USDJPY Short-Term Outlook: Upward Move but Selling Pressure on Rallies【March 24, 2025】

Fundamental Analysis

The market is closely watching the direction of U.S. tariff policies, but the outlook remains uncertain.

There are also reports that certain regions or countries may be exempt from Trump’s reciprocal tariffs.

USDJPY Technical Analysis

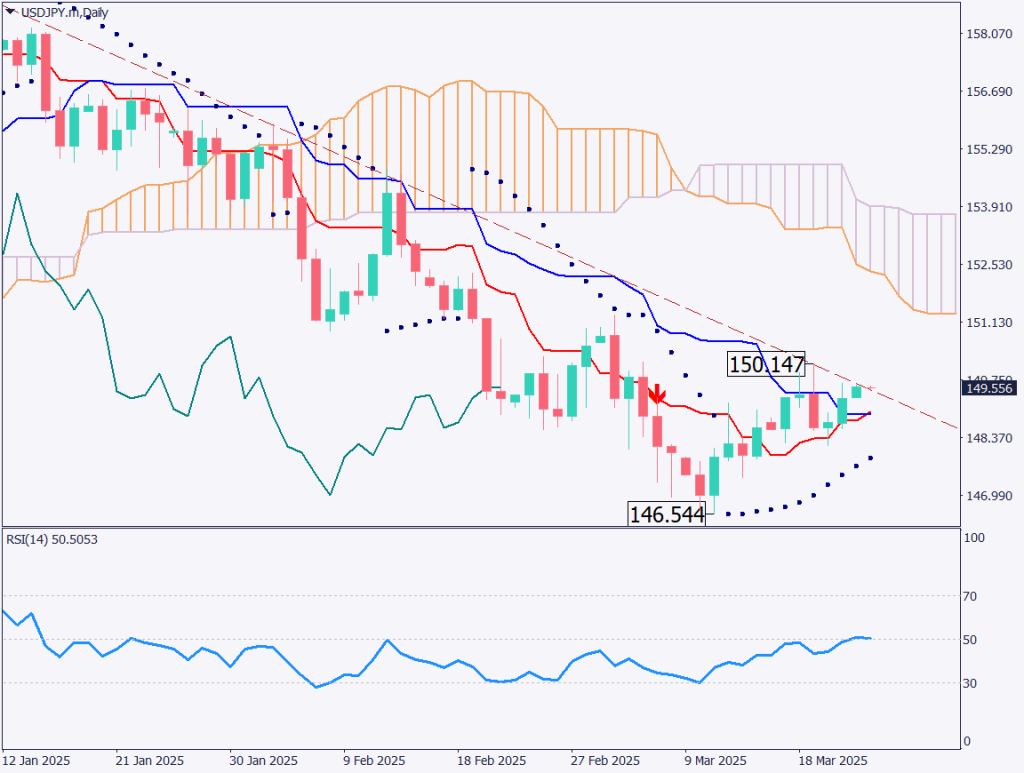

Analyzing the USDJPY daily chart, the pair is trading above the Base Line and Conversion Line but is testing the downtrend line. The focus is on whether the price will pull back from the trendline. Unless USDJPY breaks above this trendline and confirms it as a new support level, the bearish outlook should be maintained.

The RSI is currently at 50, indicating a possible timing for stronger selling pressure on rallies.The market remains sensitive to Trump’s tariff policies and remarks, so caution is warranted.

Day trading strategy (1 hour)

Analyzing the USDJPY 1-hour chart, the price is approaching the recent high of 149.66 JPY. If it breaks above this level, a test of 150.00 JPY is possible.However, due to a significant daily trendline, selling pressure on rallies is expected. Buying aggressively is not recommended.

Today’s day trading strategy:Sell entry targeting a pullback around 149.90 JPY,Take profit at 149.25 JPY,Stop loss at 150.15 JPY.

Support/Resistance lines

Key support and resistance lines to consider:

149.90 JPY – Trendline

149.25 JPY – Upper edge of the Ichimoku Cloud

Market Sentiment

USDJPY Sell: 60% / Buy: 68%

Today’s important economic indicators

Economic Indicators and EventsJapan TimeNikkei Services PMI9:30EU Manufacturing PMI18:00U.S. Manufacturing PMI22:45Bank of England Governor Speech3:00 (next day)

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.