House of Councillors

The current administration declared its intention to remain in power

With a weakened political base, cooperation with the opposition is now essential and is expected to be challenging****

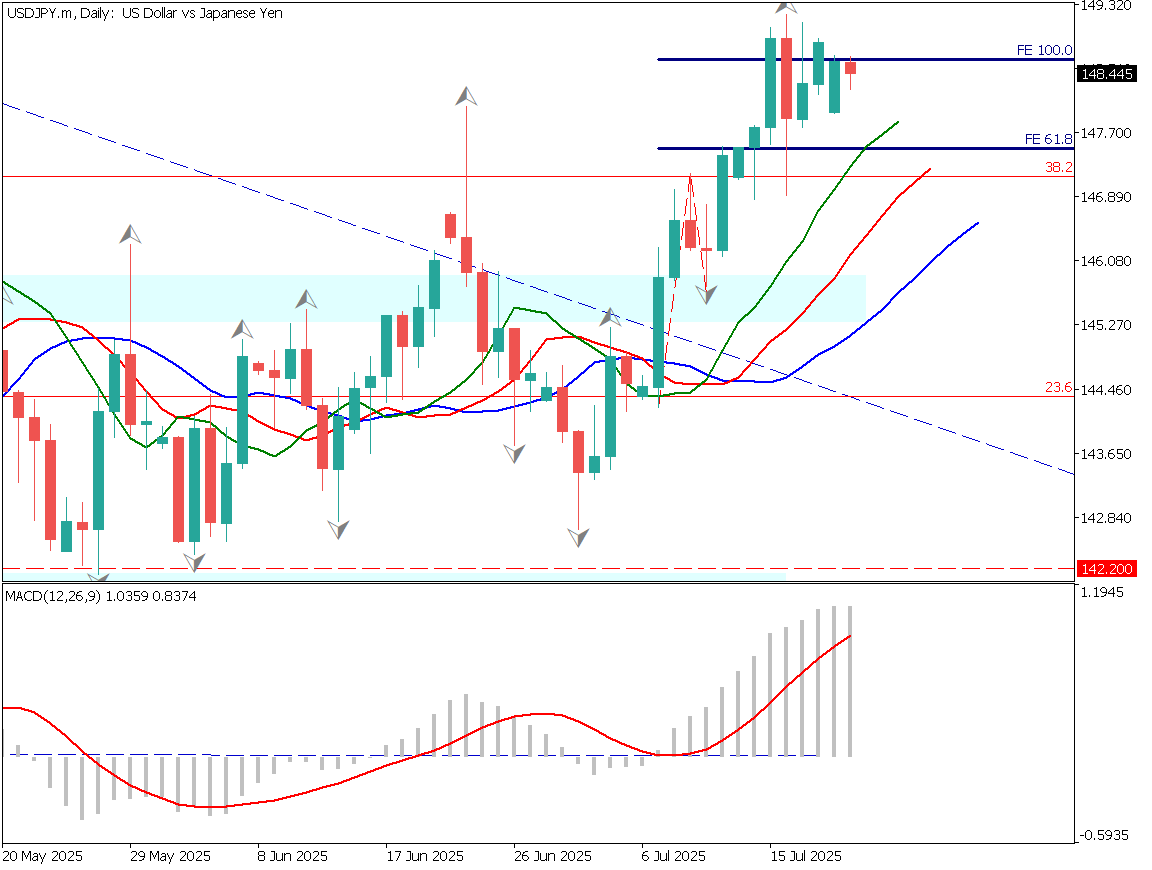

USD/JPY Swing Trade Strategy

With the Japanese Upper House election concluded, the market has passed a key event. Media had previously reported on the likely gains by the opposition, and the USD/JPY had already been pricing this in last week. Although the ruling party lost its majority, the outcome fell within market expectations.

Attention was also focused on whether the Prime Minister would resign, but he announced his intention to stay. Given the fluid political situation moving forward, USD/JPY may remain range-bound. This is also typically a “summer lull” period, and the focus now shifts to whether USD/JPY can break above 148.65 yen.

Based on Fibonacci Expansion, a clear break above 148.65 yen and a new high could set price targets at 149.39 yen, which corresponds to the 50% level on the weekly Fibonacci retracement, and 150.45 yen, which is the 161.8% Fibonacci expansion on the daily chart.

