USD/JPY Falls on Weak ADP Jobs Data

Fundamental AnalysisU.S. ADP employment data fell short of expectations: -32,000 vs forecast +51,000U.S. government shutdown forces 750,000 workers...

Loading...

Daily insights from our Chief Market Analyst

675 analysis articles available

Fundamental AnalysisU.S. ADP employment data fell short of expectations: -32,000 vs forecast +51,000U.S. government shutdown forces 750,000 workers...

Key Fundamental PointsU.S. budget expires at 1:00 PM JST, triggering a government shutdownGold continues to set new record highs for consecutive da...

USD/JPY rebounds from oversold conditions near 147.80, testing key resistance at 148.00 as the Japanese Yen shows persistent weakness despite global dollar softness.

{"en":"USD/JPY rebounds from oversold conditions near 147.80, testing key resistance at 148.00 as the Japanese Yen shows persistent weakness despite global dollar softness. ","ja":"USD/JPYは147.80付近の売られ過ぎの水準から反発し、世界的なドル安にもかかわらず日本円が持続的な弱さを示す中、148.00の主要レジスタンスをテストしています。"}

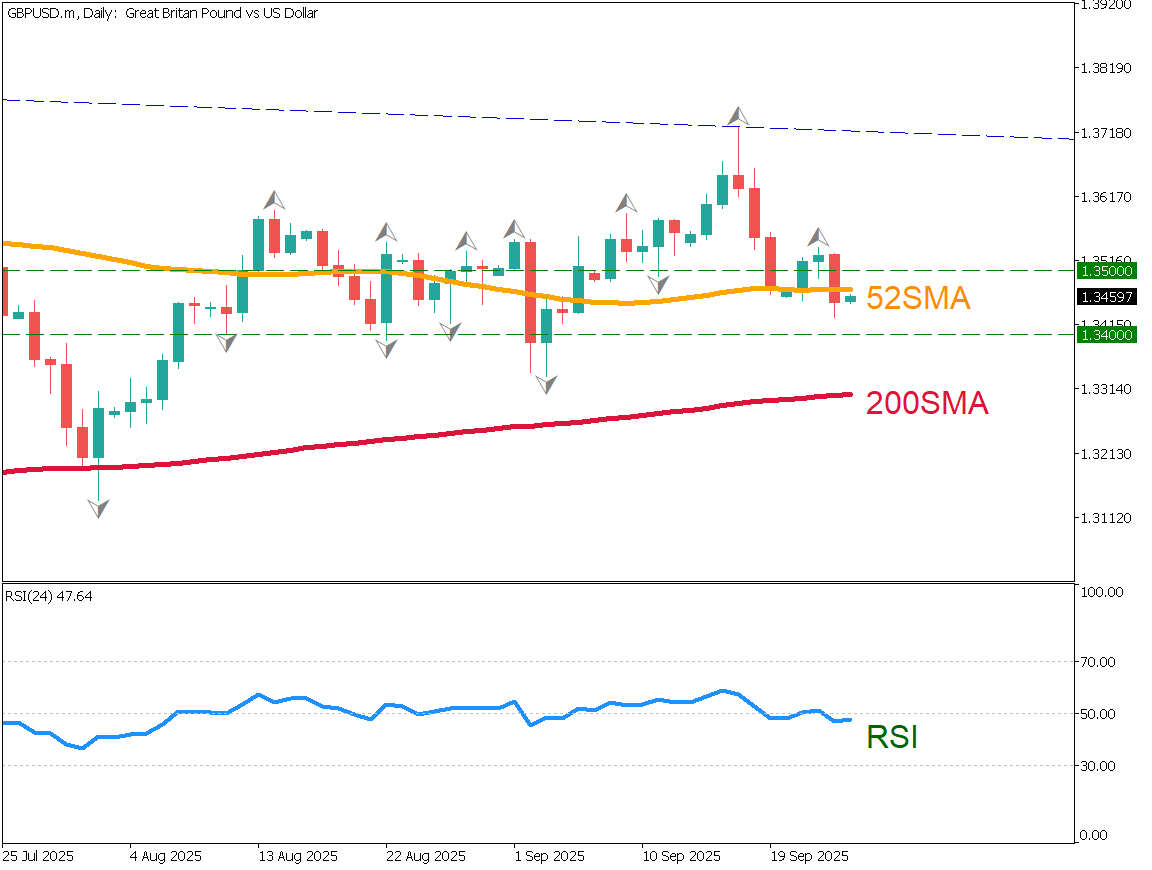

The GBP/USD fell because the Governor of the Bank of England suggested that there may still be room for further rate cuts. This made the pound easier to sell against the dollar, and the pair dropped to around 1.3425. From a technical view, it also went below the 52-day moving average, which shows a stronger selling trend. The pair may continue to move downward, and the 1.3460–1.3480 area is seen as a good level for selling on rebounds. Today, the key focus will be the Bank of Japan’s meeting minutes and the U.S. GDP release.

