EURUSD’s Downward Momentum Weakens; Focus on EU Bloc Consumer Price Index【August 18, 2023】

Fundamental Analysis

Eurozone CPI to be released today; watch for major volatility

Weakening Chinese economy may affect European economy

Markets wary as recession and inflation may hit at the same time

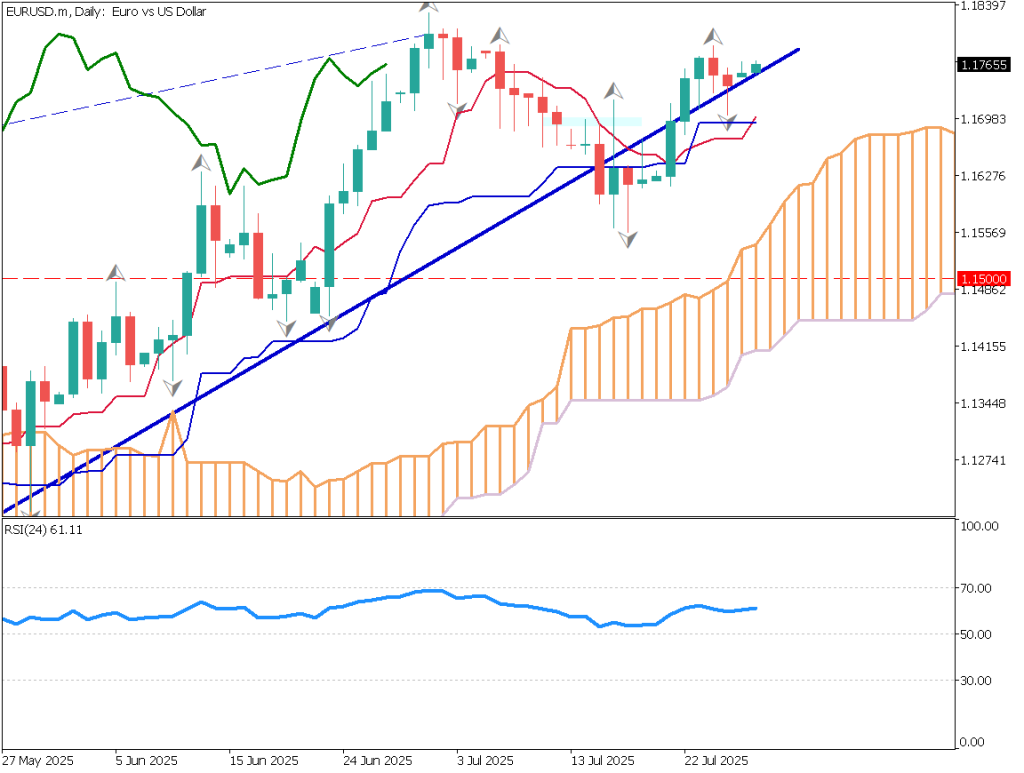

EURUSD Technical Analysis

Analysis of the daily chart of the Eurodollar shows that it has fallen below its 72-medium-term moving average. However, the momentum of the decline has gradually weakened and is approaching the USD 1.085 mark, which is considered a milestone.

From a fundamental perspective, given the proximity to the release of the EU Consumer Price Index, this indicator could cause greater volatility in the Eurodollar. The CPI is an important indicator of inflation trends and has a significant impact on policy rate policy by the ECB.

Considering the current technical developments and the upcoming fundamental events, the market is likely to be range-bound around the USD 1.085 milestone.

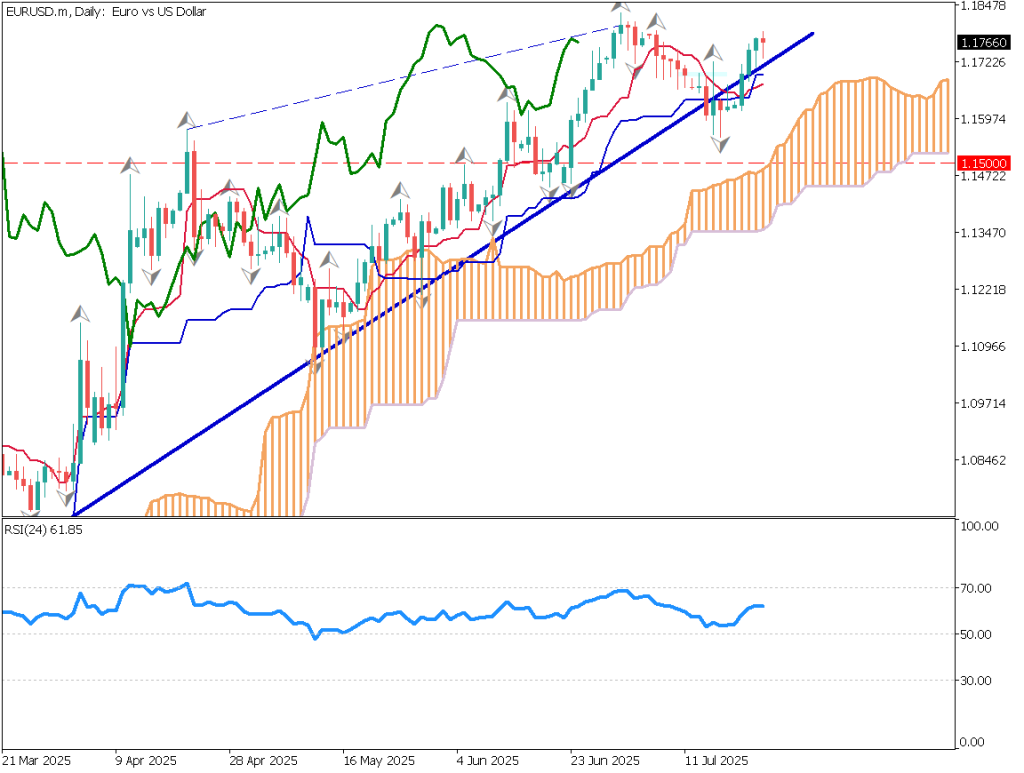

Day Trading Strategy (Hourly)

Analyzing the hourly chart of the EURUSD, we can see that the moving averages are forming a perfect order. This condition indicates the strength of the trend, but since the highs are gradually cutting off, we can conclude that the downward trend is continuing.

On the other hand, the RSI is rounding up, indicating that the downward pressure may be weakening. Therefore, a short-term contrarian opportunity can be considered, using USD 1.085 as a downside guide.

As a day trading strategy, we will adopt a short-term inverse strategy. Entry prices are set at USD 1.085 and USD 1.082, with a profit target of USD 1.088. On the other hand, the stop loss is set at USD 1.080. This strategy aims for a short-term rebound, taking advantage of weakening downward pressure to pursue profits.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

1.085 USD – Major daily support line

Market Sentiment

EURUSD Sell: 30% Buy: 70%

Today’s Important Economic Indicators

Economic Indicators and EventsJST (Japan Standard Time)Japan Consumer Price Index8:30EU Consumer Price Index18:00

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.