EURUSD Declines Amid Concerns Over a No-Confidence Motion Against French Government【December 3, 2024】

Fundamental Analysis

Political Turmoil in France: No-Confidence Motion Likely to Pass

Selling Pressure on EURUSD Increases, Breaking Below 1.05 USD

EURUSD Technical Analysis

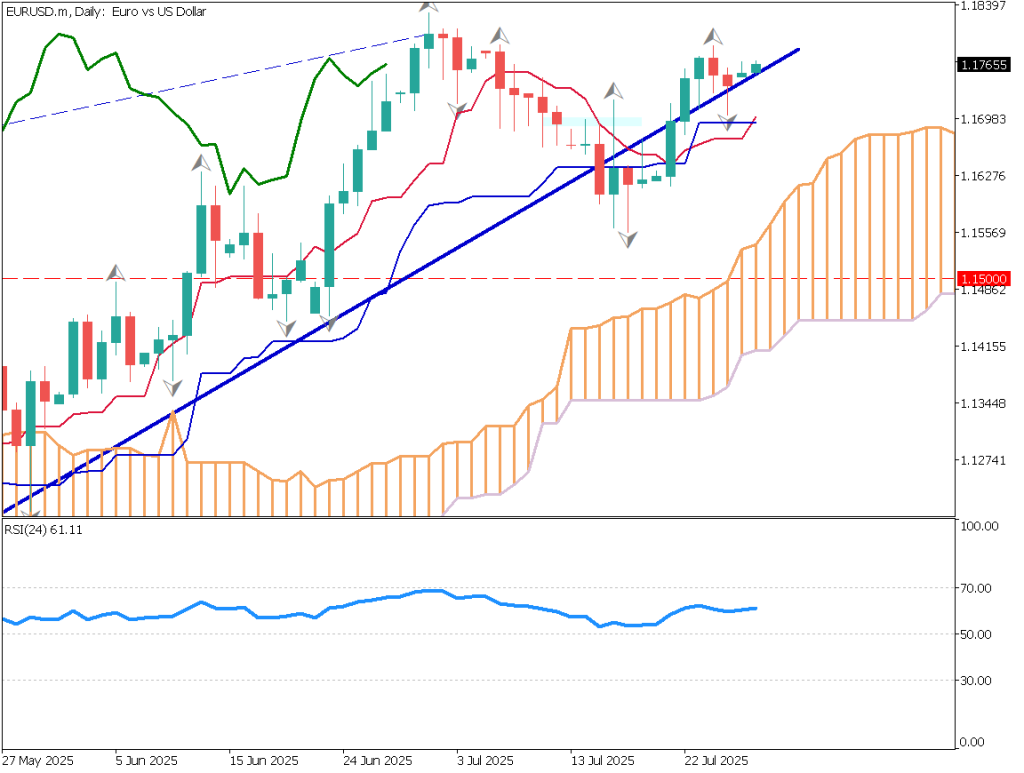

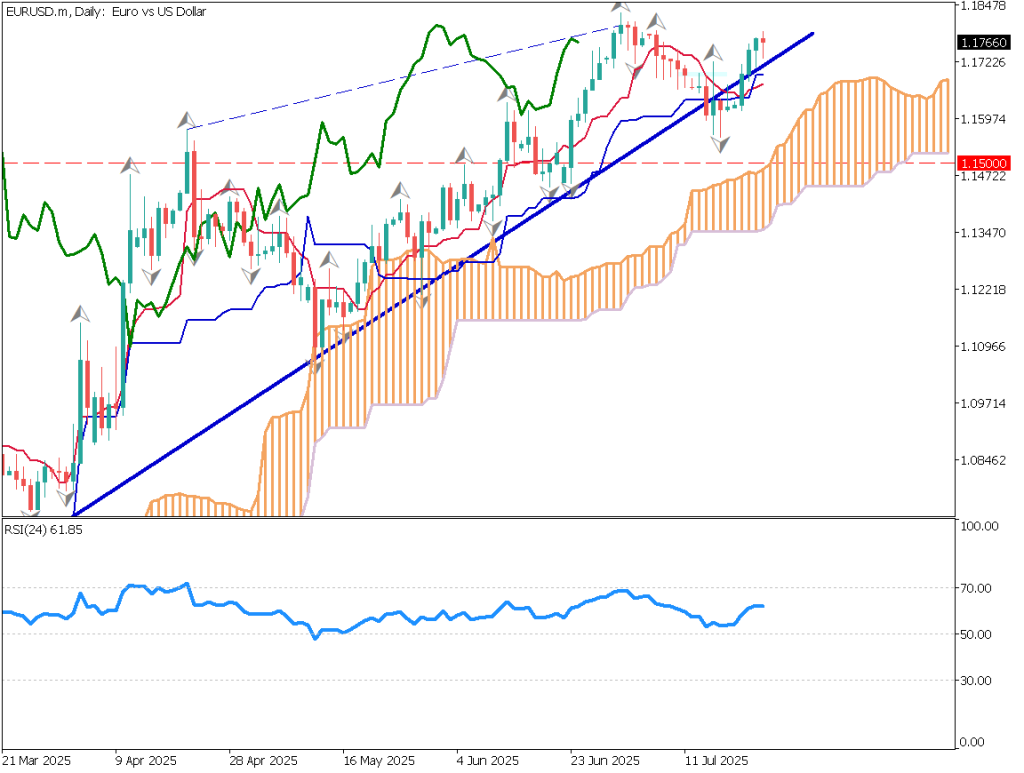

Analyzing the daily chart for EURUSD, the downward trend has persisted since October. Economic indicators across the EU remain weak, pushing the ECB toward a series of rate cuts. Adding to this, France is experiencing political turmoil. A no-confidence vote on the budget proposal is expected to pass in the coming days, potentially leading to a government collapse and escalating uncertainty.

Selling pressure on EURUSD has intensified, causing the pair to break below the 1.05 USD level yesterday. The widening gaps in the long-term GMMA suggest strong resistance to upward corrections. As EURUSD tends to respect round-number levels, the next downside target is likely at 1.04 USD.

Day trading strategy (1 hour)

Analyzing the 1-hour chart for EURUSD, the 26-period moving average serves as a key level. While short-term upward moves may occur, they are quickly countered by selling pressure, initiating a downtrend. Both fundamental and technical analysis indicate a high likelihood of further declines.

Intraday Strategy: Focus on selling during retracements. If EURUSD drops below 1.048 USD again, it is likely to test the recent low at 1.046 USD. Over the long term, the pair is expected to target 1.04 USD.

Support/Resistance lines

Key support and resistance lines to consider:

1.048 USD: Fibonacci Expansion 100%

1.04 USD: Round number

Market Sentiment

EURUSD: Sell: 24% / Buy: 76%

Today’s important economic indicators

Economic Indicators and EventsJapan TimeUS JOLTS Job Openings12:00 midnight

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.