Market Analysis

Expert market analysis and insights from Milton Markets professional traders and analysts.

693 analysis articles

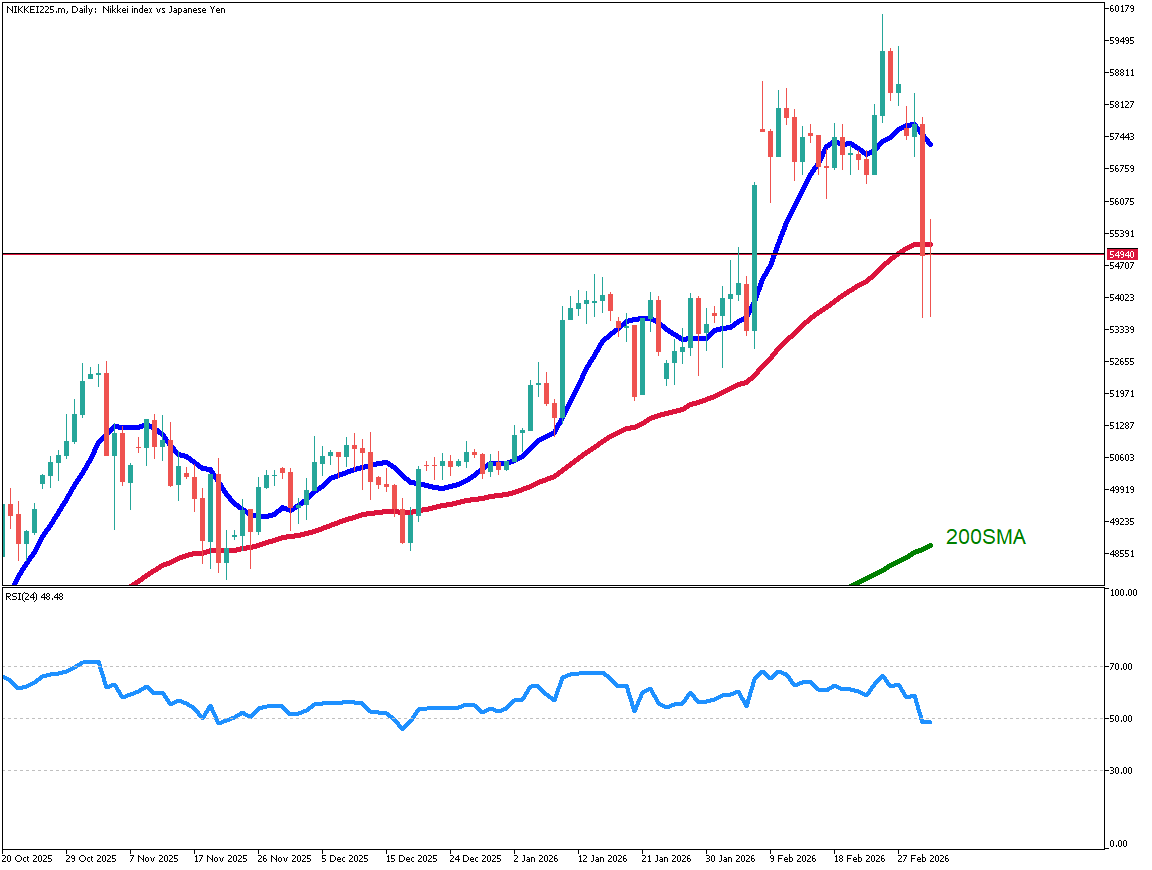

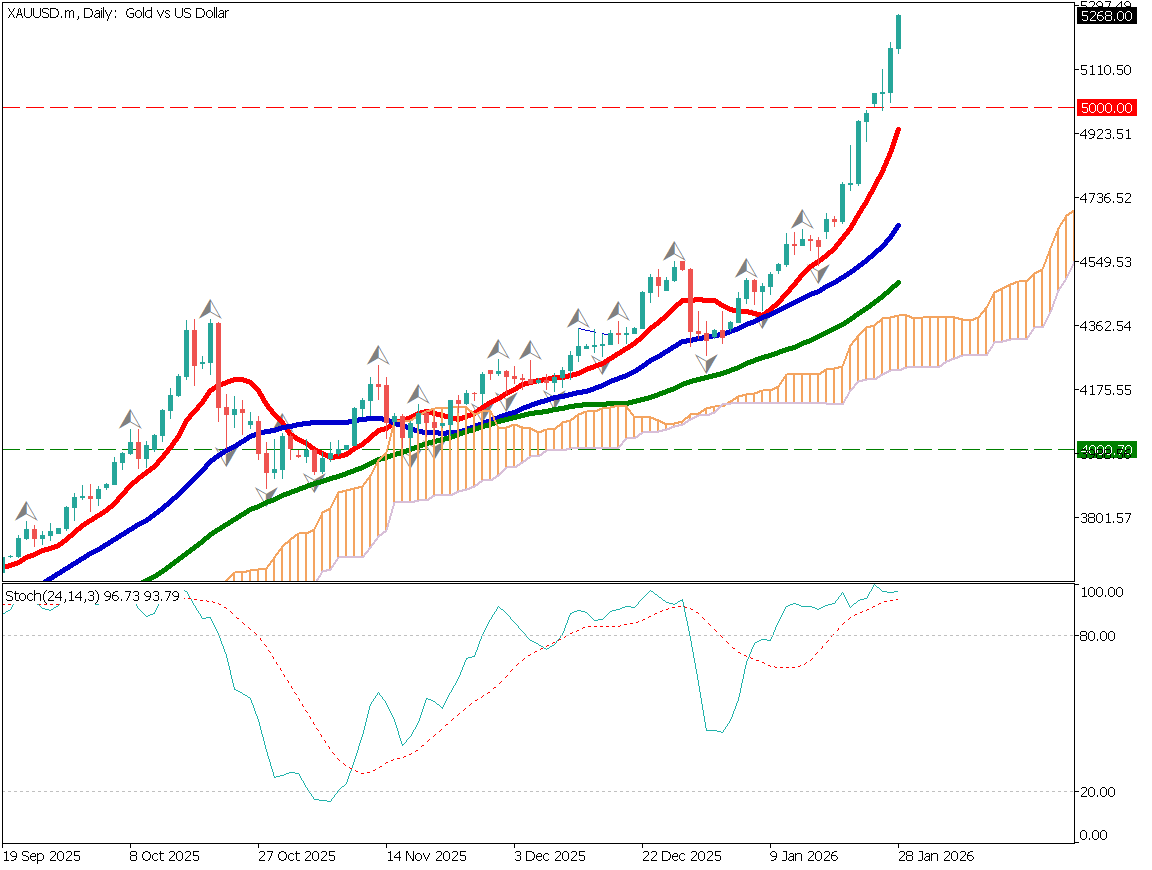

