EURUSD Surges Amid Renewed Ukraine Ceasefire Hopes【March 5, 2025】

Fundamental Analysis

European leaders reaffirm support for Ukraine and explore resuming peace negotiations.

EURUSD surpasses the 1.05 USD range, reaching the 1.06 USD level.

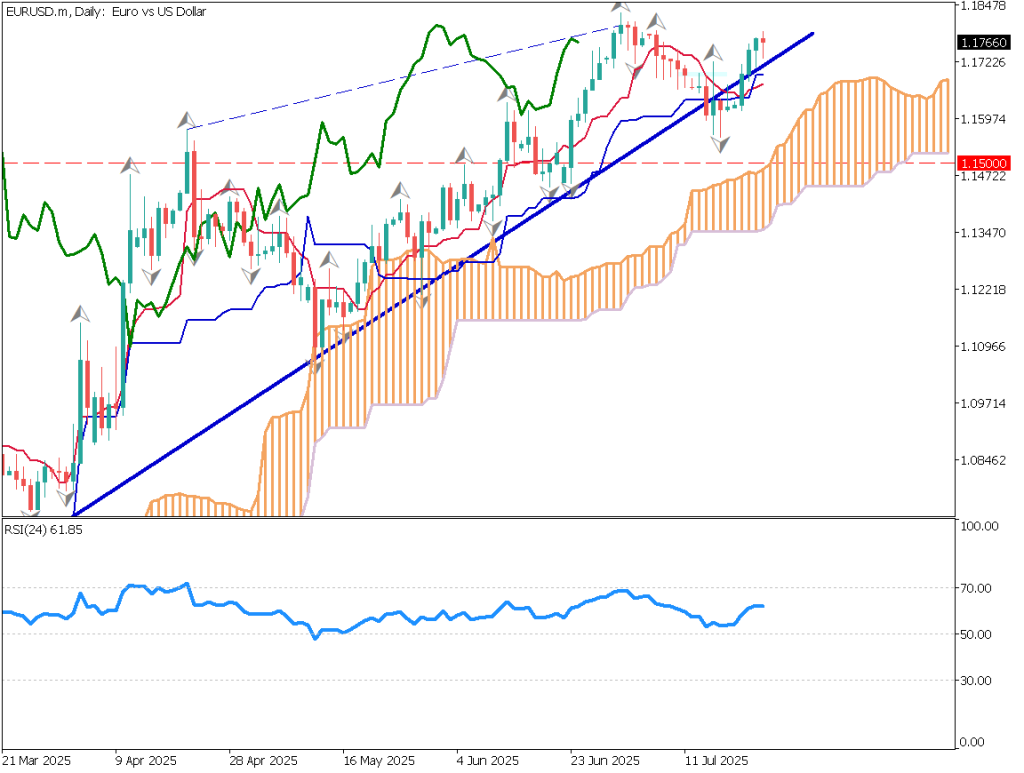

EURUSD Technical Analysis

Analyzing the daily chart, EURUSD has seen a significant upward movement. Drawing the Fibonacci Expansion, the price has surpassed the 100% extension level at 1.056 USD.

Market sentiment indicates a strong concentration of short positions, accounting for 80% of traders. This suggests that the rise may have been fueled by stop-loss triggers.

The underlying driver appears to be optimism surrounding a Ukraine ceasefire, which could boost infrastructure investments and economic recovery expectations.

While a pullback is possible, 1.056 USD and 1.057 USD are expected to act as support levels. Monitoring the correction, traders should maintain a bullish outlook.

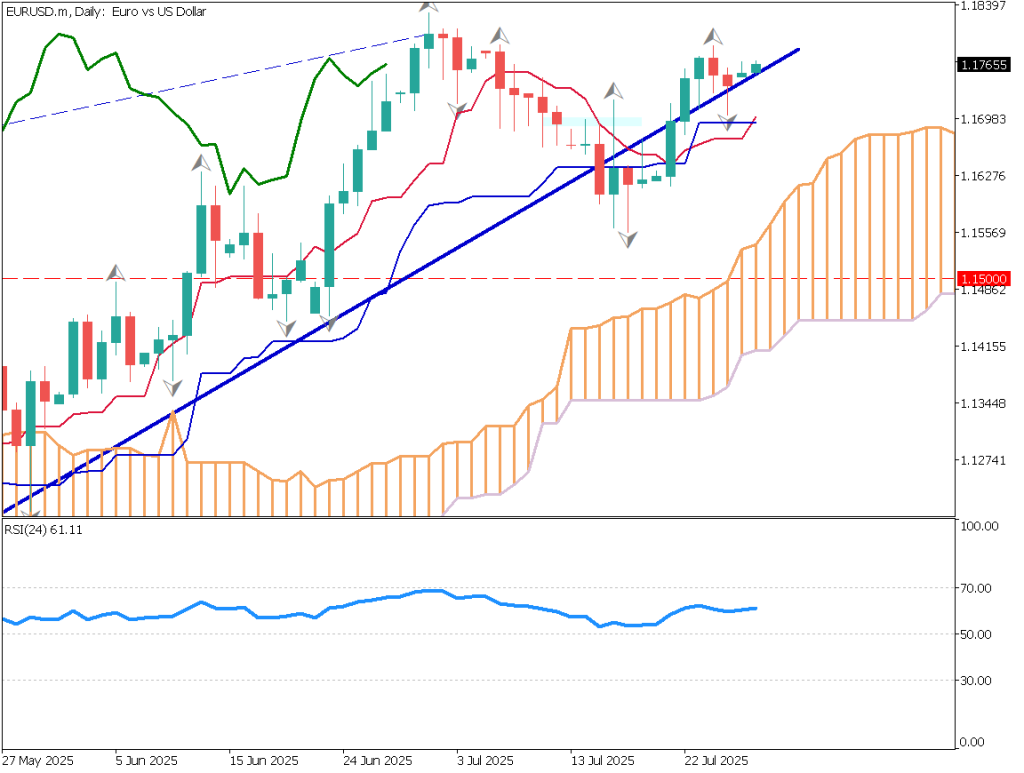

Day trading strategy (1 hour)

Examining the 1-hour chart, EURUSD has been moving within an upward channel but has now broken above it significantly.

The RSI is currently at 78, indicating overbought conditions, which suggests an imminent correction.

Avoid hasty trades and consider buying on dips when RSI approaches 50.

Day Trading Plan:

Buy Limit: 1.057 USD

Target: 1.072 USD (200-day moving average)

Stop Loss: Below 1.055 USD

Support/Resistance lines

Key support and resistance lines to consider:

1.072 USD – 200-day moving average

1.057 USD – Major support level

Market Sentiment

EURUSD Sell: 79% / Buy: 21%

Today’s important economic indicators

Economic Indicators and EventsJapan TimeAustralia GDP9:30NIKKEI Services PMI9:30US Markit Composite PMI18:00US ADP Employment Report22:15US ISM Non-Manufacturing Index00:00 (Midnight)

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.