USD/JPY Strengthens in Yen’s Favor – Position Adjustment Ahead of Major Events

Fundamental Analysis

USD/JPY declined from the 148 yen range, dropping 100 pips after hitting a high of 148.81.

Yen buying was dominant as U.S. long-term interest rates fell, with markets awaiting the FOMC meeting.

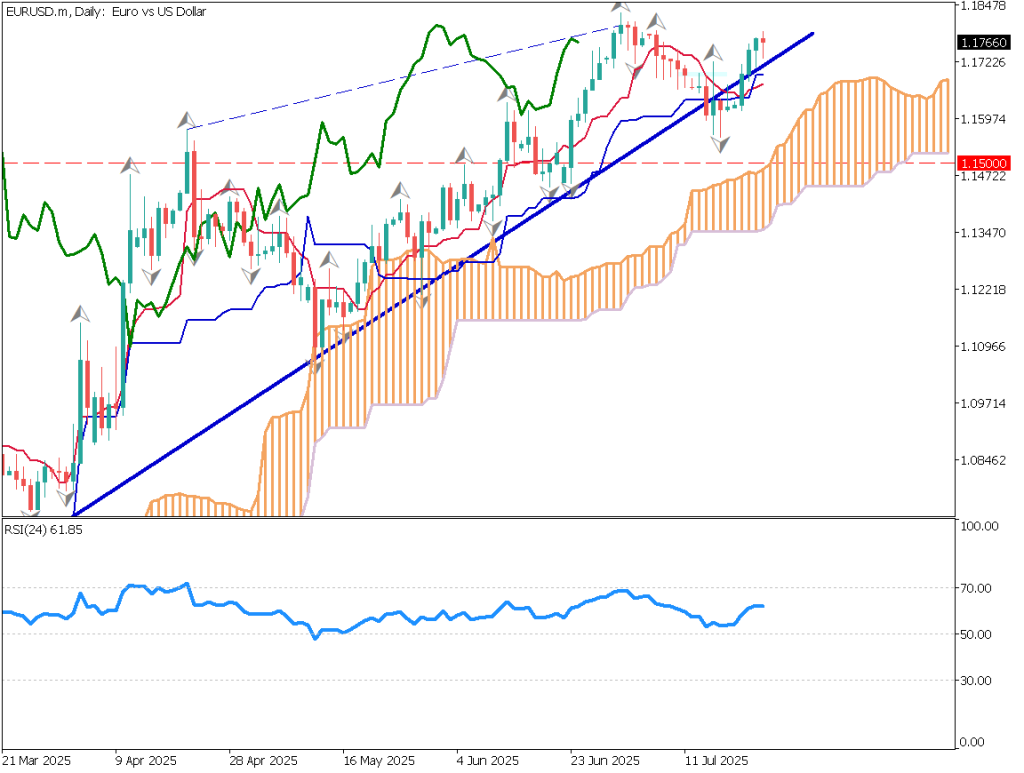

USDJPY Technical Analysis

Analyzing the daily chart for USD/JPY: The pair rebounded at the Base Line and attempted to reach new highs. However, the decline in U.S. long-term yields triggered yen-buying pressure.Today, in addition to the ADP Employment Report, the FOMC meeting will be held in the early hours of tomorrow. The market focus is on whether the FOMC will mention potential rate cuts.Concerns over tariff negotiations seem to be easing, suggesting that a full-scale trade war may be avoided.The USD/JPY chart shows a drop into the upper 147-yen range after failing to reach new highs. This may indicate position adjustments.We should remain cautious about the possibility of high volatility stemming from today’s ADP report and tomorrow’s FOMC decision.

A classic reversal pattern known as the “Evening Star” — consisting of a bullish candle + doji + bearish candle — has emerged, which is often seen as a signal of market reversal. Caution is advised for potential declines into the 145-yen range.

USDJPY/DAY

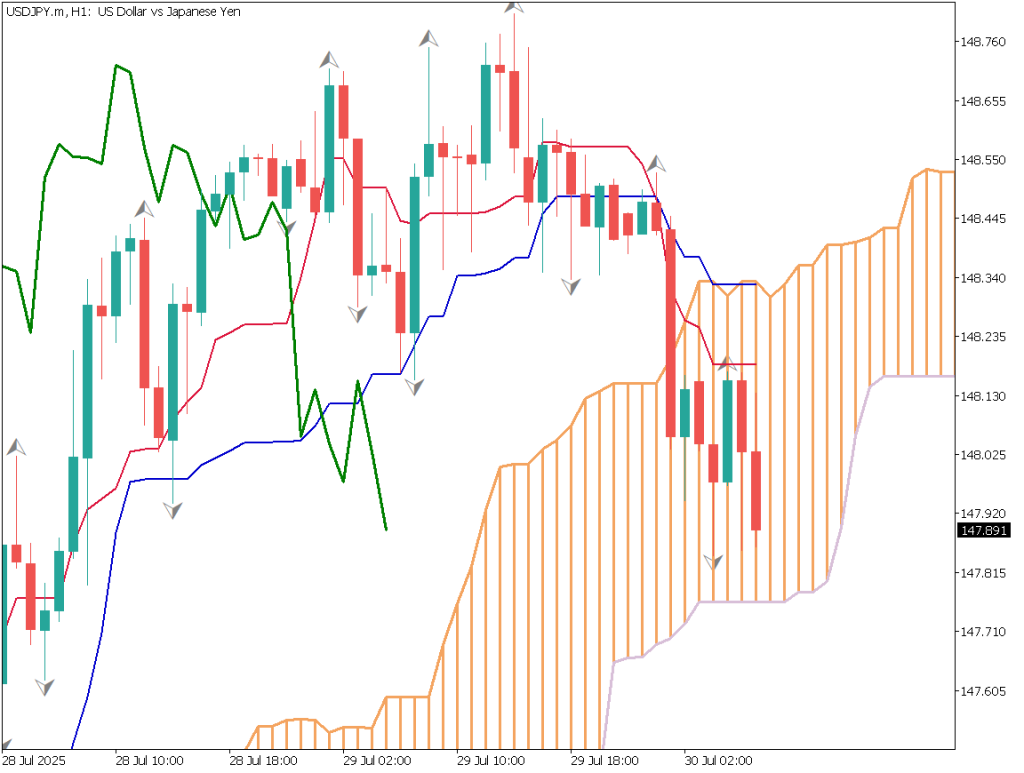

Day Trading Strategy (1-Hour Chart)

The 1-hour chart shows the price moving within the Ichimoku Cloud. The Conversion Line is acting as resistance, with the price pulling back and breaking below recent lows.Although the market remains unstable within the Cloud, the chart structure suggests an increasing bearish trend.Focus is now on whether the price can break below the lower bound of the Cloud. Since a rebound is also possible at this level, sudden reversals should be watched closely.In any case, today’s ADP report and the FOMC announcement remain key.

USDJPY/1H

Support and Resistance Levels

Key support and resistance levels to consider going forward:

- 147.85 yen – Previous support level

Market Sentiment

USDJPY Short: 56%USDJPY Long: 44%

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| --- | --- |U.S. ADP Employment Report21:15U.S. FOMC Policy Rate Announcement03:00 (next day)

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.