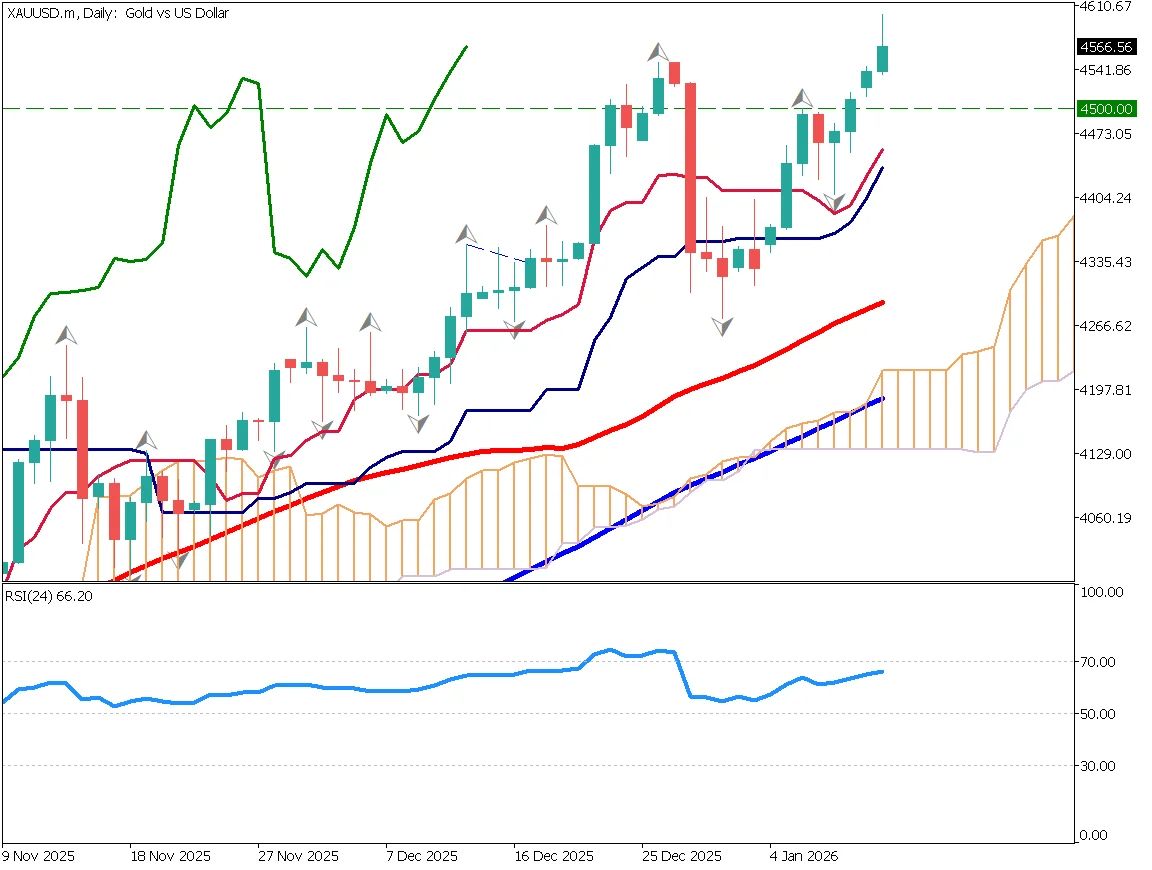

Gold Surges with a Gap Following the Attack on Iran

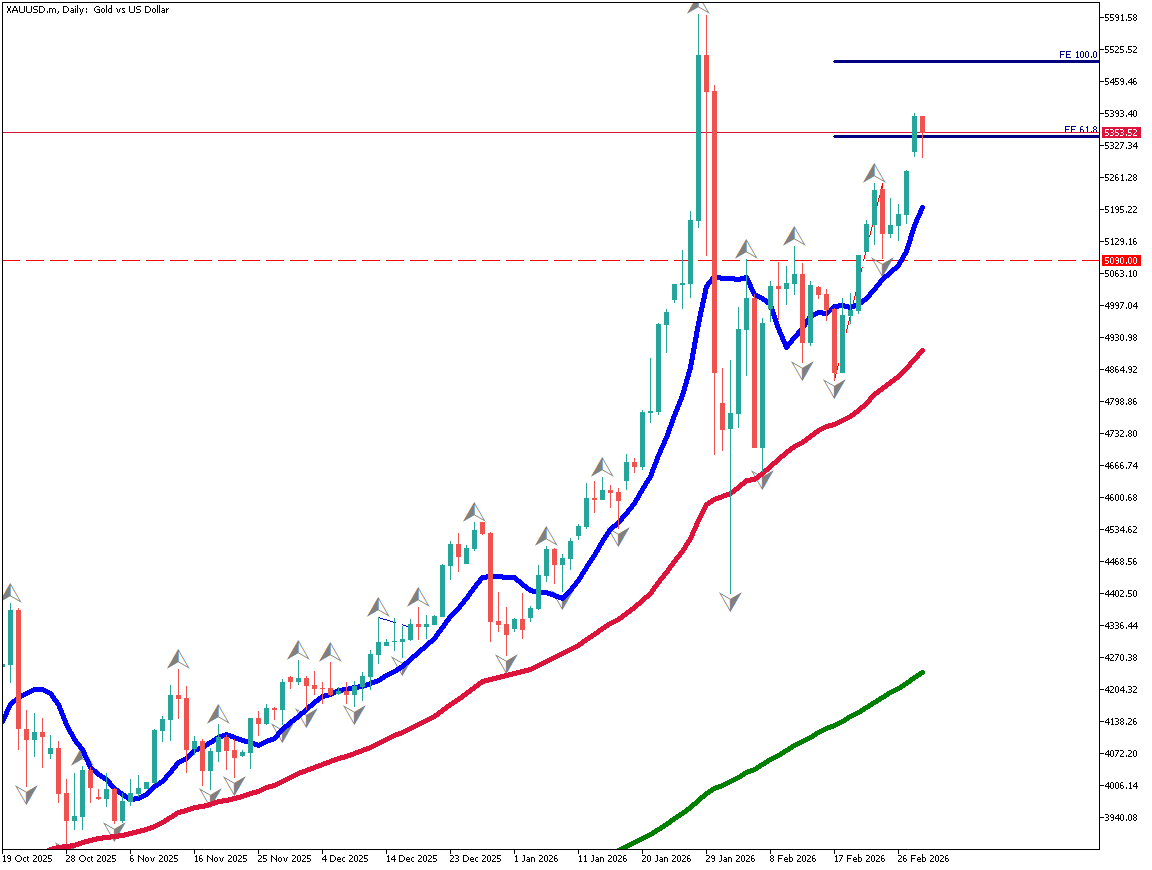

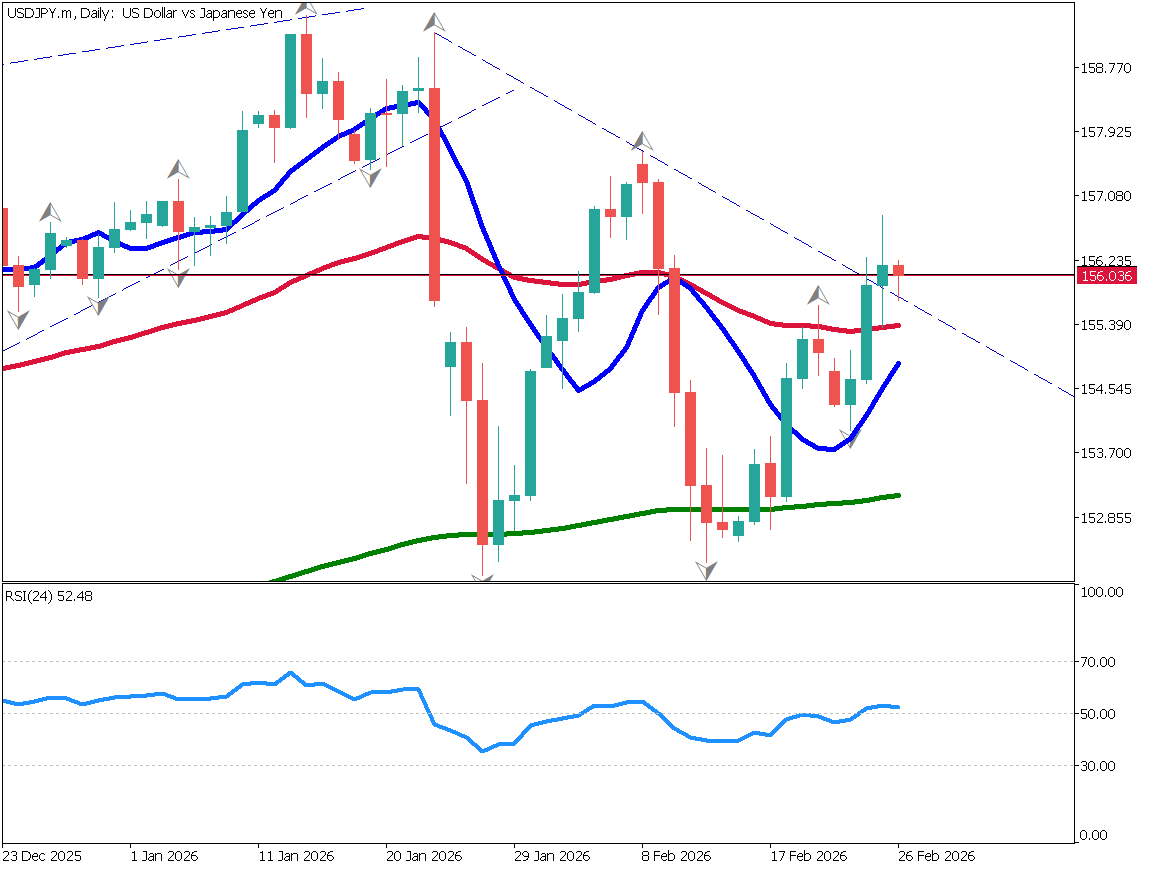

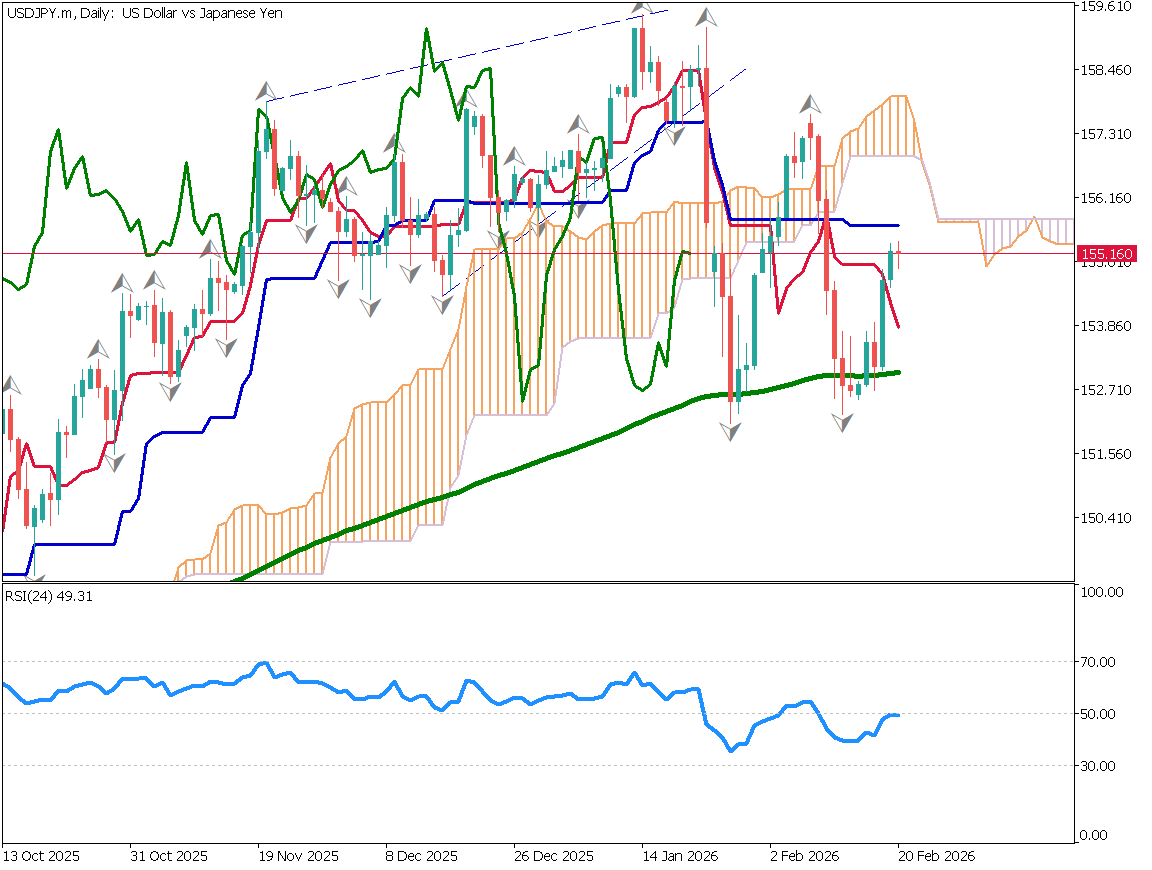