{"en":"The GBP/USD fell because the Governor of the Bank of England suggested that there may still be room for further rate cuts. This made the pound easier to sell against the dollar, and the pair dropped to around 1.3425. From a technical view, it also went below the 52-day moving average, which shows a stronger selling trend. The pair may continue to move downward, and the 1.3460–1.3480 area is seen as a good level for selling on rebounds. Today, the key focus will be the Bank of Japan’s meeting minutes and the U.S. GDP release.","ja":"ポンドドルは英中銀総裁が追加利下げの可能性を示唆したことで売りが優勢となり、1.3425ドル付近まで反落。52日移動平均線を下回り、戻り売りの形が強まっている。FRBが慎重姿勢を崩さない中、利下げ観測のある通貨が売られやすく、ポンドドルは下方向圧力が続くと見られる。本日は1.3460~1.3480ドルで戻り売り戦略が有効とされ、重要指標は日銀議事要旨と米GDPに注目が集まる。"}

USD/JPY rebounds from oversold conditions near 147.80, testing key resistance at 148.00 as the Japanese Yen shows persistent weakness despite global dollar softness.

{"en":"USD/JPY rebounds from oversold conditions near 147.80, testing key resistance at 148.00 as the Japanese Yen shows persistent weakness despite global dollar softness. ","ja":"USD/JPYは147.80付近の売られ過ぎの水準から反発し、世界的なドル安にもかかわらず日本円が持続的な弱さを示す中、148.00の主要レジスタンスをテストしています。"}

ドル円は10SMAが52SMAを下回りデッドクロスを形成。拡大トライアングルの中で推移しているが、レンジ相場の下限を割っている状況。

{"en":"ドル円は10SMAが52SMAを下回りデッドクロスを形成。拡大トライアングルの中で推移しているが、レンジ相場の下限を割っている状況。","ja":"ドル円は10SMAが52SMAを下回りデッドクロスを形成。拡大トライアングルの中で推移しているが、レンジ相場の下限を割っている状況。"}

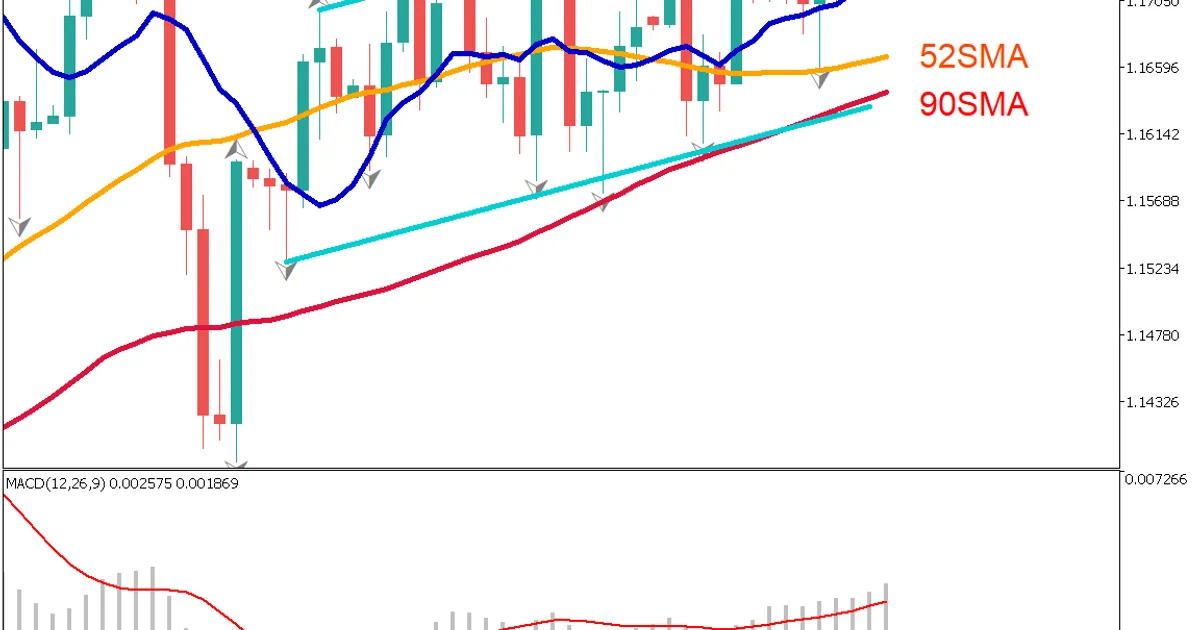

We believe this is due to widespread dollar selling across the market. The dollar weakness is primarily driven by near-certain expectations of a rate cut at today and tomorrow's FOMC meeting.

Daily Market Report [September 16, 2025] Strong upward momentum with 10SMA acting as support