USD/JPY Briefly Hits Early 140s, Watch for Yen Strengthening in 2024【December 29, 2023】

Fundamental Analysis

USD/JPY briefly hit the early 140s, forming a lower wick and a ‘Dragonfly’ pattern

Dollar strengthens towards the year-end due to position adjustments, recovering to the late 141s during NY hours

Downward trend line and 240-day moving average are in focus

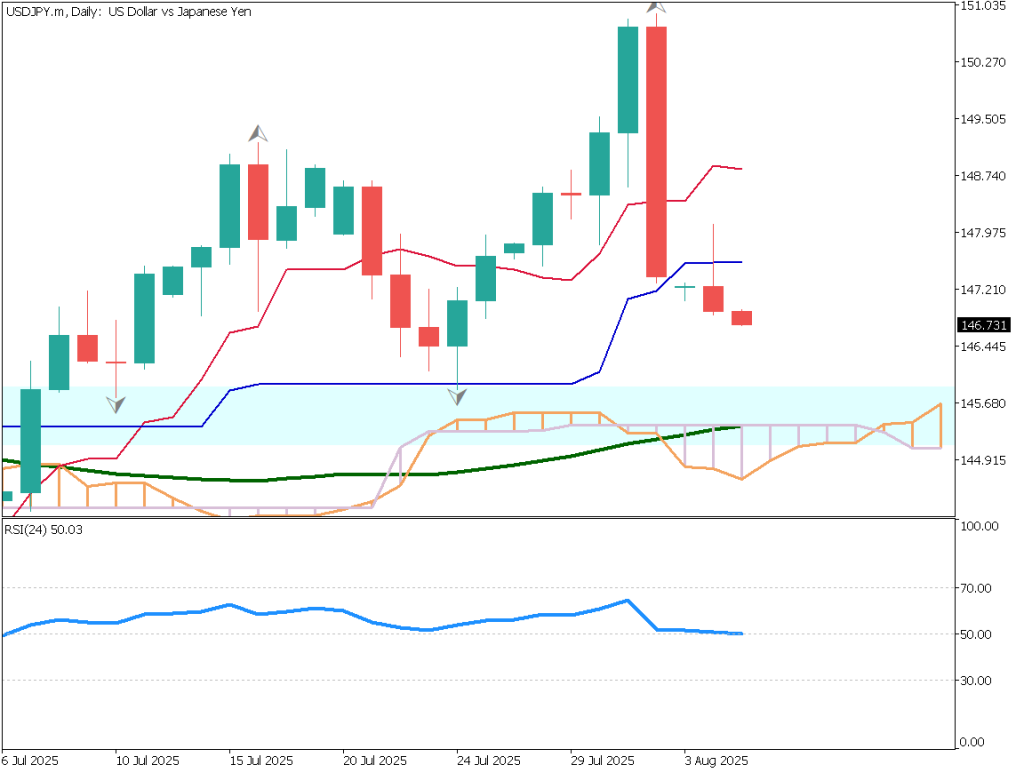

USDJPY Technical Analysis

Analysis of the daily chart for the USD/JPY shows a clear downward trend line. The market has broken below both the 200-day and 240-day moving averages.

Noteworthy is the appearance of the ‘Three Black Crows’ pattern from the Sakata’s Five Methods. This pattern, consisting of ‘a large bearish candle, three small consecutive bullish candles, followed by another large bearish candle’, generally indicates a continuation of a downtrend.

The daily RSI is around 35, suggesting the possibility of a continuing downtrend. Caution against a stronger Yen is advised as we enter 2024.

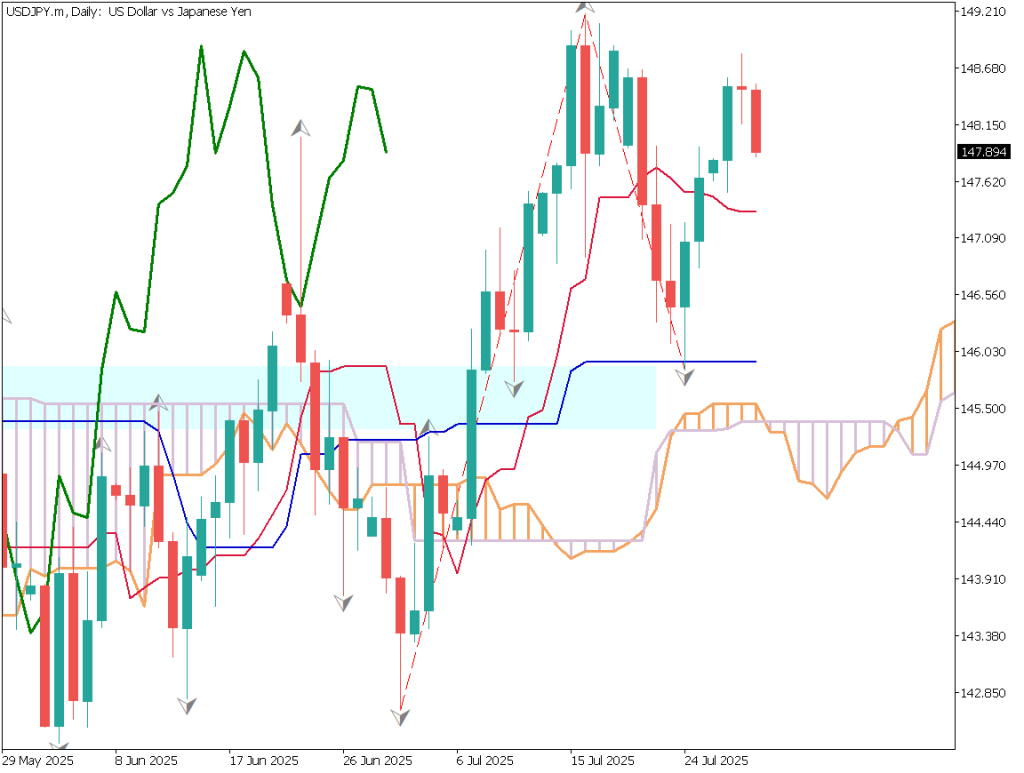

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour chart for USD/JPY, it plunged into the early 140s but failed to break below 140 JPY, failing to breakthrough. The current RSI has crossed above 30 and is at 48, whether it surpasses the critical level of 50 will be a key focus for future market trends.

Around 141.85 JPY, a significant resistance line can be drawn, which may become a barrier in future markets. Considering the year-end, strong movements for position adjustments are observed, and special caution is required for holding positions over the new year.

The strategy heading into 2024 is to consider trading from a selling perspective.

Support and Resistance Lines

Upcoming resistance lines to consider:

142.90 JPY – 240-day moving average140.25 JPY – Recent low

Market Sentiment

USDJPY Sell: 44%, Buy: 56%

Today’s Important Economic Indicators

Economic Indicators and EventsJST (Japan Standard Time)UK Nationwide Housing Price Index16:00

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.