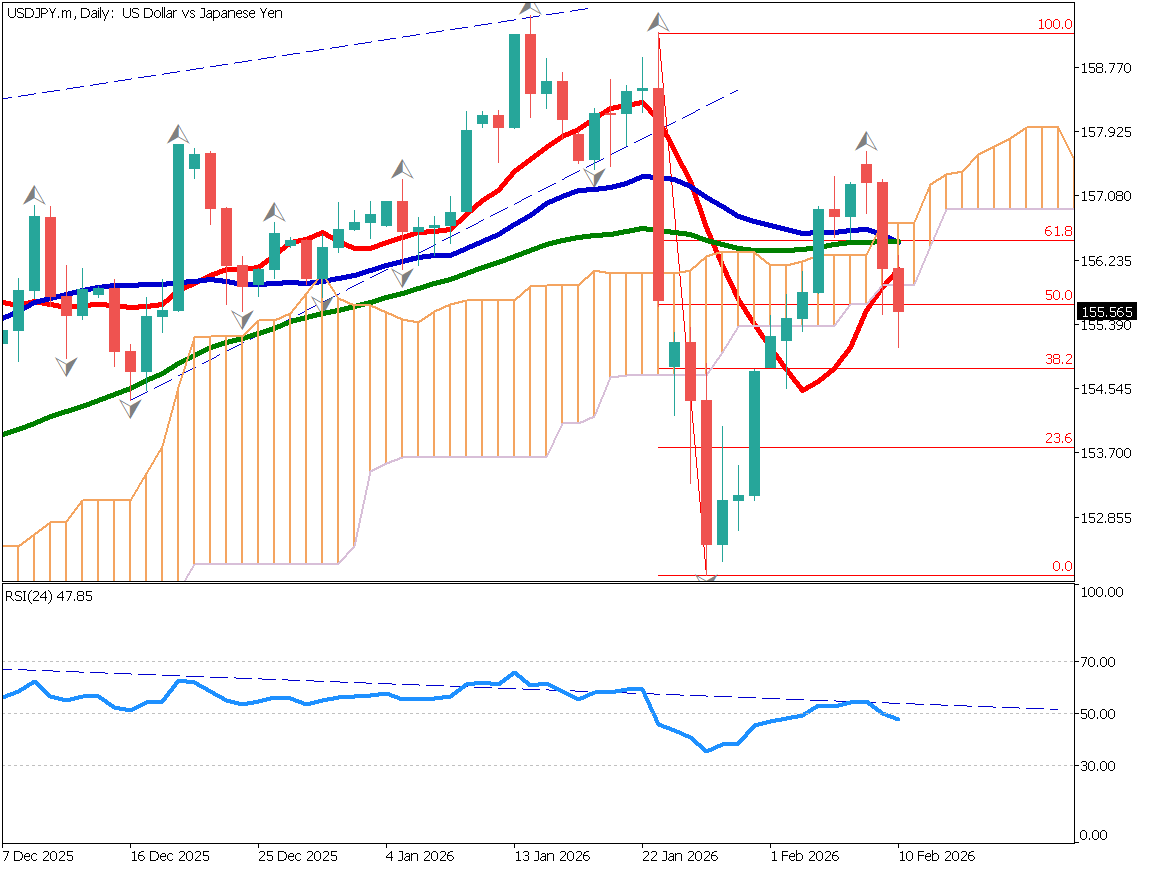

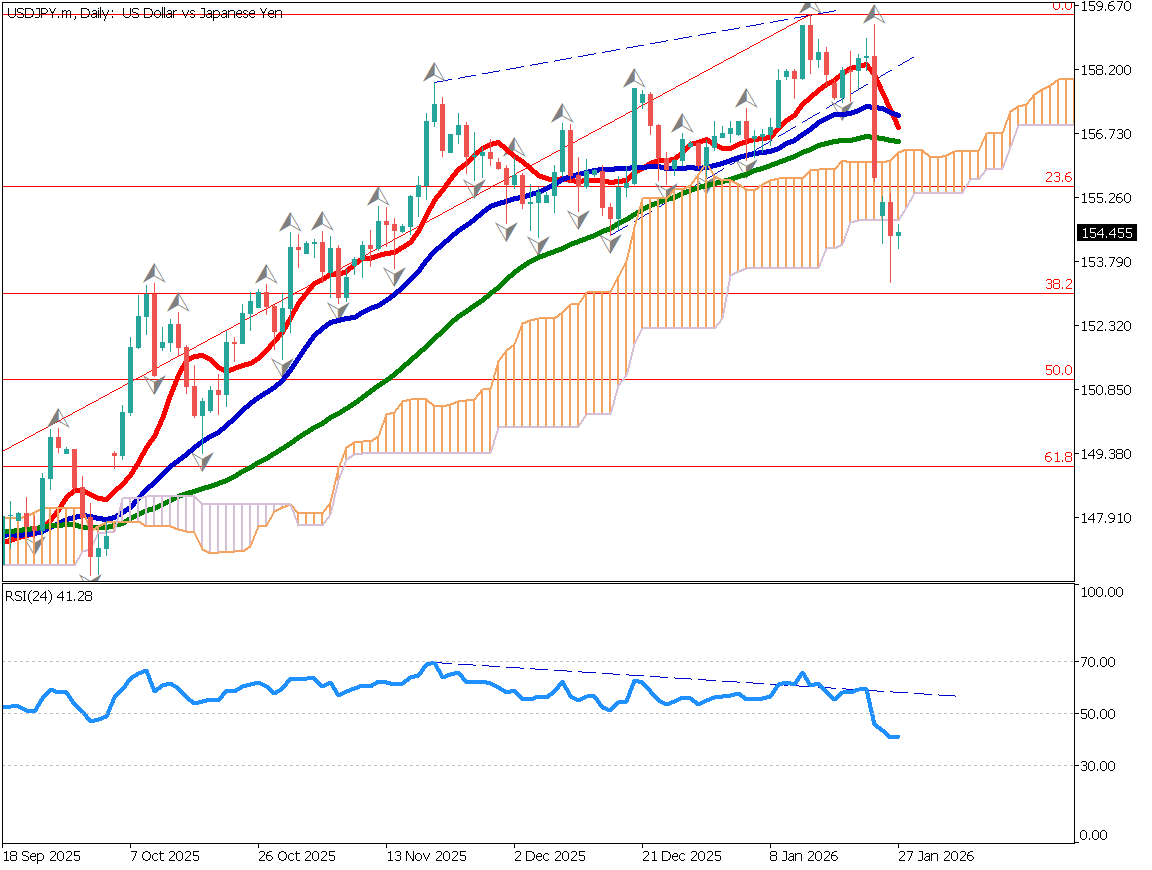

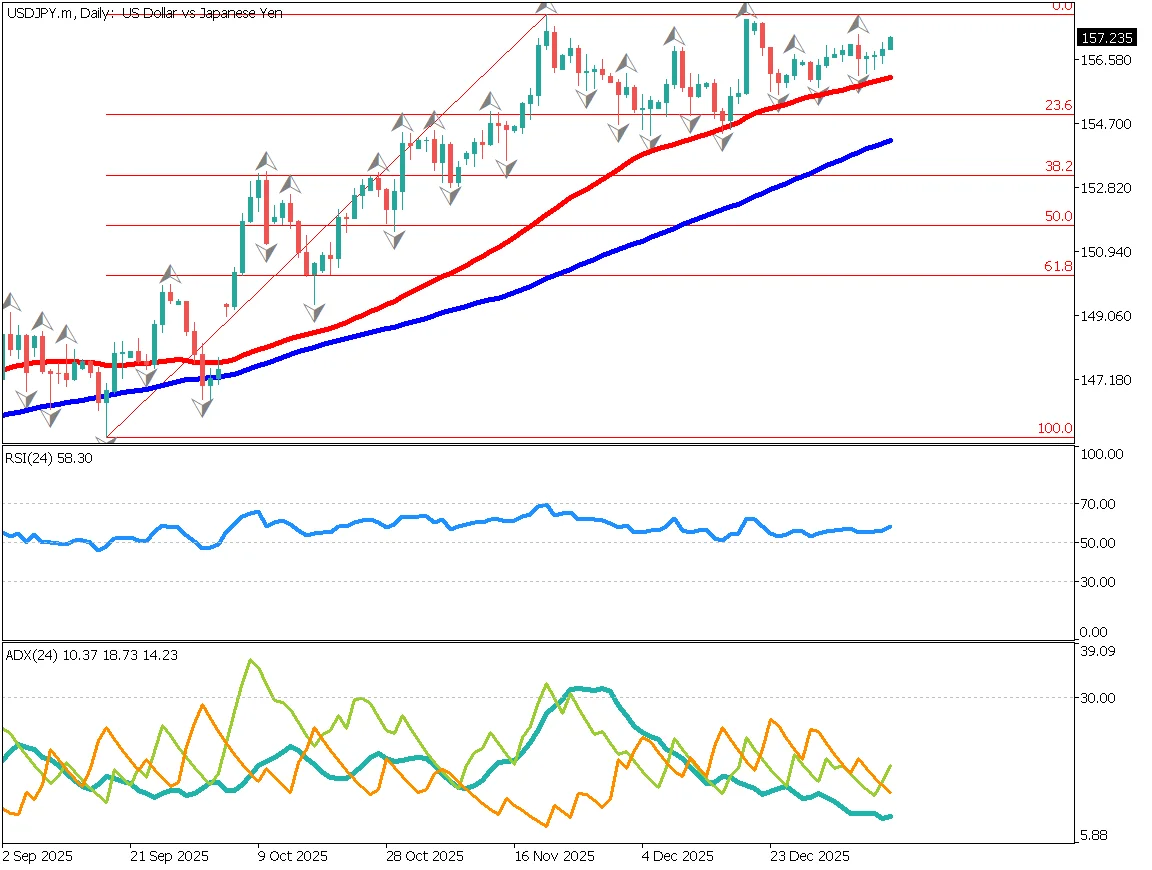

USD/JPY Trades in the 156 Range – Will the BOJ Move Toward an Early Rate Hike?

