USDJPY Experiences Sharp Decline as US Employment Report Deteriorates and Unemployment Rate Rises【August 5, 2024】

Fundamental Analysis

US Employment Report Deteriorates, Unemployment Rate Rises, Increasing Expectations for US Rate Cuts

USDJPY Experiences Rapid Decline, Trading Around 145 JPY

Japan’s Hawkish Stance vs. US Dovish Stance Favors a Stronger JPY

USDJPY technical analysis

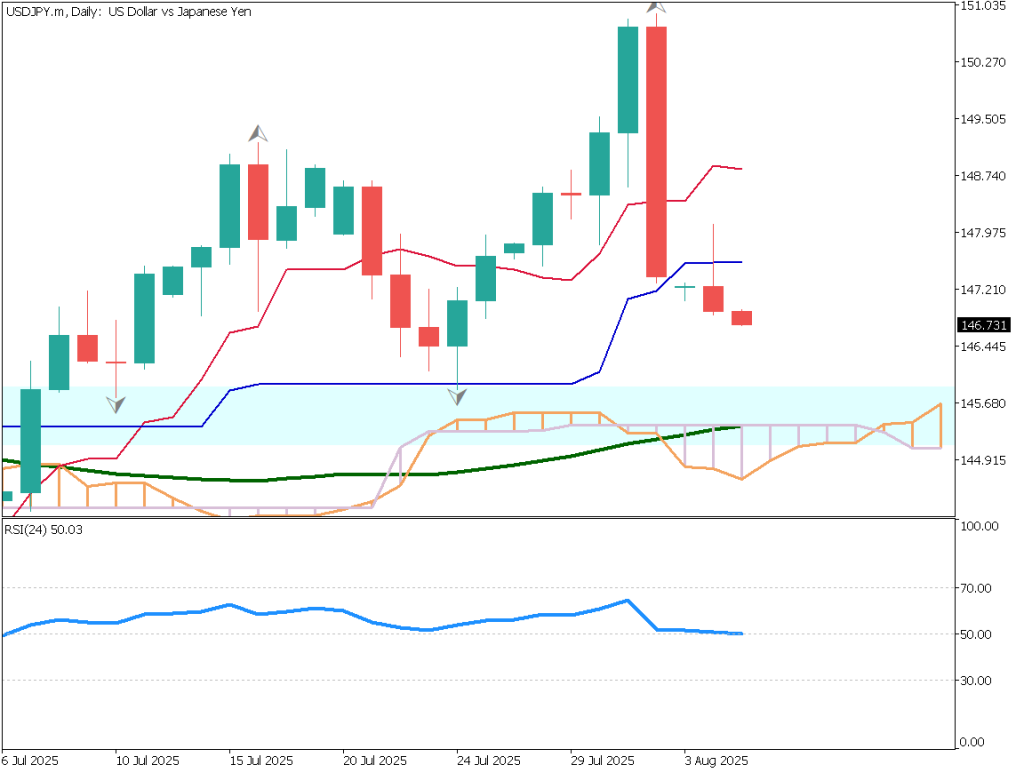

Analyzing the daily chart of USDJPY. Currently trading around 145 JPY, the pair continues its rapid decline. The backdrop includes the Bank of Japan’s interest rate hike and the growing expectations for a rate cut by the US Federal Reserve, narrowing the US-Japan interest rate differential. The rise in the US unemployment rate has triggered recession signals. With Japan and US interest rate policies moving in opposite directions, there is a greater-than-expected risk of JPY appreciation, reversing the previous JPY depreciation trend.

The RSI stands at 21.4, lower than the 27.4 level seen during the COVID-19 shock, indicating a sharper decline towards JPY appreciation compared to the COVID period.

Looking ahead, the 140 JPY level could serve as a benchmark. Sufficient caution against further JPY appreciation risk is necessary.

Day trading strategy (1 hour)

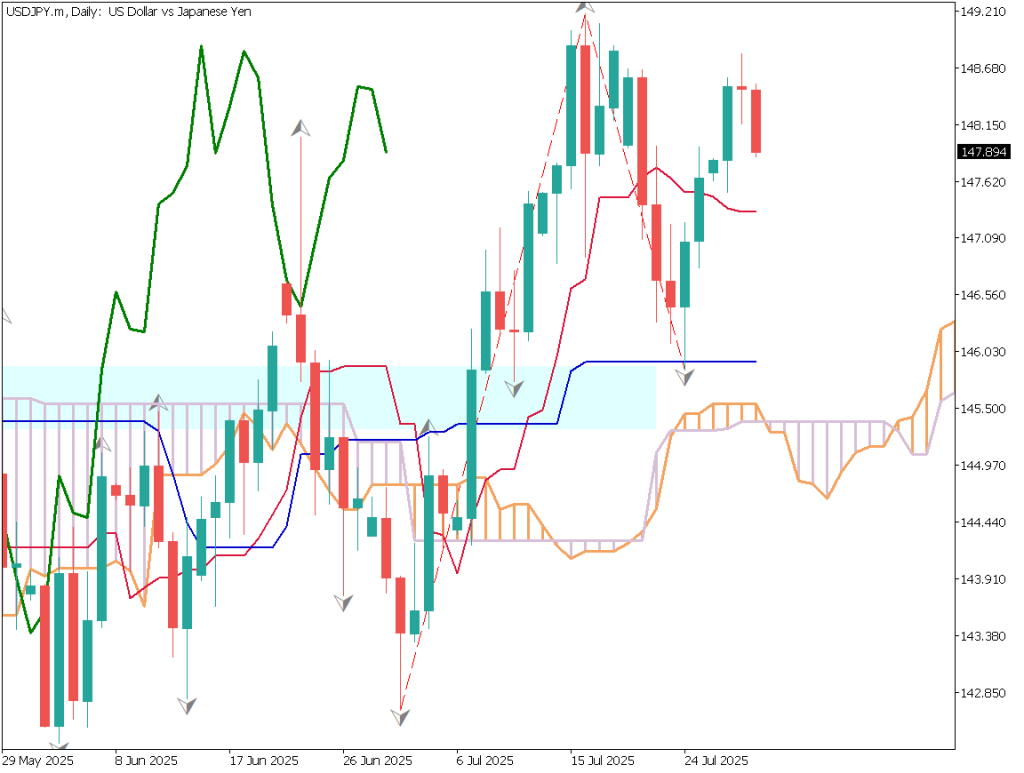

On the 1-hour chart of USDJPY, a downtrend is also evident. The RSI stands at 27, remaining below 30. From a 1-hour chart perspective, a temporary rebound can be expected. The market seems slightly oversold, indicating a sense of panic. Even during the JPY depreciation trend, there were repeated movements up and down.

On the 1-hour chart, it is expected to adjust back to around 148.5 JPY.

The day trading strategy is to aim for a rebound sell. It would be ideal to sell once the price pulls back to around 148.5 JPY. The ultimate goal is around 140 JPY, but positions will be settled if the price reaches 145 JPY. A stop should be placed if the price exceeds 149.5 JPY.

Support/Resistance lines

The following support and resistance lines should be considered in the future:

- 148.19 JPY .. Fibonacci Level

Market Sentiment

USDJPY: Sell: 57%, Buy: 43%

Today’s important economic indicators

Economic indicators and eventsJapan timeBank of Japan Monetary Policy Meeting Minutes8:50 AMUS ISM Services PMI10:45 PMUS ISM Non-Manufacturing Index11:00 PM

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.