EUR/USD Rising as ECB Holds Rates After Eight Consecutive Cuts

Fundamental Analysis

ECB holds rates after seven consecutive cuts

President Trump denies putting pressure on Fed Chair Powell to resign

EUR/USD Technical Analysis

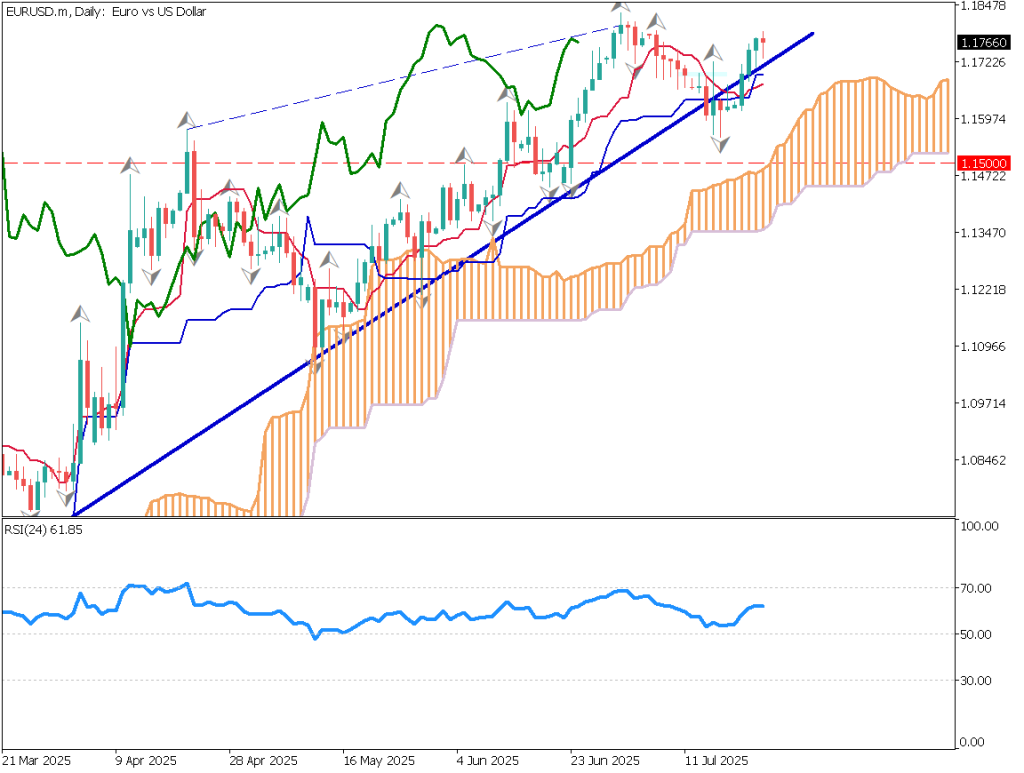

Analyzing the daily EUR/USD chart: Although the pair remains in an uptrend, momentum appears to be weakening. Compared to the steeper trendline connecting the recent lows, the trendline connecting the highs is more gradual.

Another notable point is that the conversion line (Tenkan-sen) is below the base line (Kijun-sen) in the Ichimoku Kinko Hyo indicator. The recent high near 1.1830 USD may serve as a resistance level. On the other hand, the RSI is showing a series of lower highs, indicating a divergence between price and oscillator indicators.

There is a significant possibility of the rally stalling just before the round number of 1.18 USD.

EURUSD/DAY

Day Trading Strategy (1-Hour Chart)

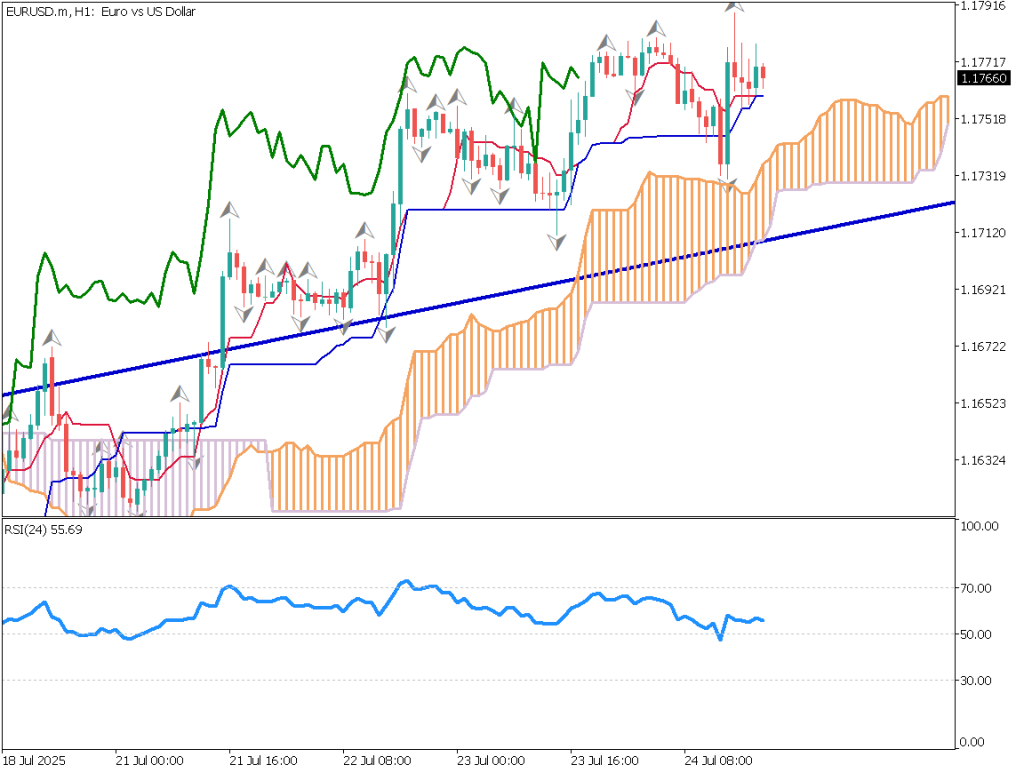

Looking at the 1-hour chart, the EUR/USD has been alternating between large bullish candles and tight ranges, breaking higher on event-driven moves. However, overall, the uptrend seems to be losing momentum. RSI is on a downward path, and divergence is also observed in the 1-hour chart.

A contrarian entry near recent highs could be considered. Place limit sell orders at 1.1800 and 1.1825 USD, targeting a take-profit at 1.1765 USD. Stop-loss should be set above 1.1850 USD.

EURUSD/1H

Support and Resistance Levels

Key support and resistance levels to consider going forward:

- 1.1800 USD – Round number

Market Sentiment

USD/JPY – Short: 37% | Long: 63%

Key Economic Events Today

*Event/Indicator***Time(JPT)**UK Retail Sales Index15:00Germany Ifo Business Climate Index17:00US Durable Goods Orders21:30

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.