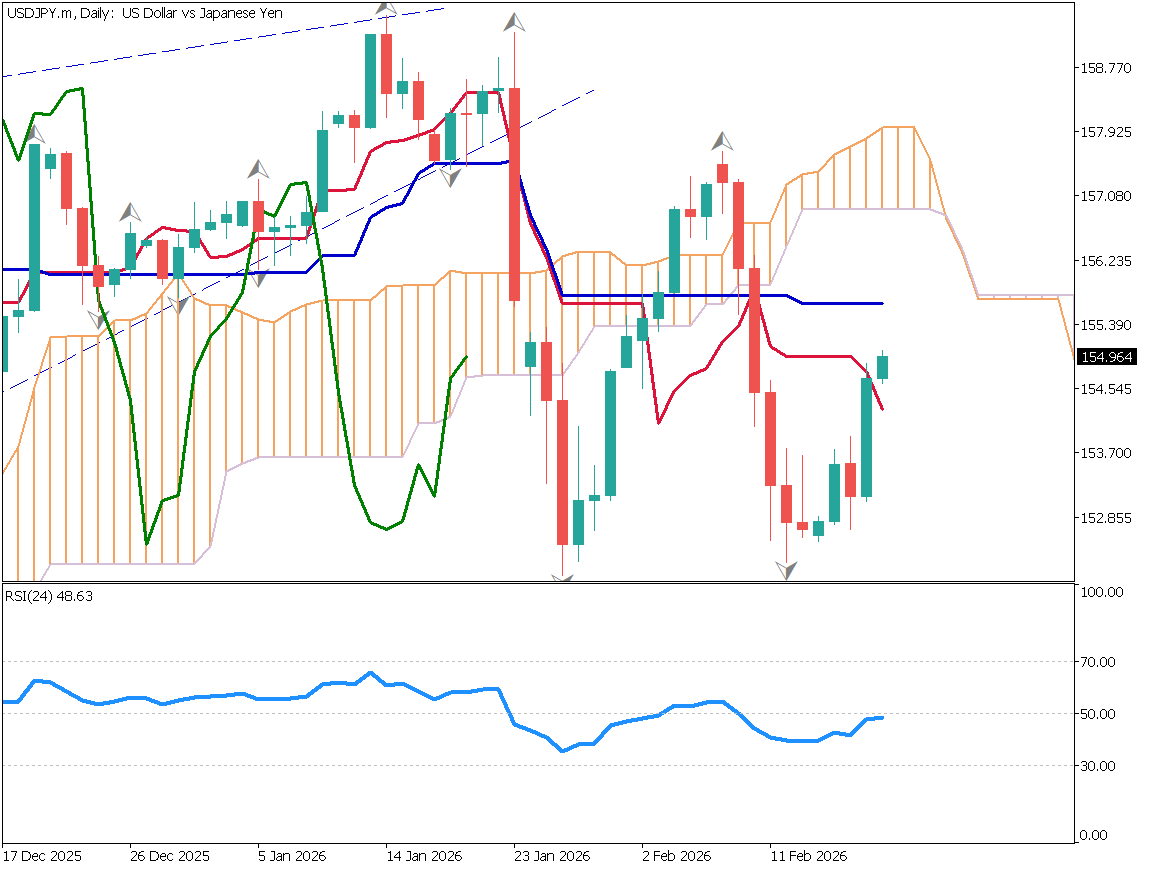

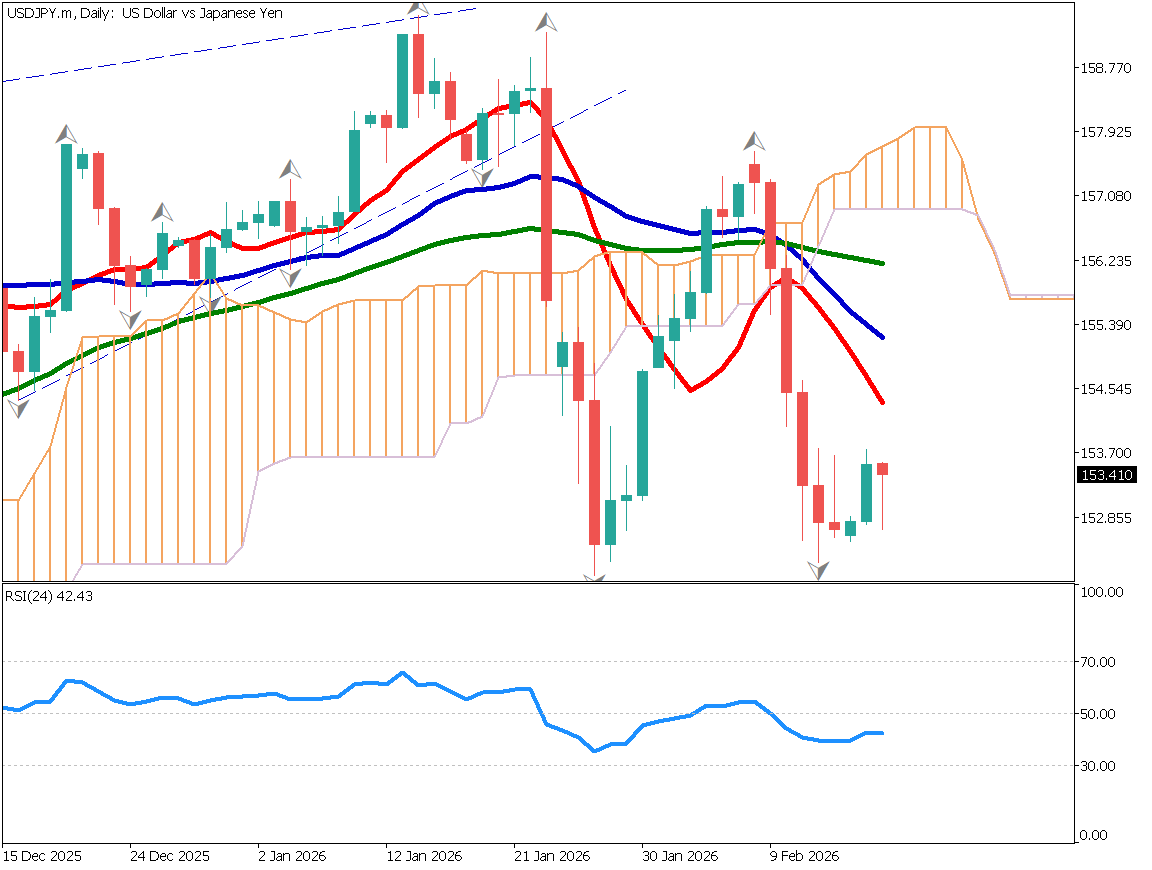

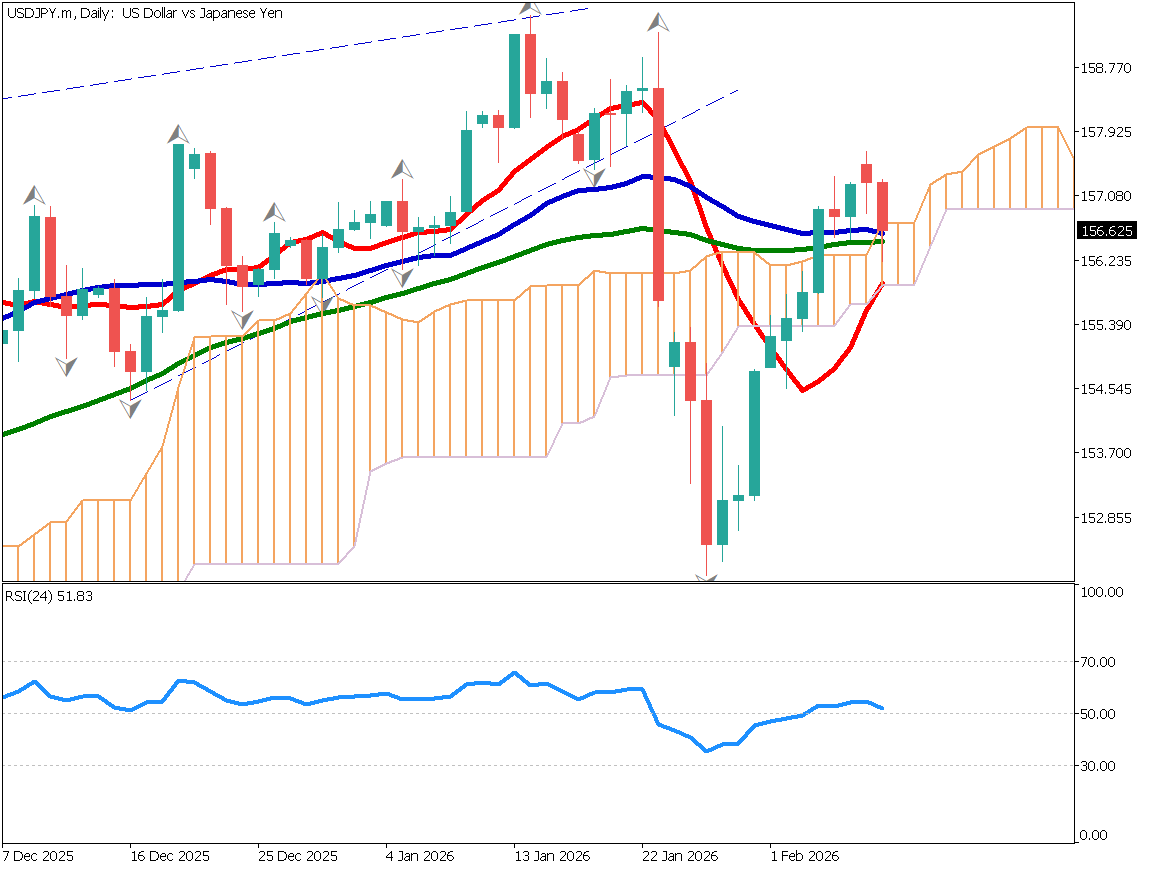

