EURUSD Rises, Influenced by the Dovish Stance of the Federal Reserve【May 3, 2024】

Fundamental Analysis

The U.S. Federal Reserve maintains its dovish stance, leading to a decline in U.S. long-term interest rates

Japan’s monetary authorities may implement a second currency intervention, similar in scale to 2022

USD selling strengthens, and USDJPY is trading around 152.8 JPY

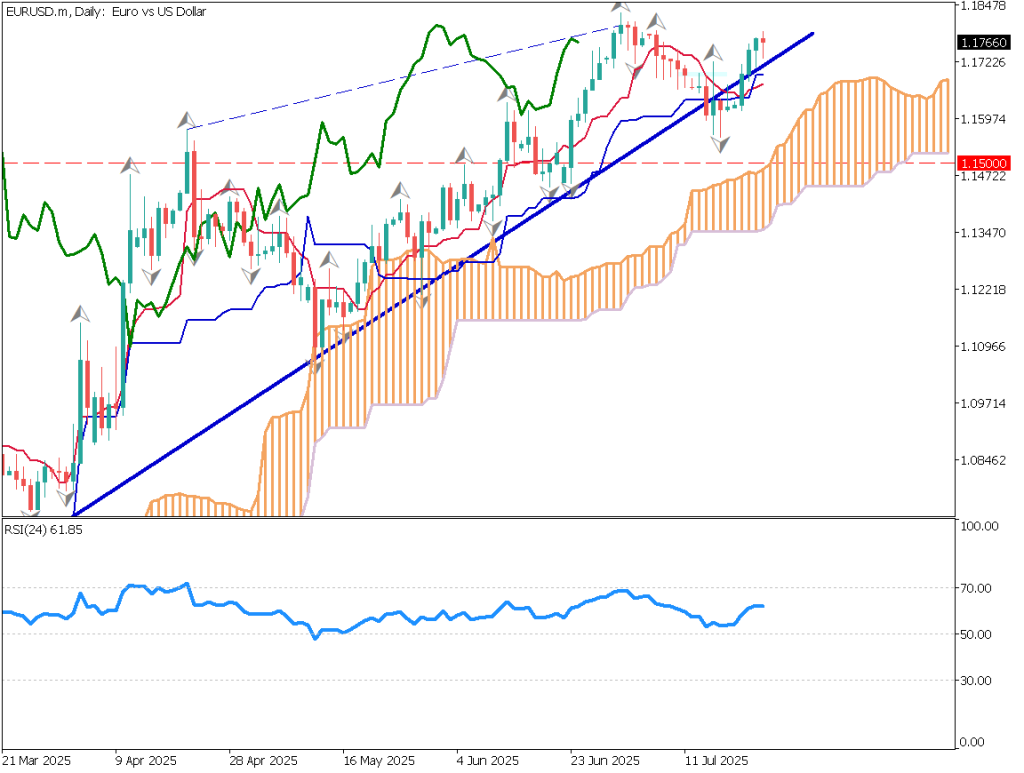

EURUSD technical analysis

Analyzing the daily chart of EURUSD. Although EURUSD temporarily rebounded from the 28-day moving average, the continued dovish stance of the U.S. Federal Reserve and the resultant decline in long-term interest rates intensified USD selling.

EURUSD also sees short covering, recovering to around 1.072 USD. A hammer candlestick has appeared, and it is slightly above the 28-day moving average. It has surpassed the 23.6% Fibonacci retracement level, and focus remains on whether it will break higher. If it does not fall back at 23.6%, it could aim for around 1.08 USD, corresponding to the 38.2%.

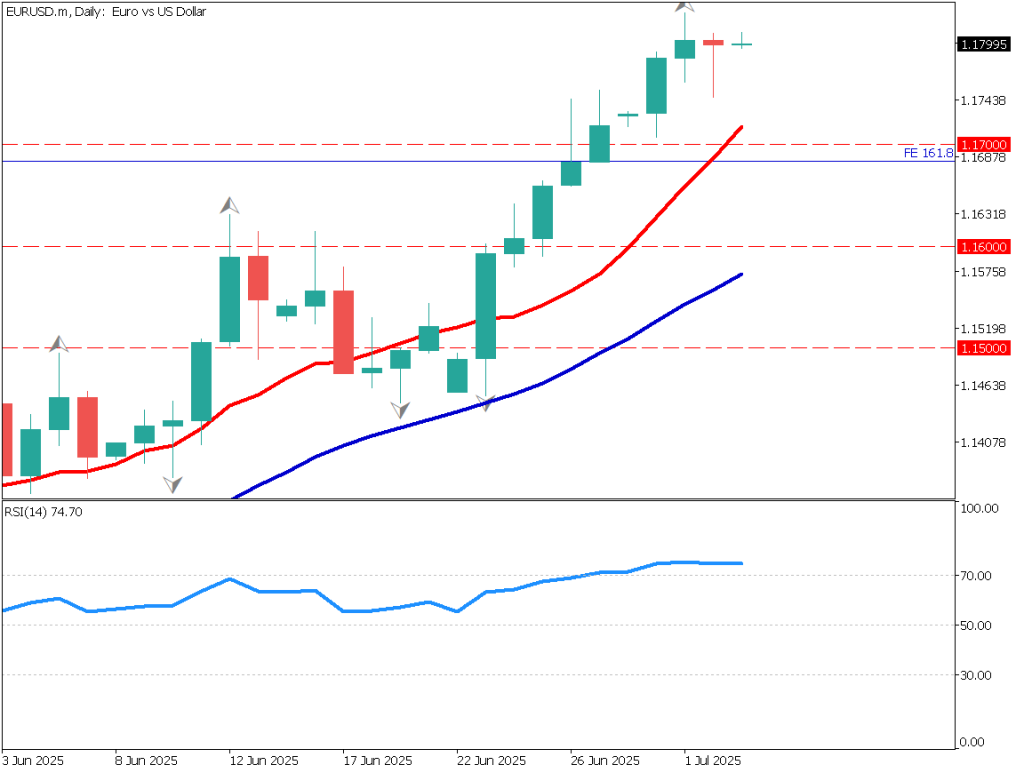

Day trading strategy (1 hour)

Analyzing the 1-hour chart of EURUSD. Viewing the 1-hour chart, there is some volatility, and a large-scale range market is continuing. The upper range is between 1.073 and 1.075 USD, with the lower range forming around the 1.06 USD level.

The movements of Japan’s currency authorities in buying JPY and selling USD also affect the volatility. A currency intervention similar to the previous one, around 8 trillion JPY, has been implemented, and intervention is considered to have paused.

Day trading strategy is to position short around 1.072 to 1.075 USD. If it reaches 1.076 USD and makes a new high, a stop is placed. Settlement is around 1.07 USD.

Support/Resistance lines

Key support and resistance lines to consider are as follows.

1.072 USD – Neckline

Market Sentiment

EURUSD Sell: 65% Buy: 35%

Featured Currency Pair of the Week (EURCHF)

EURCHF rebounded around 0.984 CHF. It was sold near the 28-day moving average, and a double top formation could be considered. Continued attention should be paid to whether the 28-day moving average continues to function as a support line.

Today’s important economic indicators

Economic indicators and eventsJapan timeU.S. Employment Report21:30U.S. ISM Non-Manufacturing Index23:00

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.