Will Trump’s Auto Tariffs Spark a Risk-Off Shift?【March 27, 2025】

Fundamental Analysis

The Trump administration has announced auto tariffs, including on Japanese cars.

Auto parts are excluded, and attention is also focused on the April 2 tariffs.

USDJPY Technical Analysis

Analyzing the USDJPY daily chart. USDJPY is currently hitting the 200-day moving average. However, major U.S. stock indices fell sharply yesterday, which is expected to affect USDJPY. The 200-day moving average is expected to function strongly as a resistance line.

The Trump administration announced a 25% tariff on imported cars, including Japanese vehicles. Auto parts are expected to be excluded, but the impact on Japanese companies is significant. With factors such as exhaustion of market-moving news and the fiscal year-end, as well as the upcoming detailed announcement of the April 2 tariffs, future movements are difficult to predict.

If risk-off sentiment intensifies, there is a possibility of a pullback to around 149.50 JPY, where the conversion line is moving.

Day trading strategy (1 hour)

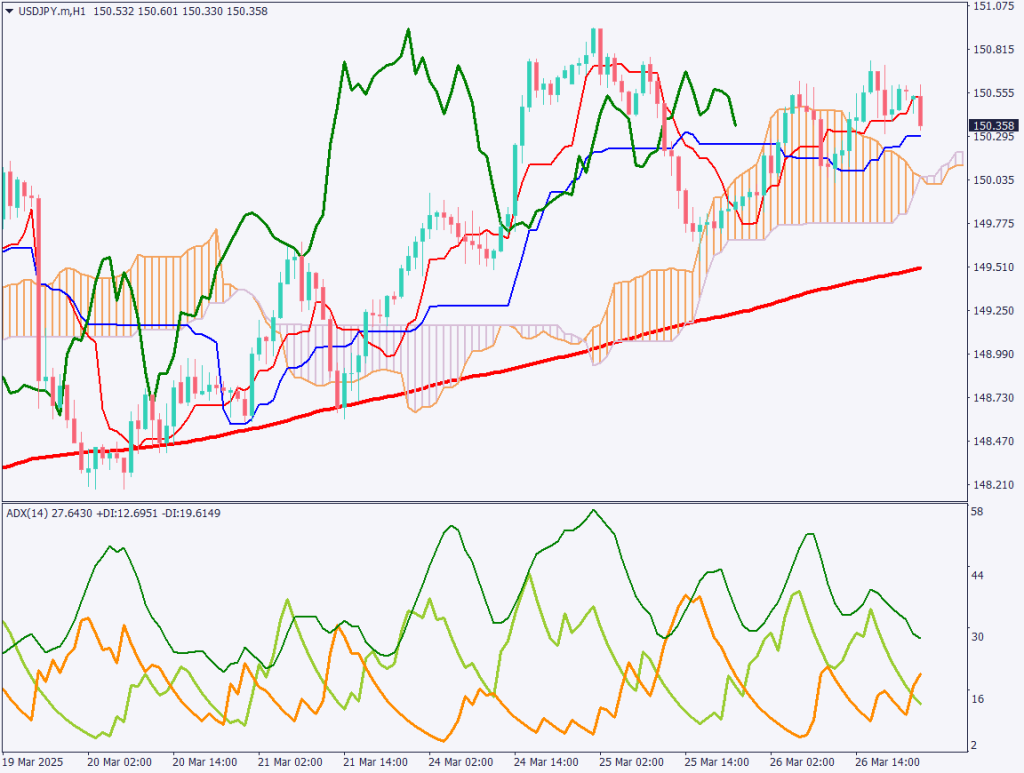

Analyzing the USDJPY 1-hour chart. From the ADX analysis, it can be confirmed that the -DI has crossed above the +DI, indicating increasing downward pressure. As the cloud is thinning, the price may drop to around the 200-hour moving average. Since the 200-day moving average is above in the daily chart, it is a market that is hard to rise.

The day trading policy is to newly sell. Entry around 150.35–55 JPY, with settlement around 149.50 JPY. If it exceeds 150.70 JPY, consider it a stop.

Support/Resistance lines

Key support and resistance lines to consider:

- 150.60 JPY – 200-day moving average

Market Sentiment

USDJPY – Sell: 48% / Buy: 52%

Today’s important economic indicators

Economic Indicators and EventsJapan TimeU.S. GDP21:30U.S. Initial Jobless Claims21:30

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.