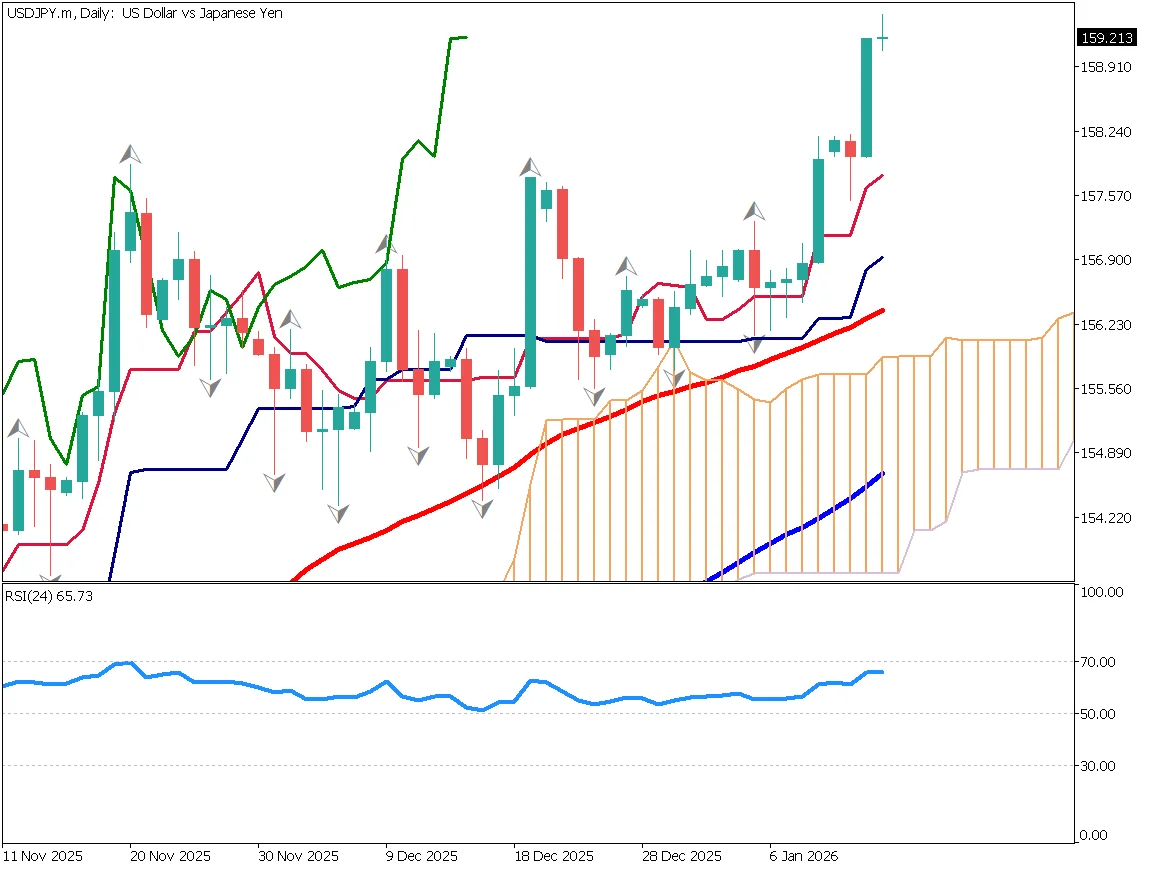

Will USD/JPY Continue Rising? Don’t Miss the Breakout

USD/JPY Breaks Out of Range Market!

