USD/JPY Falls Significantly, Reaching a One-Month Low【November 21, 2023】

Fundamental Analysis

Microsoft Announces Hiring of Former OpenAI CEO Altman

US Stock Market Rises Significantly, While the End of US Interest Rate Hikes Strengthens the Dollar’s Decline

The Yen Strengthens, USD/JPY Falls to 148.30 JPY

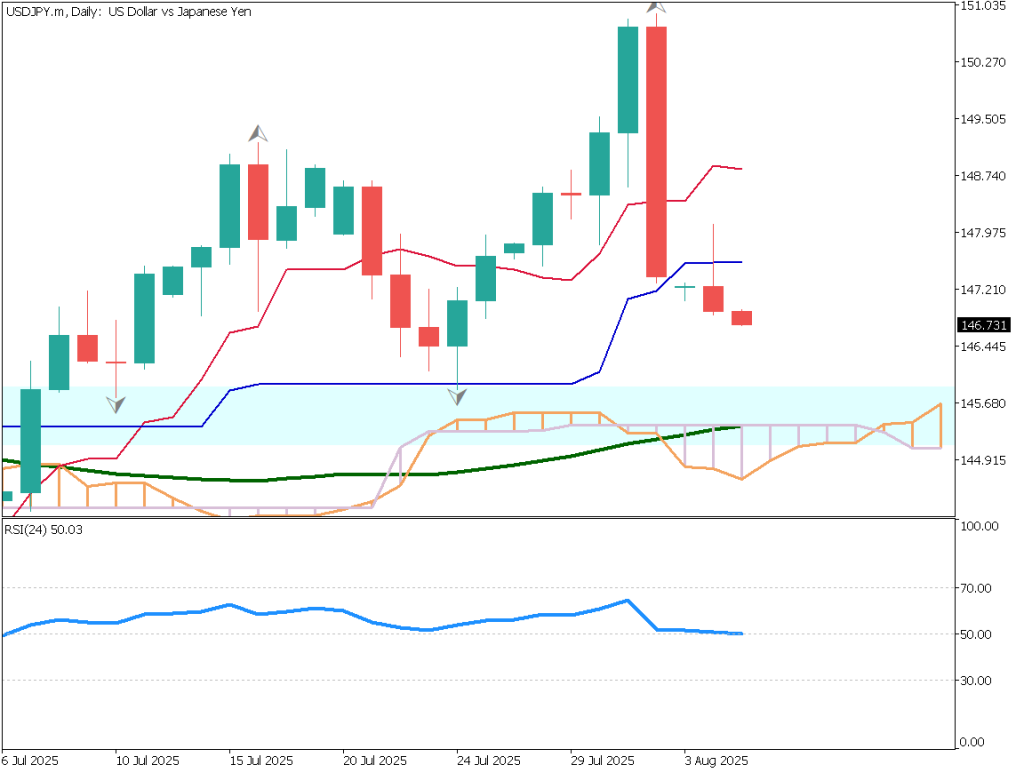

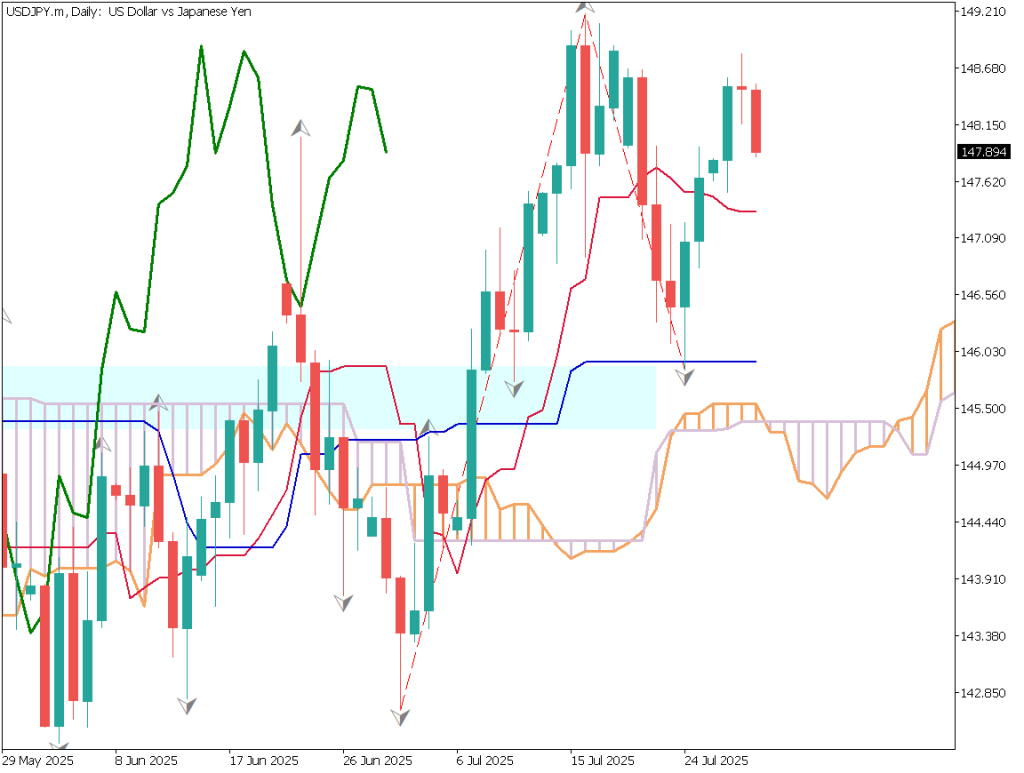

USDJPY Technical Analysis

Analysis of the USD/JPY daily chart reveals an entry into the Ichimoku Cloud, where price consolidation frequently occurs, requiring time before a breakout. A movement below the -2σ of the Bollinger Bands was observed, but a slight rebound is also noticeable.

If the -2σ line acts as a resistance line, it could form a band walk, potentially accelerating the downward trend. However, a rebound is expected even if it momentarily reaches the -3σ line at around 147.79 JPY.

While considering the acceleration of the downward trend, one should be cautious of an oversold market.

Day Trading Strategy (1-Hour Chart)

Analysis of the USD/JPY 1-hour chart shows movements below 148.50 JPY as technically interesting. RSI is rising with each new low, indicating divergence, but whether this signifies an upward shift remains unclear.

After yesterday’s significant movements, today might see a ranging market around the 148 JPY level. While temporary adjustments are possible, the aim is to effectively use the downward trend.

The day trading strategy is to sell on rallies. The entry point is set at 149.00 JPY, target profit at 148.60 JPY, and stop-loss at 149.35 JPY.

Support and Resistance Lines

Upcoming resistance lines to consider:

148.80 JPY – Major resistance zone148.50 JPY – Major resistance zone

Market Sentiment

USDJPY – Sell: 45%, Buy: 55%

Today’s Important Economic Indicators

Economic Indicators and EventsJST (Japan Standard Time)Minutes of the Australian Monetary Policy Meeting9:30Canadian Consumer Price Index22:30US Existing Home SalesMidnight 0:00Speech by Lagarde, ECB PresidentFollowing 1:00FOMC MinutesFollowing 4:00

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.