USDJPY/DAY

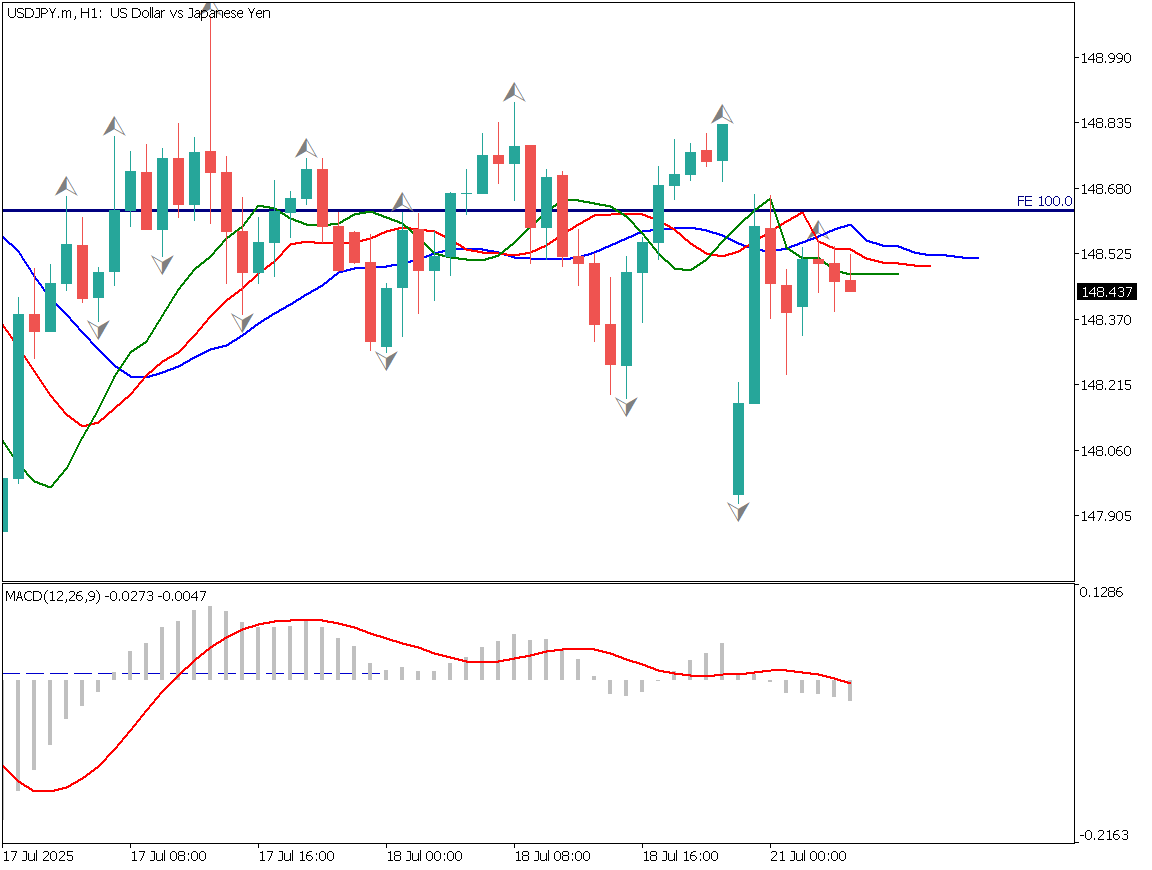

USDJPY Day Trading Strategy

On the 1-hour chart, a clear range has formed around the 148 yen level. The market briefly opened lower at the start of the week, falling below 148 yen, but quickly rebounded. It’s difficult to predict how the London and New York sessions will react today. Currently, there is no clear trend.

Considering the uncertainty in parliamentary operations, many analysts believe the Bank of Japan will find it difficult to proceed with rate hikes. This could intensify yen depreciation pressure.

For day trading:

Place a buy limit order in the low 148 yen range

Take profit near 149.39 yen

Set a stop-loss at 147.85 yen

USDJPY/1H

Fundamental Analysis

British media have labeled the surging opposition party as “far-right” and pointed out the weakened foundation of the administration. Given such international reporting, yen selling pressure may intensify during overseas sessions.

The rise of far-right parties is a trend seen in Europe and, combined with anti-globalism in the U.S., foreign investors may view this as a spillover effect into Japan.

Key Economic Events Today

*Event/Indicator**Time(JPT)U.S. Leading Economic Index23:00*

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.