USDJPY Range Break Could Signal Next Trend

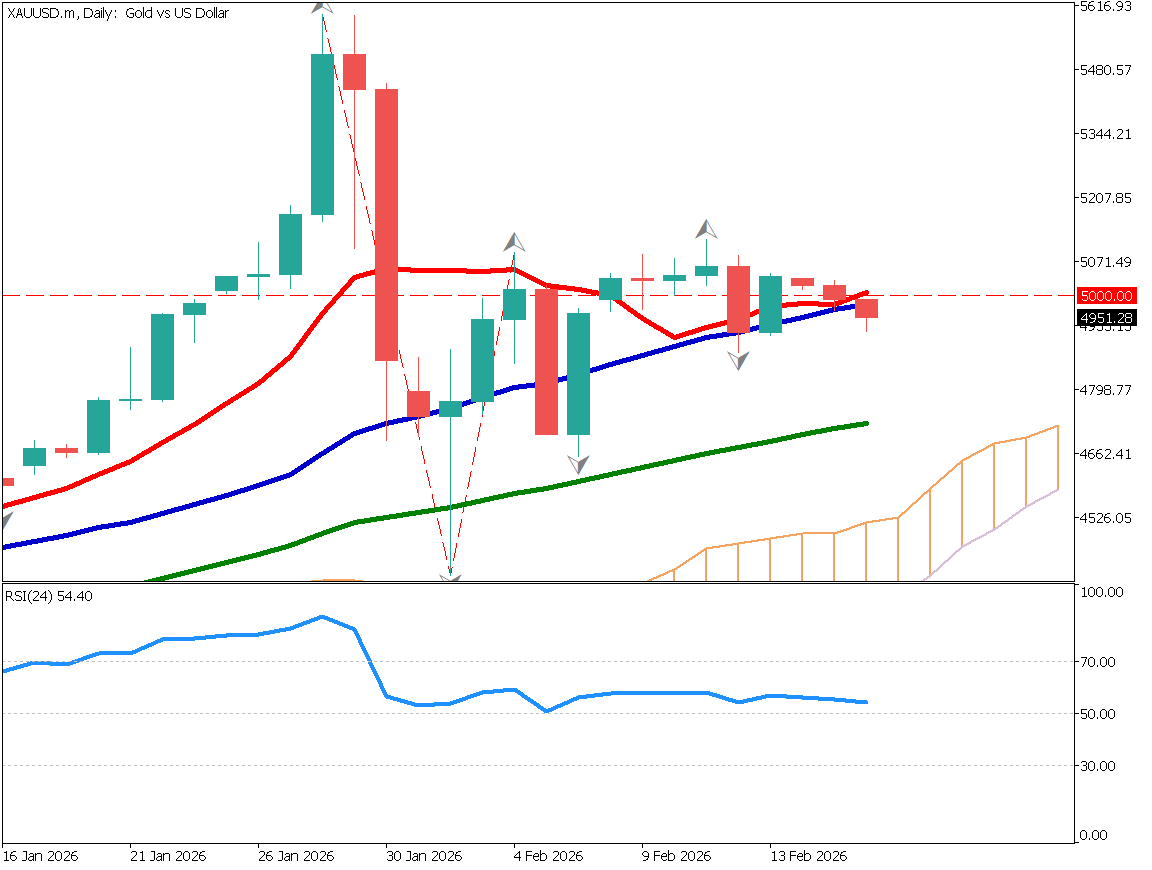

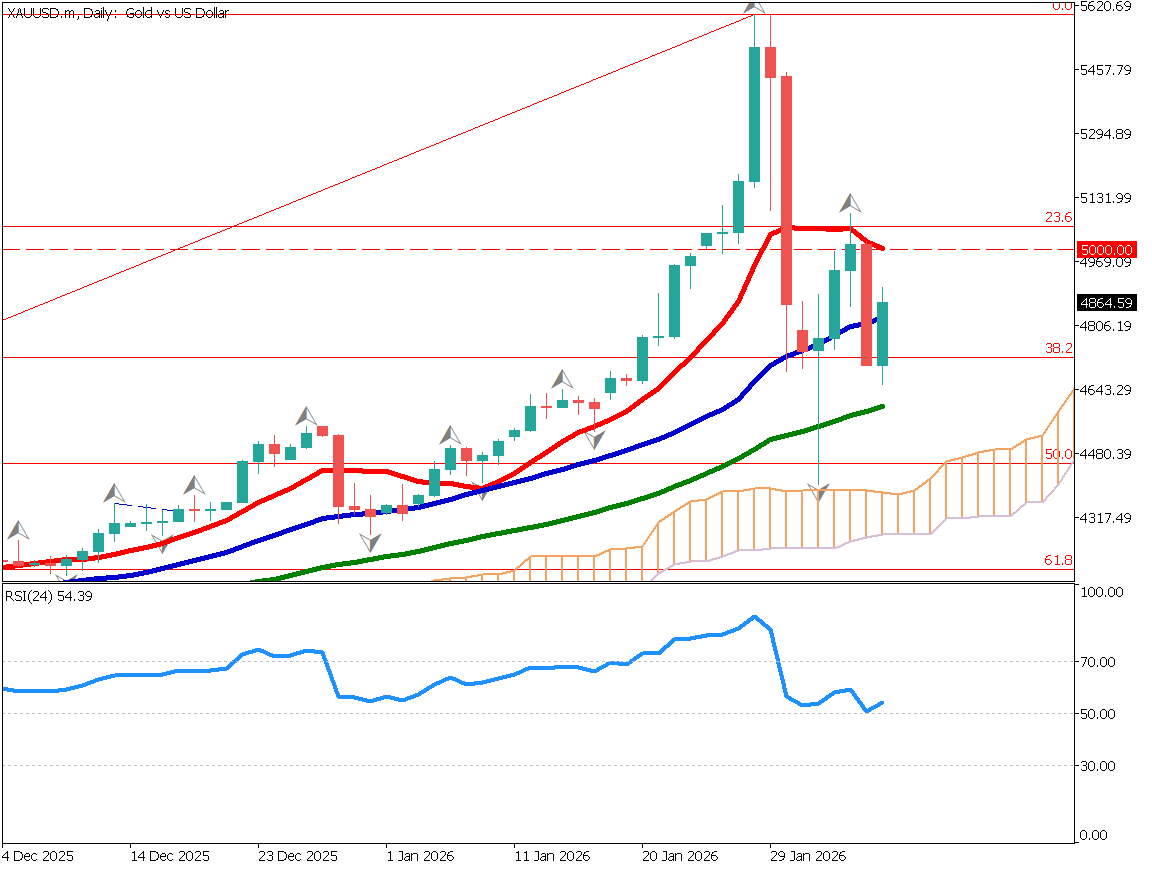

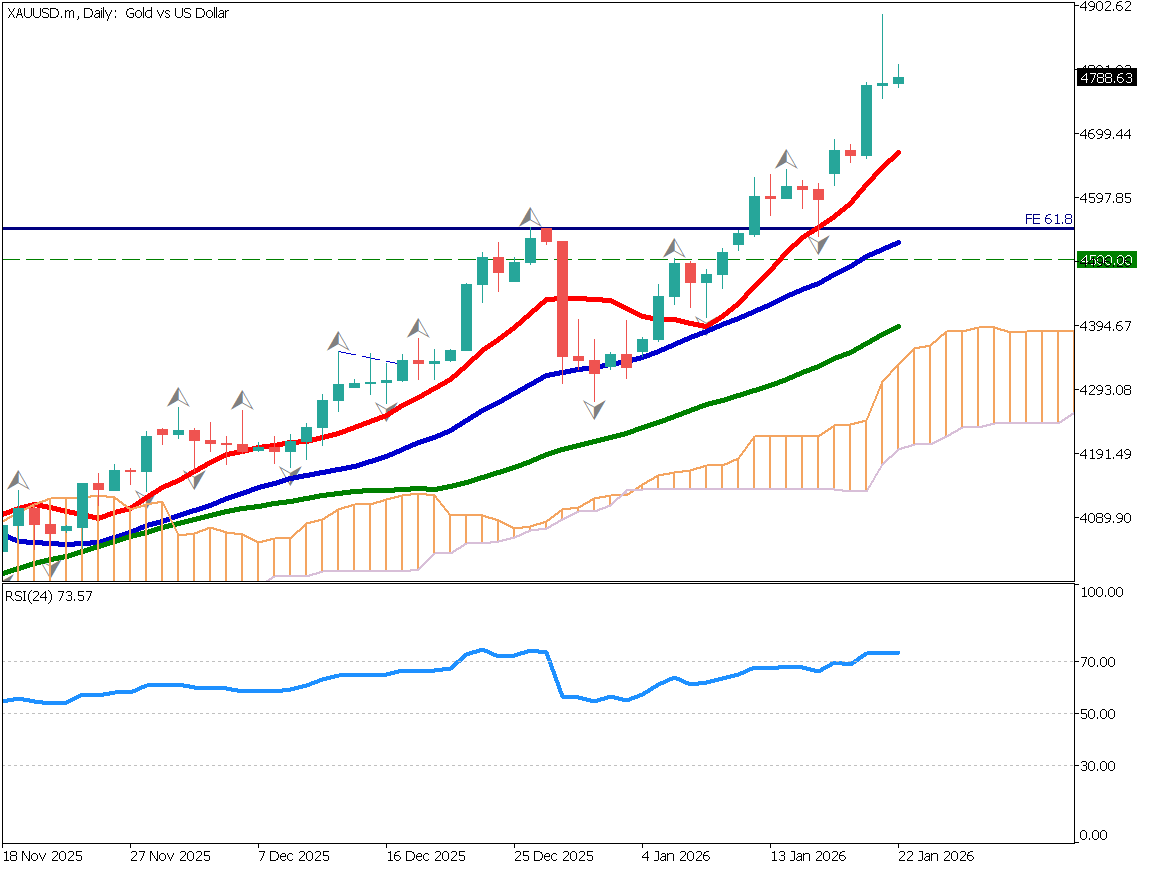

Gold Remains in a Downtrend, $5,000 Acts as Strong Resistance

USD/JPY Forms a Range — What’s Next?

