USDJPY forms a narrow range, unlikely to move until the BOJ meeting【July 18, 2023】

Fundamental Analysis

U.S. stock indexes rebound; buy orders increase in the stock market as interest rate hike speculation recedes

Chinese economic indicators suggest economic slowdown, putting downward pressure on crude oil prices

Dollar Straight Currency Pairs Form Slight Range, Awaiting Monetary Policy Meetings

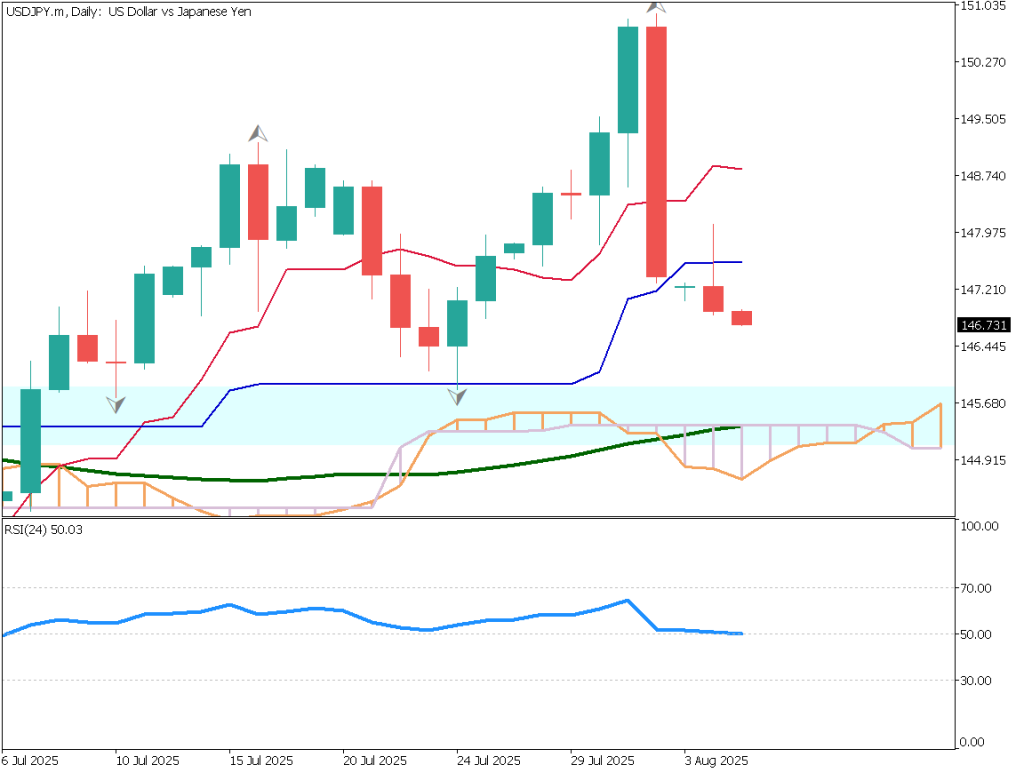

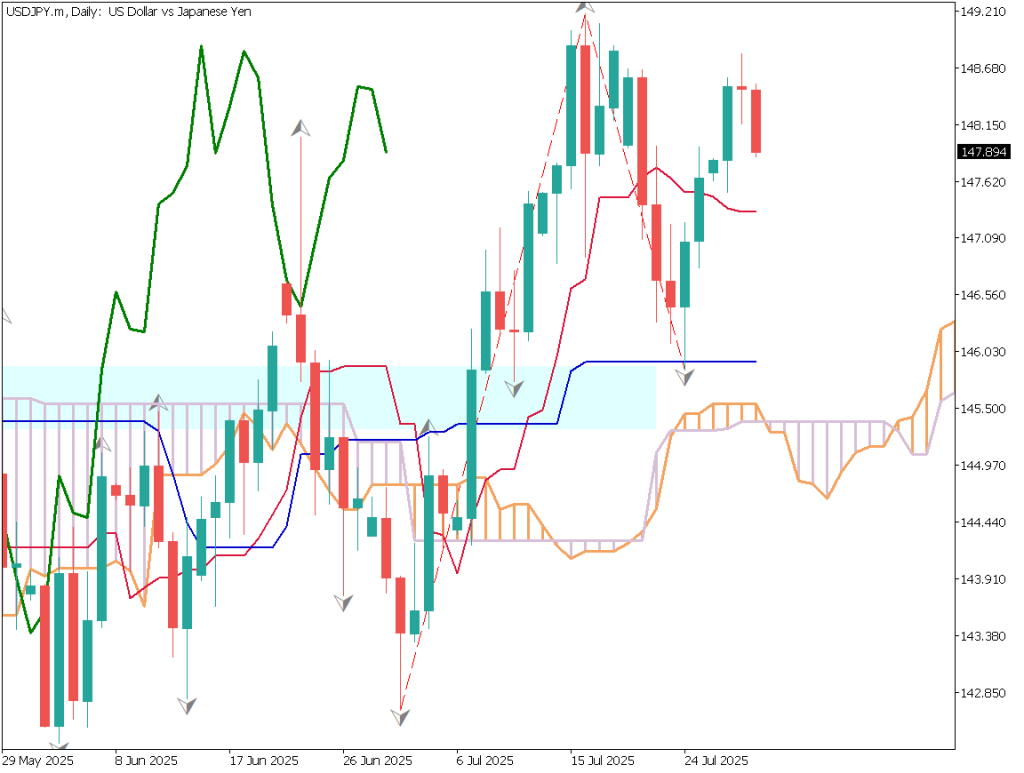

USDJPY Technical Analysis

USDJPY is making an adjustment after falling to JPY 137.25. It is back to 23.6% of the Fibonacci retracement. In terms of fundamental analysis, the return is likely to be sold off as a certain number of investors are anticipating a change in the BOJ policy. Also, the decline in the dollar index seems to have made the JPY relatively easier to buy. Note, however, that the RSI is at 53, which is at odds with the technicals.

In addition, since there is a lull in the dollar’s depreciation, the market is waiting for new materials in the market going forward. Next week, monetary policy meetings will be held in various countries, and we would like to wait for the results of these meetings to prepare for the emergence of a new trend.

Day Trading Strategy (Hourly)

Day trade policy is reverse trade. However, we want to pull back enough. Specifically, we would consider a sell trade at JPY 139.8 and the first half of JPY 140, and a buy trade when the price is around JPY 137.86. Since profit-taking is expected to increase, we would like to buy aggressively below JPY 137.80.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

140.12 JPY – Major resistance zone139.80 JPY – A key resistance zone137.86 JPY- Important support zone on a monthly basis

Market Sentiment

USDJPY Sell: 37% Buy: 63%

Today’s Important Economic Indicators

Economic Indicators and EventsJST (Japan Standard Time)U.K. Consumer Price Index15:00EU Consumer Price Index18:00

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.