FOMC Meeting Today, Uncertainty Regarding U.S. Rate Cut Extent Leads to Diverging Forecasts【September 18, 2024】

Fundamental Analysis

The FOMC meeting will be held late tonight, and the market is on high alert for increased volatility.

USDJPY rose to the 142 JPY level, as U.S. retail sales exceeded expectations.

There is no clear consensus regarding the FOMC outcome, with 55% of forecasts expecting a significant rate cut.

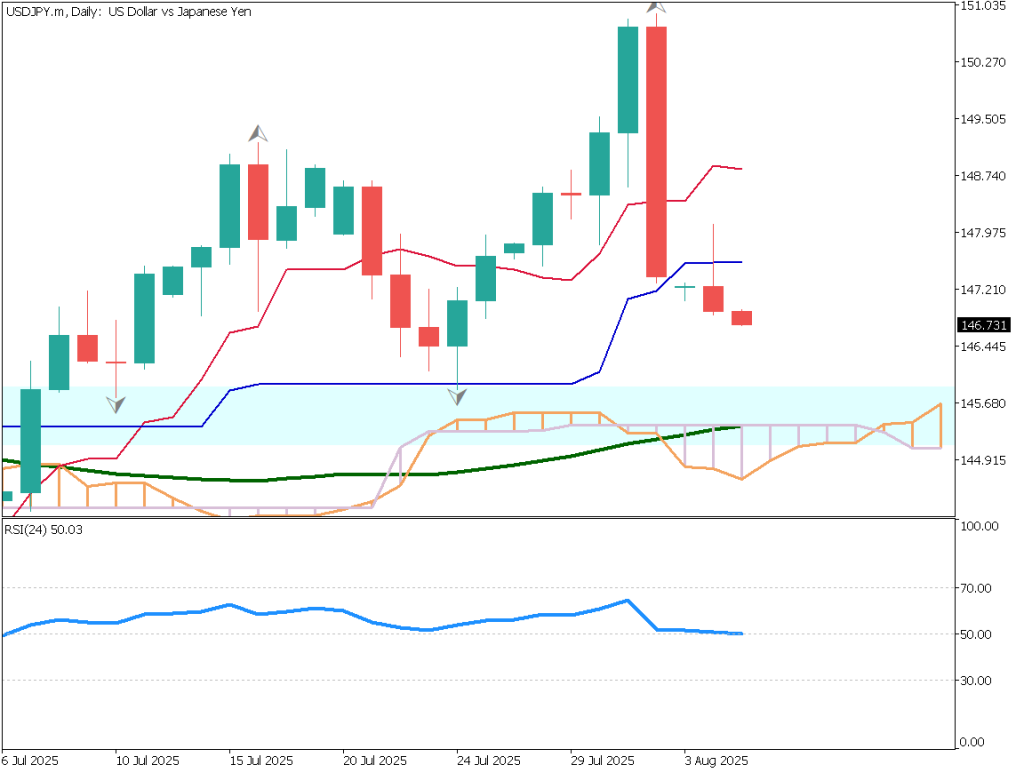

USDJPY technical analysis

USDJPY surged to the 142 JPY level. Previously, it was sold down to the 139 JPY range, but it rebounded as U.S. retail sales exceeded market expectations. The pair broke above the conversion line, likely triggering short covering and stop orders, leading to a sharp rise.

The FOMC outlook remains uncertain, and market forecasts are split in two. Market sentiment shows a balance between short and long positions, making it difficult to predict even for experts. Whether there is a significant rate cut or a 0.25% cut, volatility is expected to increase sharply.

Analyzing the RSI, it shows a rising low. The Federal Reserve is most concerned about the resurgence of inflation, and indeed, the recent U.S. inflation rate saw a slight uptick. While the labor market is shrinking, other indicators of economic health are not too negative.

If there is only a slight rate cut, USDJPY could temporarily rise to just below 145 JPY. Position management requires strict caution.

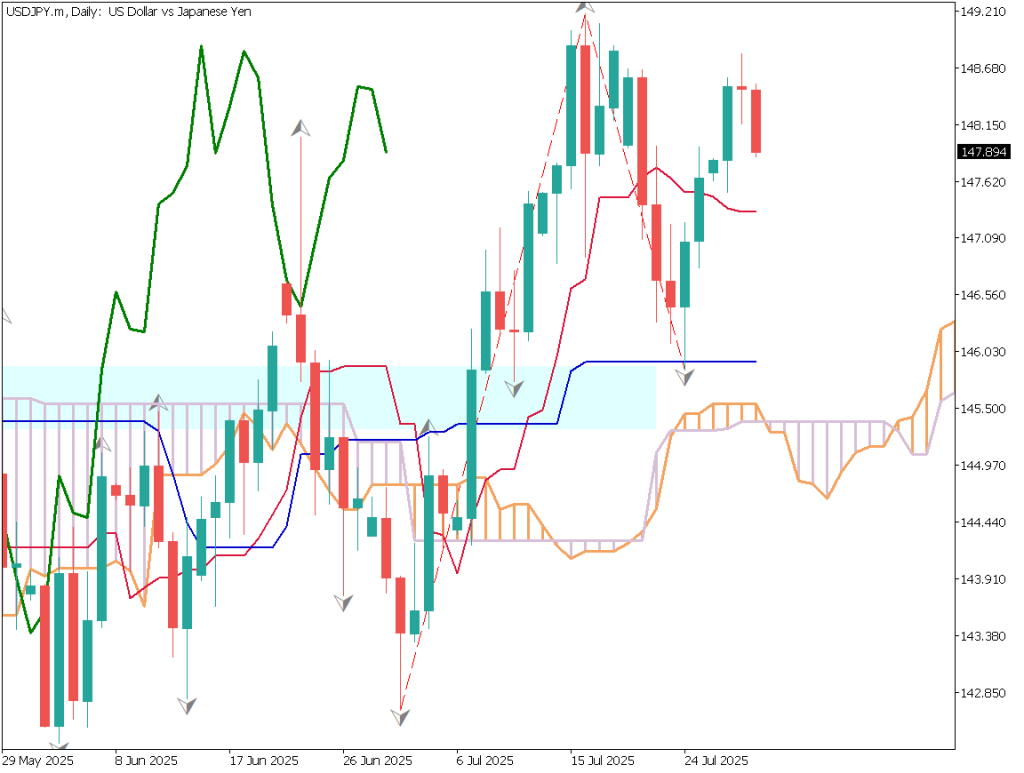

Day trading strategy (1 hour)

Analyzing the 1-hour chart for USDJPY. The pair is slightly declining. The RSI on the 1-hour chart has fallen below 70, signaling a downward trend. Since the main FOMC meeting is scheduled for tonight, there is likely to be no drastic moves before it. No significant buying activity is expected, and a gradual decline seems probable.

It is possible that USDJPY could drop to the lower 141 JPY range.

Today’s day trading strategy suggests selling, but only in the context of scalping, and closing all positions by night. The FOMC outcome is hard to predict, making it difficult to set a clear day trading strategy. Traders with open positions should exercise extreme caution.

Support/Resistance lines

The following support and resistance lines should be considered going forward:

140.810 JPY – Lowest point in January 2024

140.250 JPY – Lowest point at the end of last week

Market Sentiment

USDJPY – Short: 50% | Long: 50%

Today’s important economic indicators

Economic indicators and eventsJapan timeUK Consumer Price Index15:00EU Consumer Price Index18:00U.S. Housing Starts21:30U.S. Crude Oil Inventories22:30Policy Rate Announcement & U.S. Interest Rate Projections03:00 (Next Day)FOMC Press Conference03:30 (Next Day)

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.