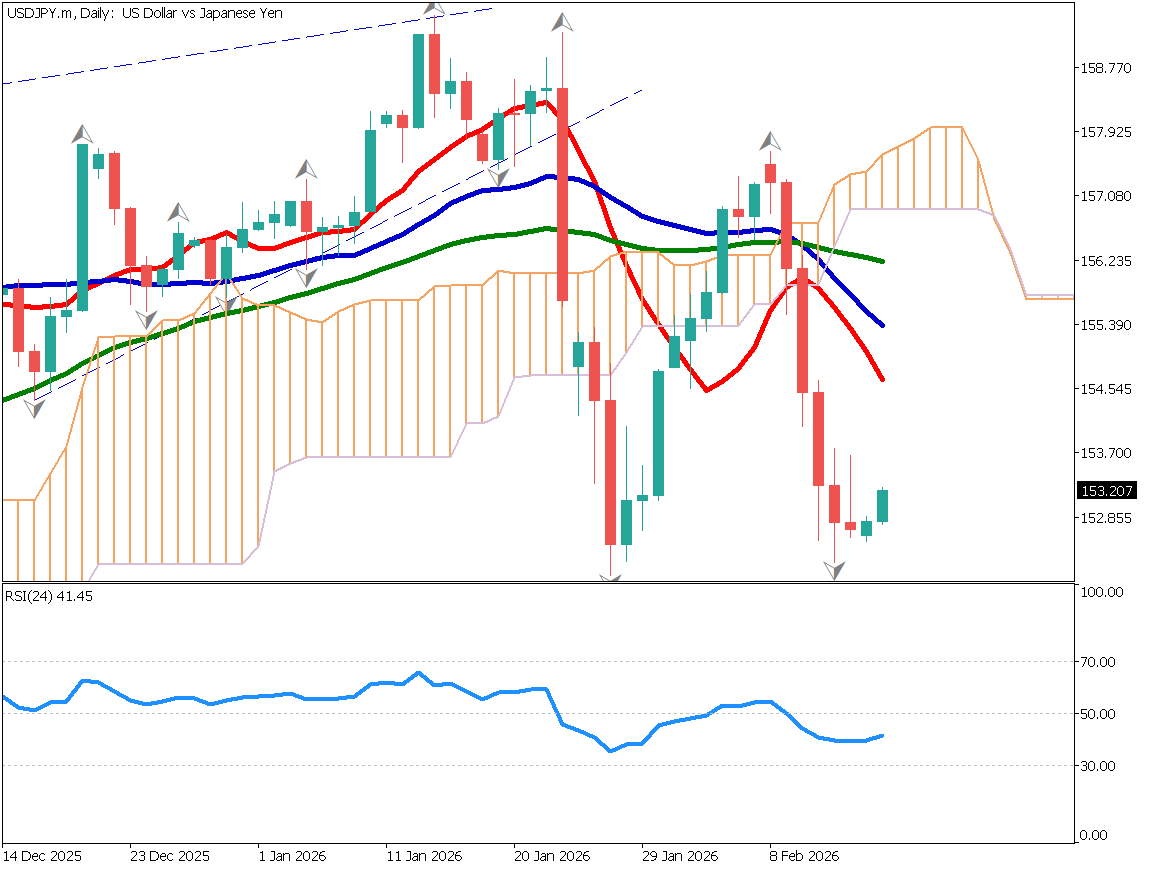

USD/JPY: Selling Pressure Dominates on Rallies

USD/JPY dips slightly on LDP landslide victory

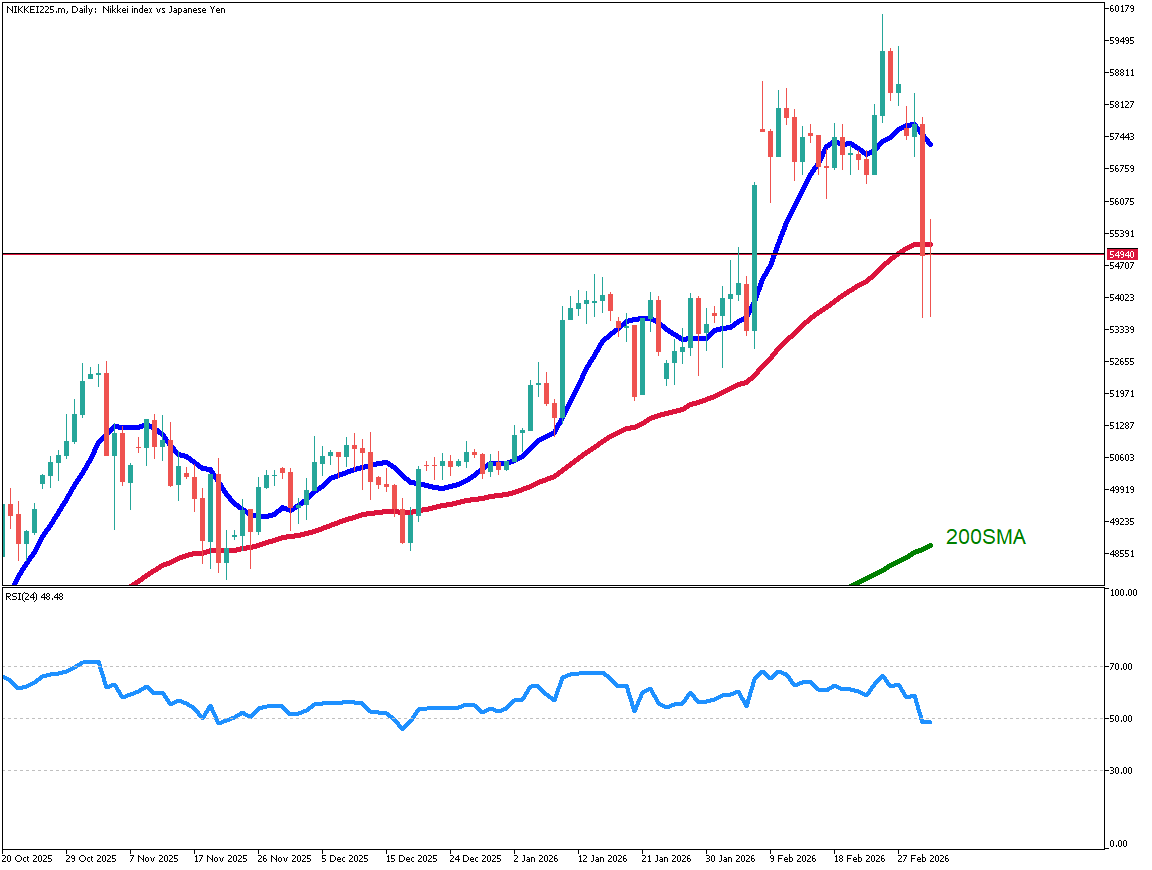

Can Gold Renew Its Record High?

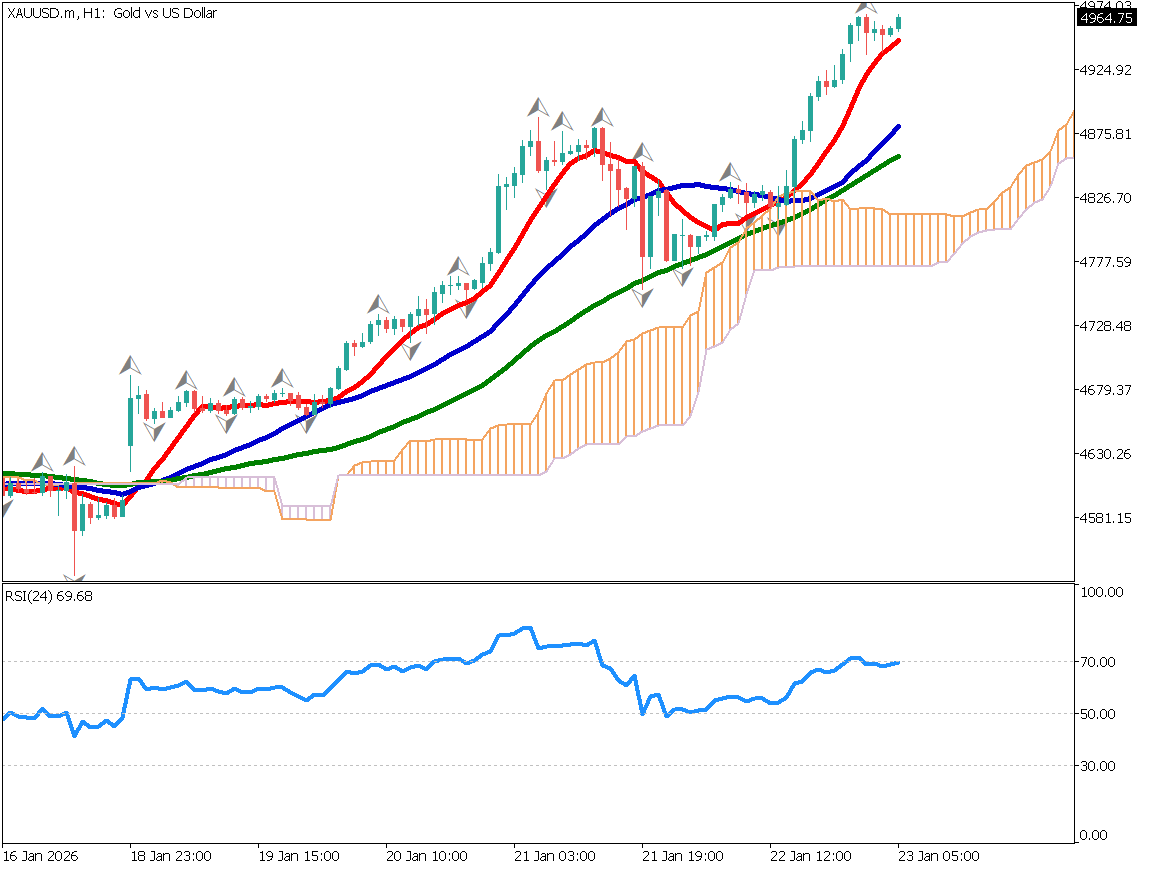

Gold and Silver Continue to Hit Record Highs

No Currency Intervention Conducted; Reports of Additional Tariffs on South Korea

Gold Near USD 5,000 as Risk-Off Sentiment Grows

Will Gold Aim for USD 5,000? TACO Trades Re-emerge

USD/JPY Forms a Rising Wedge

US–EU Tensions Deepen, EUR/USD Declines

Daily Market Report [January 20, 2026]

USD/JPY Falls Below the Conversion Line, Shaken by Geopolitical Risks and Domestic Politics

Daily Market Report [January 19, 2026]

