USD/JPY Strengthens in Favor of the Yen: Market Sees Japan as the Winner in US-Japan Negotiations

USD/JPY Market Overview

The market appears to perceive Japan as having the upper hand in the recent US-Japan tariff negotiations. Japan successfully negotiated a reduction in auto tariffs, which is expected to revitalize its key automobile industry. Furthermore, Japan’s increased investment in the United States suggests the potential for Japanese companies to gain more profits in the U.S. market.

The stock market has surged, with the Nikkei approaching 42,000. USD/JPY responded with yen appreciation, briefly dipping into the 145 range. While there were speculations that Prime Minister Ishiba would resign, he denied the reports and will remain in office, resulting in a somewhat chaotic situation.

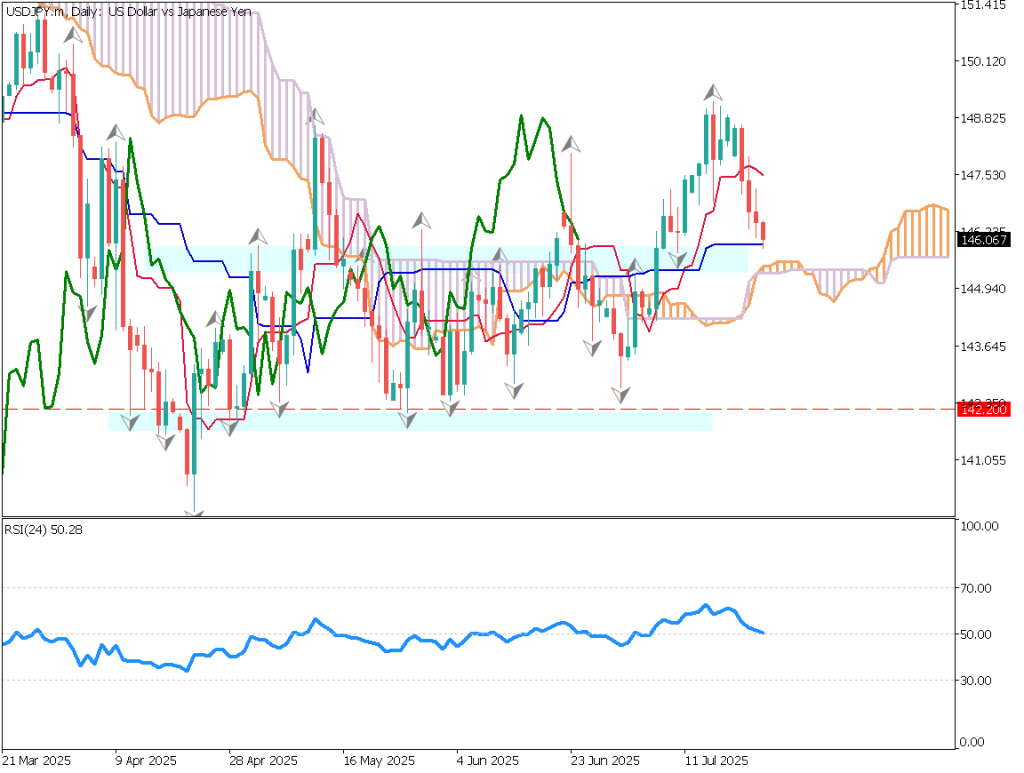

USD/JPY continues to decline and is trading near the base line. While the yen’s upward trend is intensifying, the RSI has reached 50, which typically signals a potential for stronger dip-buying. Therefore, a rebound from the base line is possible. The 145 yen level is a strong support zone, and market participants should keep a close eye on its movements.

USDJPY/DAY

USDJPY Day Trading Strategy

Looking at the 1-hour chart, a descending channel can be drawn. A downtrend is clearly underway and ongoing. However, the downward momentum is showing signs of pausing, and the price is beginning to consolidate. This is a technical setup where a rebound on the daily chart may occur. Watch for a possible move above the conversion line.

Given the strong support at the 145 yen level, we adopt a dip-buying strategy in the mid-145 yen range. Take profits when the price nears the upper line of the descending channel. Set a stop-loss below 145 yen.

USDJPY/1H

Key Economic Events Today

Event/Indicator*Time(JPT)*ECB Interest Rate Decision21:15*U.S. Initial Jobless Claims*21:30ECB President Lagarde Press Conference21:45U.S. New Home Sales23:00

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.