USD/JPY Declines Amid Repeated Verbal Intervention

Daily Market Report – January 16, 2026

EUR/USD in a Range as a Second Geopolitical Risk Emerges

Daily Market Report – January 15, 2026

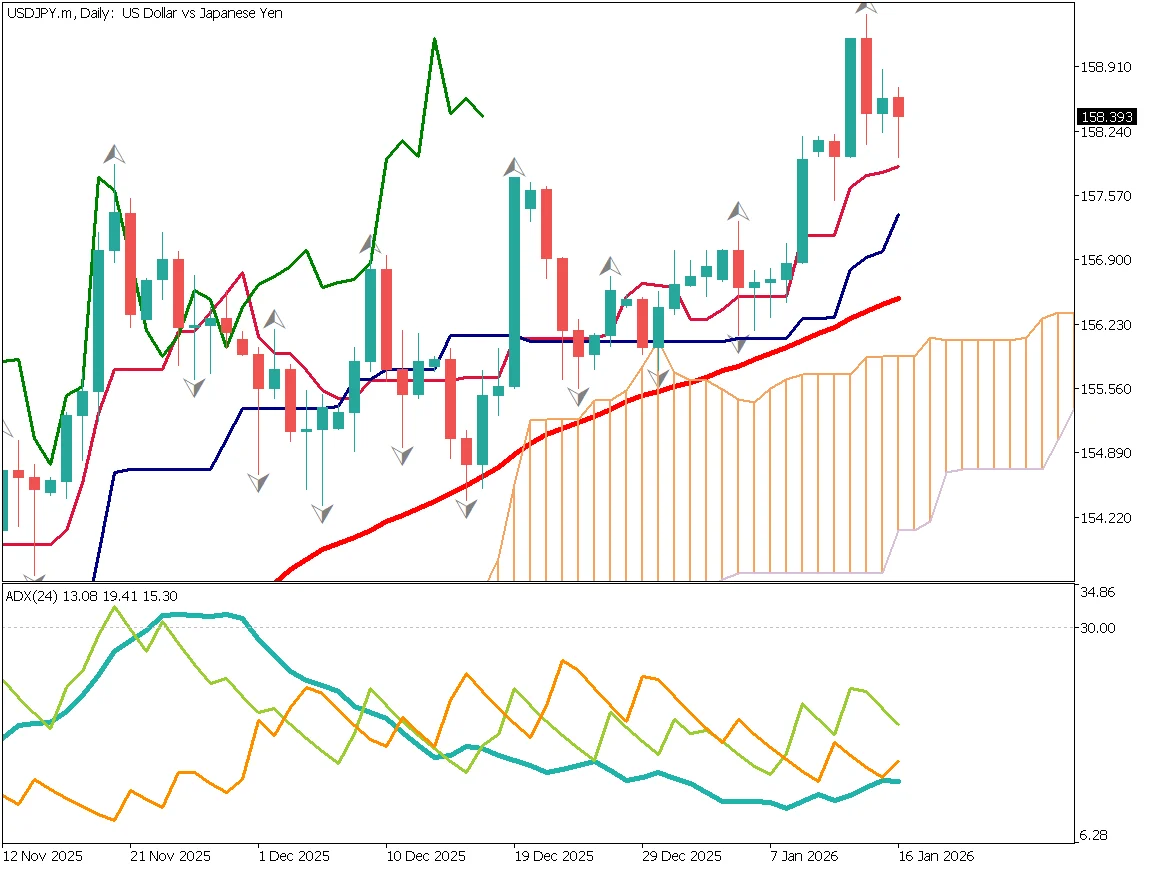

USD/JPY Nears 160, Yen Weakens on "Takaichi Trade"

Daily Market Report – January 14, 2026

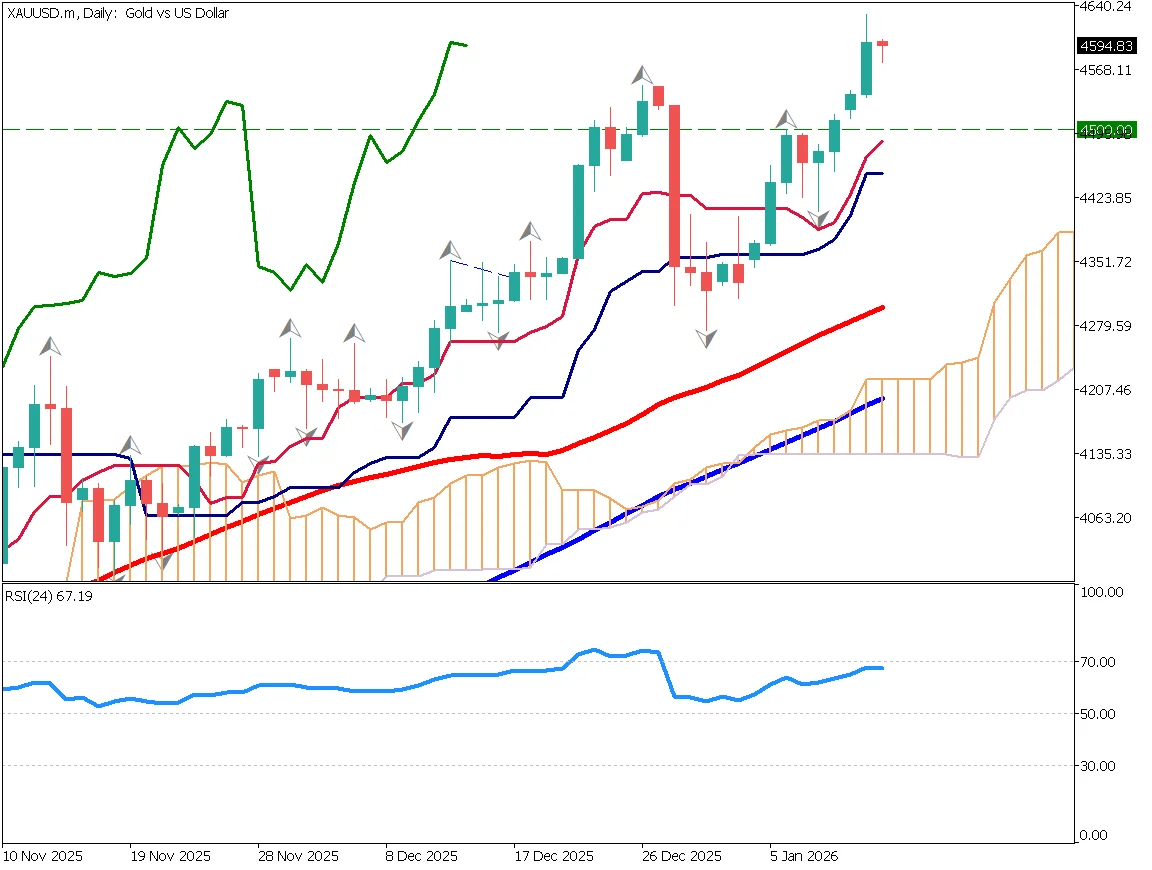

Gold Hits New Highs, Investigation Reports Into Fed Chair

Daily Market Report – January 13, 2026

Gold Hits Record High as U.S. Jobs Data Misses Expectations

Daily Market Report – January 12, 2026

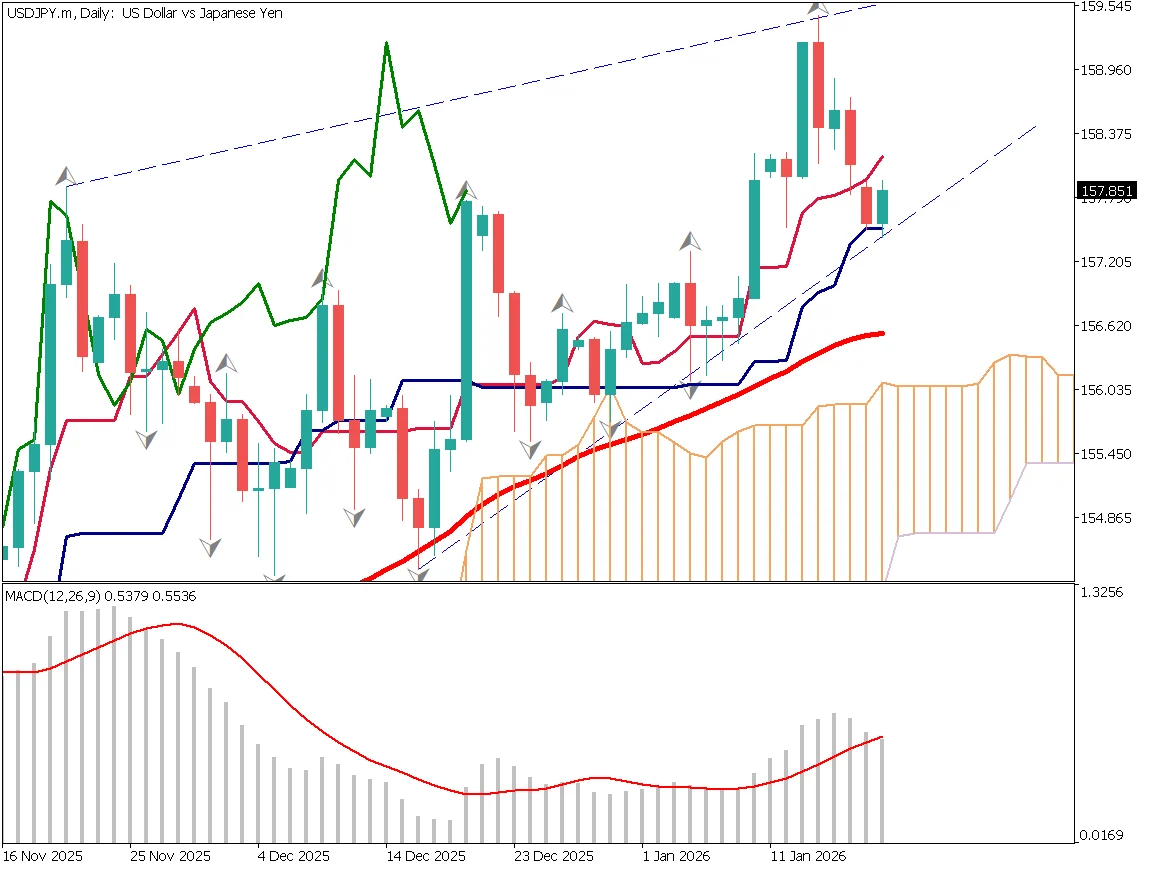

USD/JPY Shows Slight Upward Bias, Awaiting U.S. Employment Report

Daily Market Report [January 9, 2026]